European banks powered through a sharp jump in cross-border deals as the total value of €17 billion showed a break from years of slow activity. The rise came after stronger profits and higher share prices pushed banks across Europe to take bigger bets again.

Last year’s total came from many large mergers that moved the sector to its highest level since the 2008 crisis.

The figure had been €3.4 billion the year before, so the scale of the change was hard to ignore for anyone who follows money, markets, or crypto.

Financial firms worldwide also pushed $660 billion in M&A, up from $454 billion in 2024. That shift kept the sector at 14% of total global deal value.

The main themes in 2025 were bigger deal sizes and stronger consolidation inside Europe, where banks wanted scale.

Banks in the Middle East also stayed active, with half of the largest banks in the region taking part in deals over the past five years, mostly linked to Islamic banking. In the United States, a market with more than 4,000 banks, midsize firms looked for mergers to grow, which gave the sector more space for activity, according to data from McKinsey.

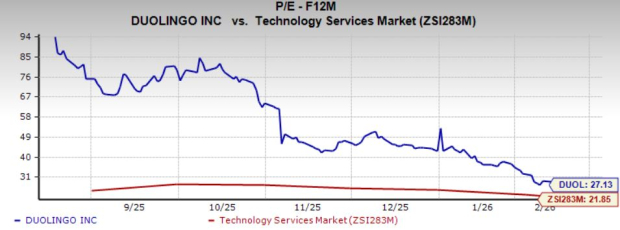

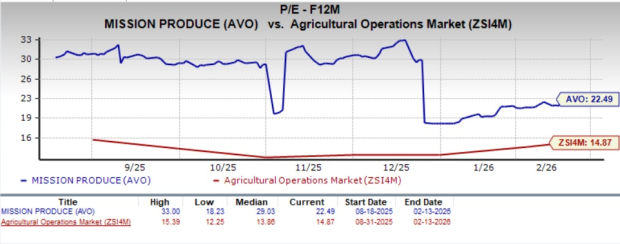

Tracking sharp changes in deal value across markets

S&P Global said:-

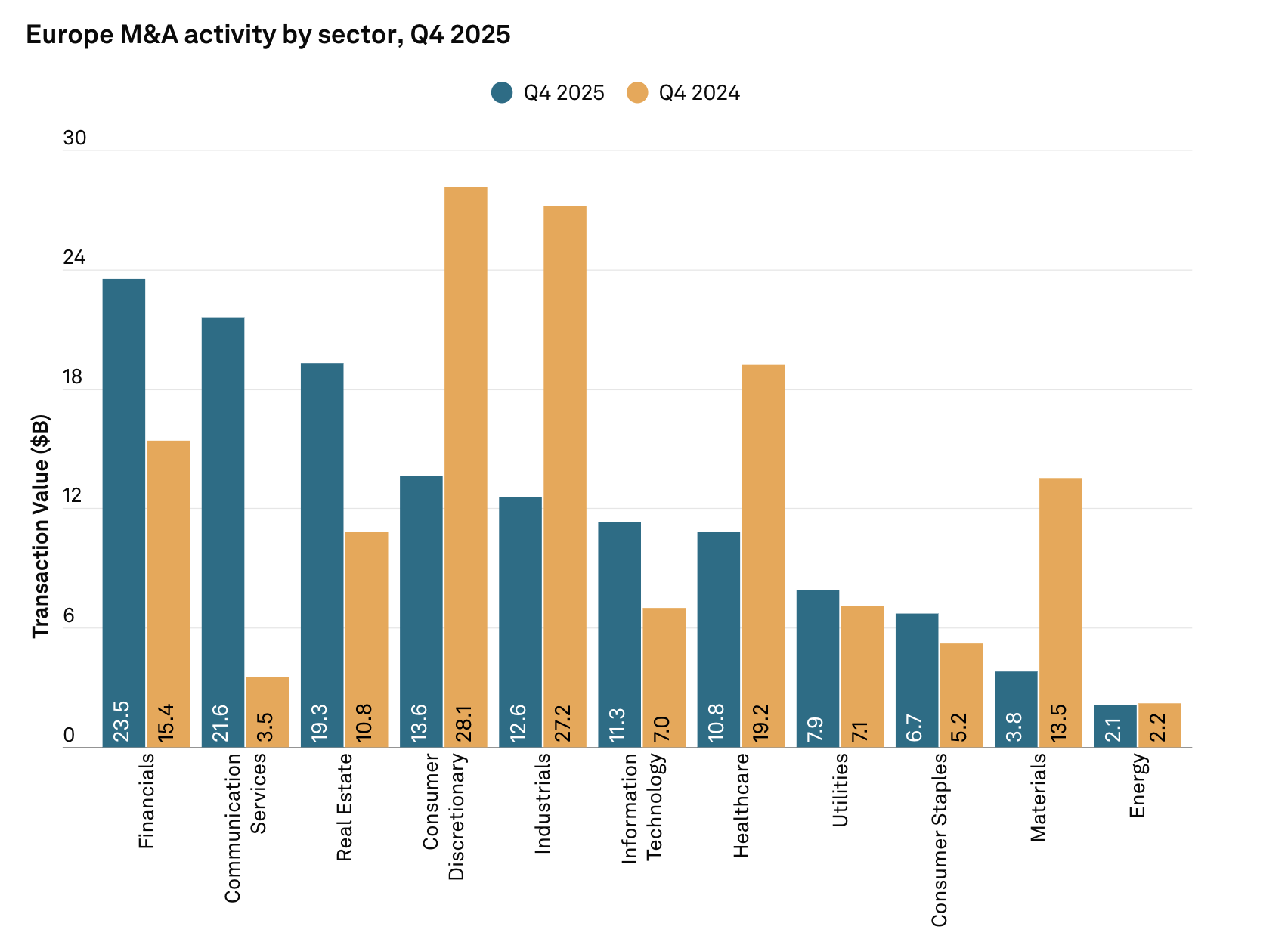

“The European M&A market declined year over year in both deal value and volume, with the United Kingdom leading the charge despite remaining the top destination. Deal values dropped from $162.7B to $150.9B, with deal volume also dropping from 4,186 to 3,244, marking -7% and -23% decreases in activity.”

S&P Global also noted that Communication Services and Financials were the only sectors that grew, and most big deals came from foreign buyers. Nine of the top ten deals involved buyers from outside the region, and six involved buying a single asset or division, which showed strong demand for carve-outs and divestitures.

The Americas carried more than half of global deal value. Activity there hit $2.9 trillion in 2025, which beat the ten-year average of $1.9 trillion by 50%.The US economy stayed firm with falling rates, higher stock indexes, steady profits, and extended tax cuts under President Donald Trump.

Source: S&P Global

Source: S&P Global

That mix pushed more companies toward deals. The Federal Deposit Insurance Corporation in March approved a plan to reduce checks on mergers that create banks with more than $50 billion in assets.

In July, the Federal Reserve proposed changes that would make it easier for banks to keep a well-managed status. A bank would now lose that status only after several low ratings, not just one.

Europe’s deals, IPO limits, and private equity moves

EU banks completed only 19 cross-border mergers last year, even though the value was high. The public-offering market in Europe stayed weak, with a small IPO window. The IPOs that did happen came from sectors with strong demand and clearer earnings paths.

These sectors were healthcare, industrial tech, and consumer and retail. Large offerings were rare because many firms waited for better market conditions. Spin-offs stayed active because they depend more on company plans than on IPO conditions.

Private equity moved back into the picture. PE deal value rose 18% to $331 billion, equal to 33% of all deal value.PE kept a larger share of deals in EMEA than in the United States because several regions in EMEA have long-established PE markets.

The sector also had large dry powder levels, more access to IPO exits, and long-term bets on infrastructure and Europe’s competitiveness.

Sector numbers showed clear patterns. TMT led with 20% of all deal value in 2025, reaching $202 billion, up 9% from the year before.

Six of the 20 biggest deals in the region came from financial services, giving that sector 17% of deal value, up from 10% in 2024.