Countdown to Travel Leisure Co. (TNL) Q4 Earnings: Wall Street Forecasts for Key Metrics

Wall Street analysts expect Travel + Leisure Co. (TNL) to post quarterly earnings of $1.83 per share in its upcoming report, which indicates a year-over-year increase of 6.4%. Revenues are expected to be $999.53 million, up 2.9% from the year-ago quarter.

Over the last 30 days, there has been no revision in the consensus EPS estimate for the quarter. This signifies the covering analysts' collective reconsideration of their initial forecasts over the course of this timeframe.

Before a company reveals its earnings, it is vital to take into account any changes in earnings projections. These revisions play a pivotal role in predicting the possible reactions of investors toward the stock. Multiple empirical studies have consistently shown a strong association between trends in earnings estimates and the short-term price movements of a stock.

While investors typically use consensus earnings and revenue estimates as a yardstick to evaluate the company's quarterly performance, scrutinizing analysts' projections for some of the company's key metrics can offer a more comprehensive perspective.

Given this perspective, it's time to examine the average forecasts of specific Travel Leisure Co. metrics that are routinely monitored and predicted by Wall Street analysts.

The consensus estimate for 'Net Revenues- Travel and Membership' stands at $155.49 million. The estimate indicates a change of -1% from the prior-year quarter.

The collective assessment of analysts points to an estimated 'Net Revenues- Vacation Ownership' of $844.98 million. The estimate indicates a change of +3.9% from the prior-year quarter.

Analysts' assessment points toward 'Adjusted EBITDA- Travel and Membership' reaching $49.57 million. The estimate is in contrast to the year-ago figure of $52.00 million.

The average prediction of analysts places 'Adjusted EBITDA- Vacation Ownership' at $232.49 million. The estimate is in contrast to the year-ago figure of $222.00 million.

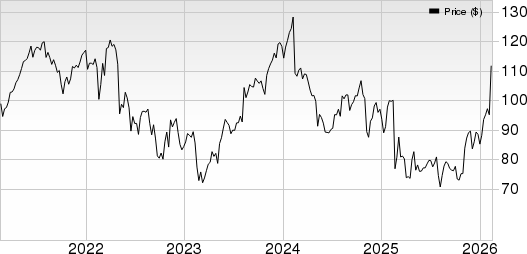

View all Key Company Metrics for Travel Leisure Co. here>>>Over the past month, shares of Travel Leisure Co. have returned -2.2% versus the Zacks S&P 500 composite's -1.7% change. Currently, TNL carries a Zacks Rank #3 (Hold), suggesting that its performance may align with the overall market in the near future. You can see the complete list of today's Zacks Rank #1 (Strong Buy) stocks here >>>> .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

Will Healthy Revenue Growth Boost Akamai's (AKAM) Q4 Earnings?

What a $1,000 Investment in This $0.04 New Crypto Could Be Worth by 2027