USANA's (NYSE:USNA) Q4 CY2025 Earnings Results: Revenue In Line With Expectations

Health and wellness products company USANA Health Sciences (NYSE:USNA)

USANA (USNA) Q4 CY2025 Highlights:

- Revenue: $226.2 million vs analyst estimates of $226 million (5.9% year-on-year growth, in line)

- Adjusted EPS: $0.60 vs analyst estimates of $0.41 (46.3% beat)

- Adjusted EBITDA: $28.47 million vs analyst estimates of $25.31 million (12.6% margin, 12.5% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $2.12 at the midpoint, beating analyst estimates by 15.2%

- EBITDA guidance for the upcoming financial year 2026 is $105.3 million at the midpoint, in line with analyst expectations

- Operating Margin: 1.7%, down from 3.8% in the same quarter last year

- Market Capitalization: $382.1 million

“USANA delivered fourth quarter net sales in line with our preliminary results announced on January 12, 2026,” said Kevin Guest, Chairman and Chief Executive Officer.

Company Overview

Going to market with a direct selling model rather than through traditional retailers, USANA Health Sciences (NYSE:USNA) manufactures and sells nutritional, personal care, and skincare products.

Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years.

With $925.3 million in revenue over the past 12 months, USANA is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers.

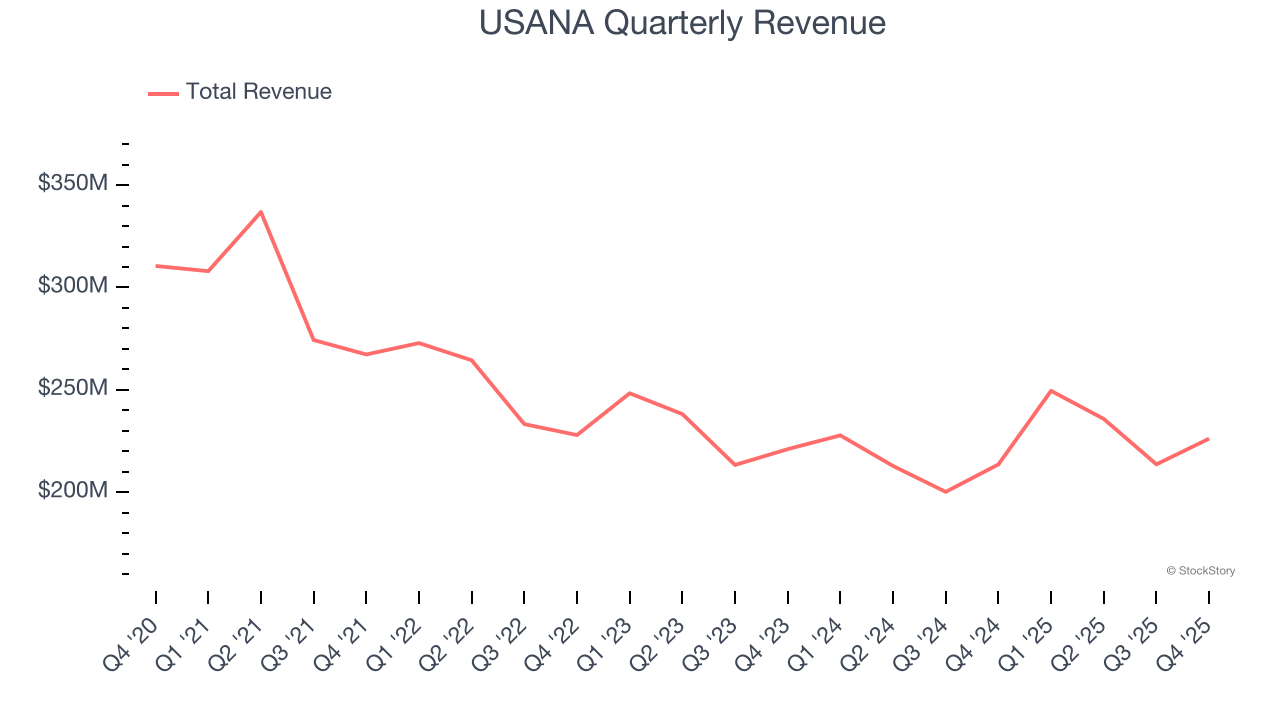

As you can see below, USANA’s demand was weak over the last three years. Its sales fell by 2.5% annually, a poor baseline for our analysis.

This quarter, USANA grew its revenue by 5.9% year on year, and its $226.2 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 3.3% over the next 12 months. While this projection indicates its newer products will catalyze better top-line performance, it is still below the sector average.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

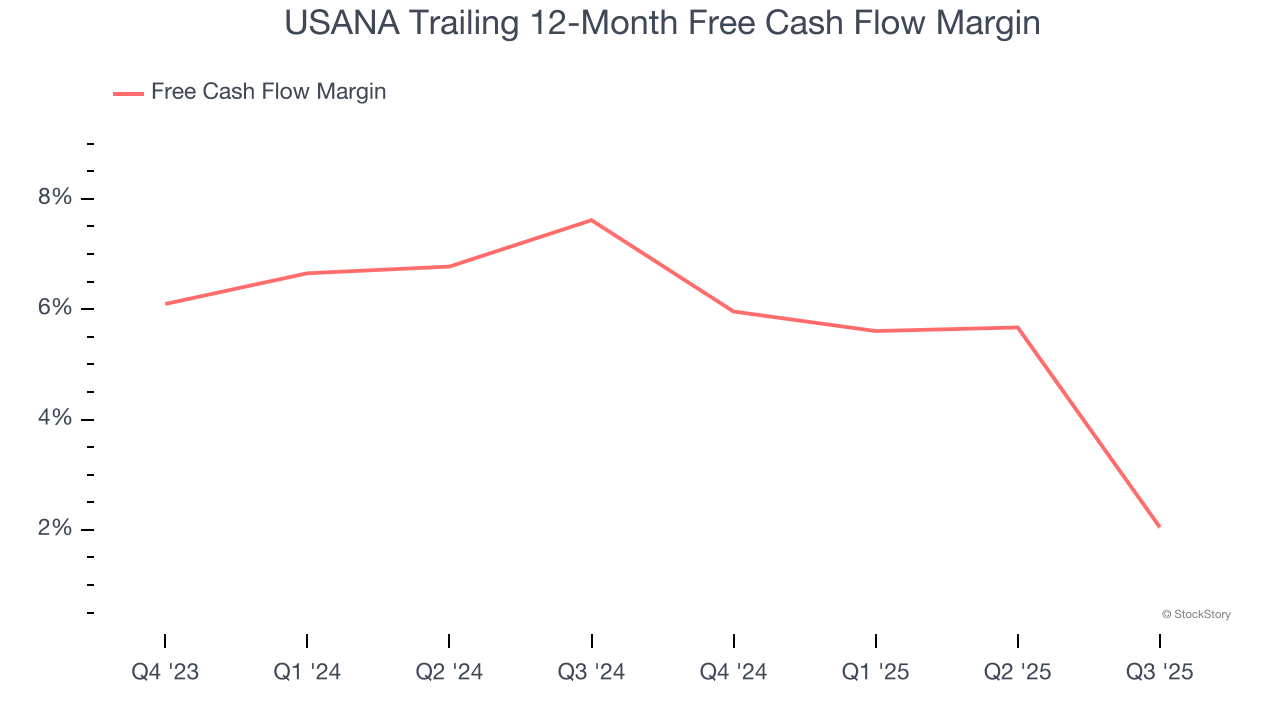

USANA has shown mediocre cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 4.2%, subpar for a consumer staples business.

Key Takeaways from USANA’s Q4 Results

It was good to see USANA beat analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. Overall, we think this was a decent quarter with some key metrics above expectations. The stock remained flat at $20.65 immediately after reporting.

Indeed, USANA had a rock-solid quarterly earnings result, but is this stock a good investment here? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Liftoff, backed by Blackstone Group, resubmits IPO application confidentially

In Warren Buffett’s final quarter as CEO, Berkshire offloaded these two major technology stocks

Tactile Systems Technology (TCMD) Q4 Earnings and Revenues Top Estimates

Beta Bionics, Inc. (BBNX) Reports Q4 Loss, Tops Revenue Estimates