Traders pinpoint three price targets for Bitcoin if $70K holds as resistance

Bitcoin (BTC) analysts mapped out the key BTC price levels to watch as the market’s focus shifted to the $58,000 to $65,000 zone as the last line of defense.

Bitcoin price is wedged between two key levels

Bitcoin is currently wedged between the 200-week simple moving average (SMA) at $68,300 and the 200-week exponential moving average (EMA) at $58,400.

Generally, in Bitcoin’s trading history, major BTC bottoms have formed between the 200-week SMA and EMA, according to analyst Jelle. This suggests that Bitcoin is possibly forming a bottom between these trendlines.

Related: Bitcoin accumulation wave puts $80K back in play: Analyst

While Bitcoin has produced a weekly close above the 200-week EMA for the second week in a row, “this doesn’t mean it is now in the clear,” trader and analyst Rekt Capital said in a Monday X post, adding:

“The absence of any meaningful upside from here going forward, there is a risk that BTC loses the 200-week EMA in time, triggering additional downside.”

BTC/USD weekly chart. Source: Rekt Capital

BTC/USD weekly chart. Source: Rekt Capital

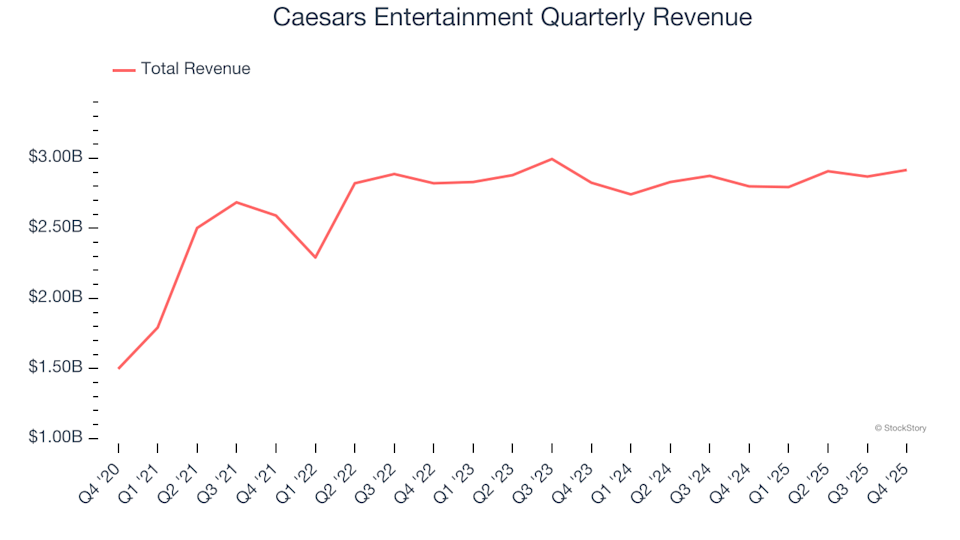

Crypto investor and entrepreneur Ted Pillows had an expanded view, focusing on $71,000 for a bullish breakout.

In a Tuesday post on X, Ted Pillows said that Bitcoin needs a daily close above the $71,000 level to increase the chances of an upside rally, adding:

“And if a breakdown happens below $66,000, BTC might revisit $60,000.”

BTC/USD two-day chart. Source: Ted Pillows

BTC/USD two-day chart. Source: Ted Pillows

Cointelegraph reported that the CME gap between $80,000 and $84,000 could act as a magnet, representing the upper price target for Bitcoin. With nine out of 10 CME gaps filled since August 2025, the $80,000–$84,000 range stands out as the key level to watch on the upside.

Bitcoin bulls must hold the price above $65,000

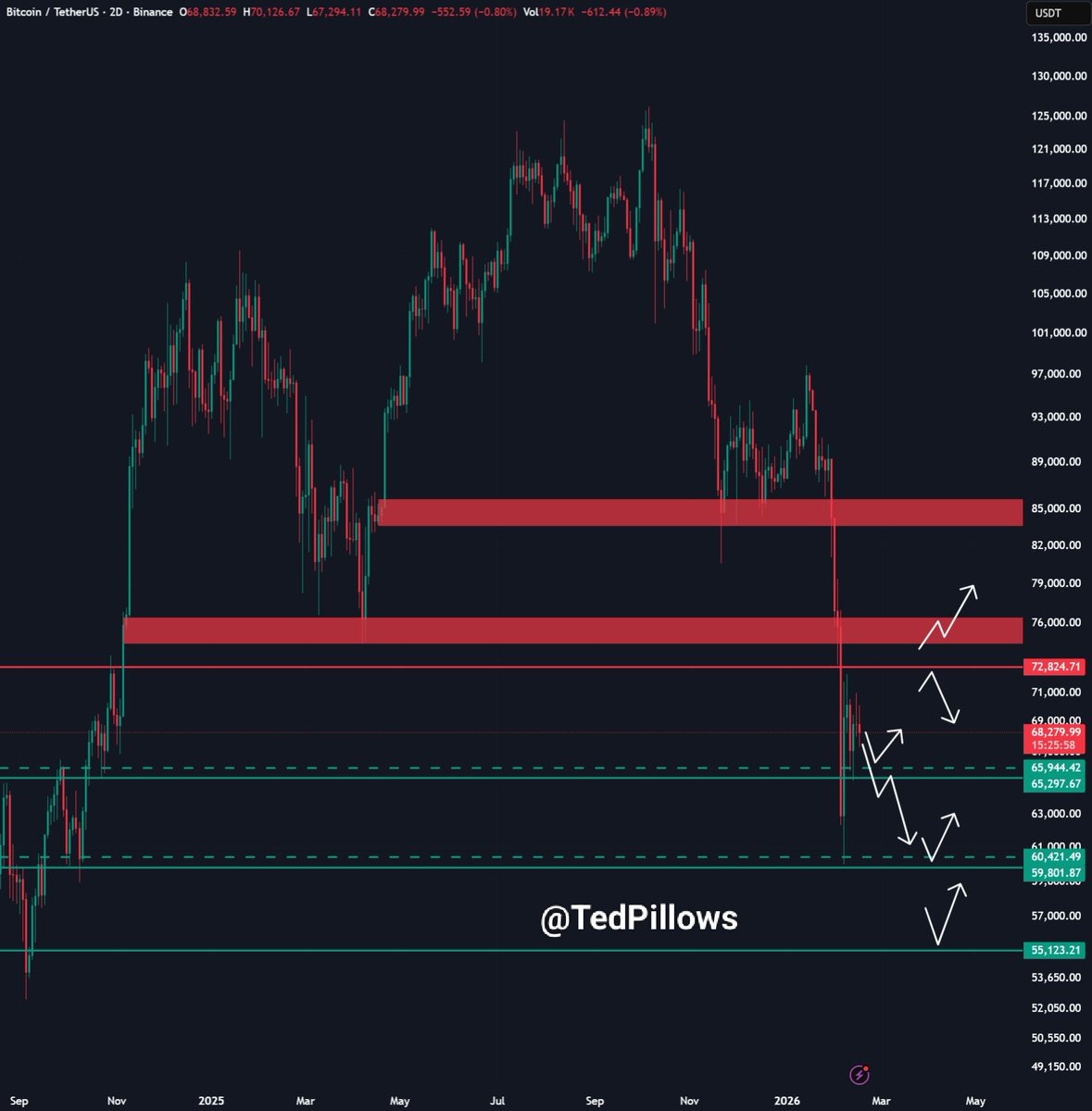

After turning away from $72,000 last week, Bitcoin found support at $65,000. Glassnode’s cost basis distribution heatmap reveals a significant support area recently established between $63,000 to $65,000, where long-term holders recently acquired approximately 372,240 BTC.

A decisive break below this level “would likely open the path toward the realized Price” around $55,000, Glassnode said in a Monday post on X.

Bitcoin cost basis distribution heatmap. Source: Glassnode

Bitcoin cost basis distribution heatmap. Source: Glassnode

Current analysis suggests that the bears may aim to hold BTC price below $65,000 to remain in control. If they succeed, the BTC/USDT pair may then retest the critical $60,000 level. If the $60,000 support cracks, the next stop is likely to be $52,500.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Palo Alto Networks (NASDAQ:PANW) Reports Q4 CY2025 In Line With Expectations But Stock Drops

Bakkt Announces Partnership with Nexo

Bitcoin: Corporations rush to secure BTC – So why is price still falling?

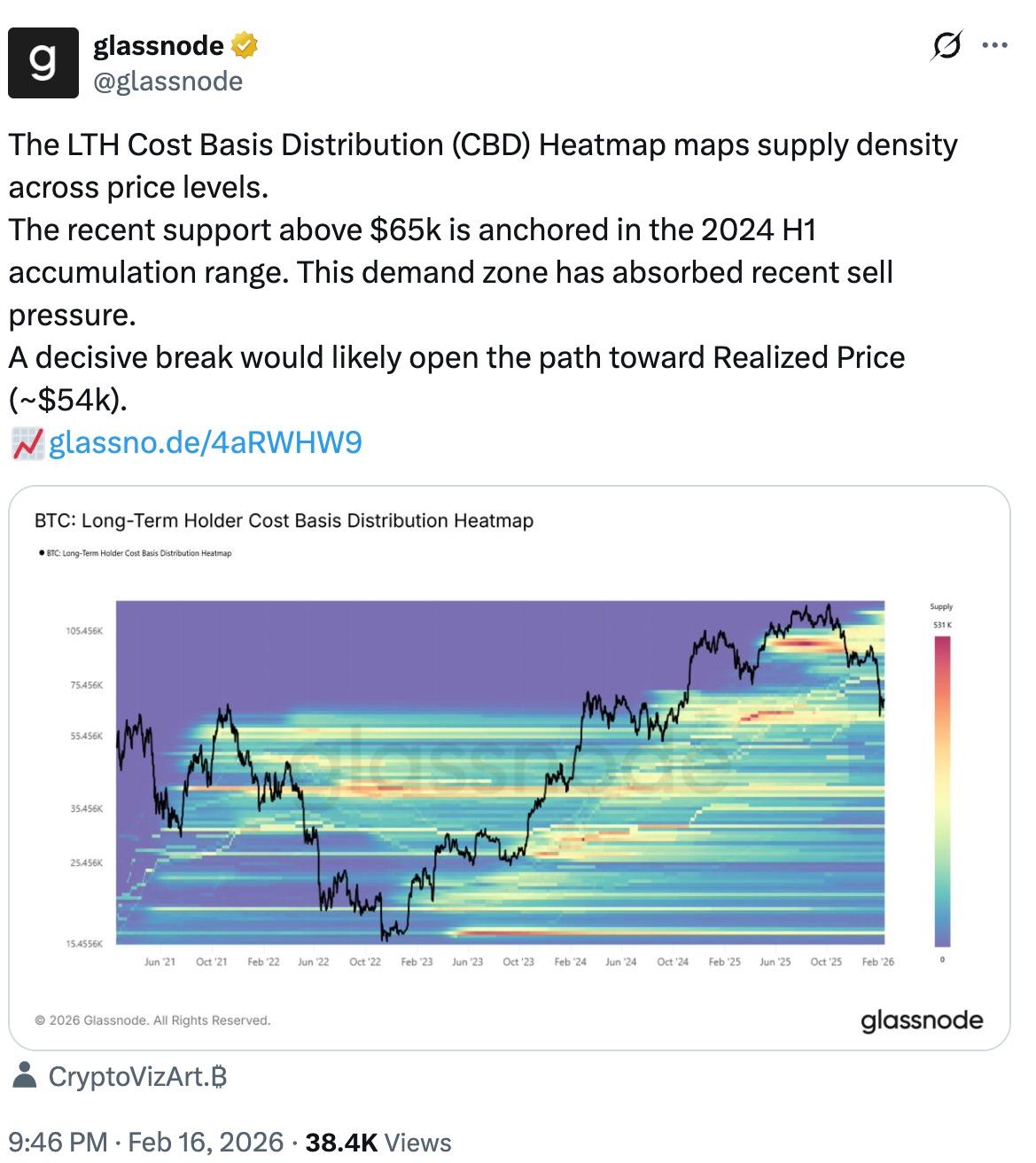

Caesars Entertainment (NASDAQ:CZR) Exceeds Q4 2025 Sales Expectations