Asian stocks rise while the majority of local markets remain shut for Lunar New Year festivities

Asian Markets Climb as Japan Leads Gains

Asian stock markets saw an uptick on Wednesday, with Japan’s Nikkei 225 rising over 1% following a subdued session on Wall Street. Many regional exchanges remained closed in observance of the Lunar New Year.

Meanwhile, U.S. futures showed little movement, and oil prices experienced a modest increase.

Japan’s Political and Market Developments

By midday in Tokyo, the Nikkei 225 had advanced 1.2% to reach 57,249.43, as lawmakers prepared to confirm Sanae Takaichi for another term as prime minister after her party’s decisive win in the February 8 election.

Technology stocks drove the rally, with Tokyo Electron surging 3.5%. However, shares of SoftBank Group, a major player in tech and energy, dropped 2%, extending losses from the previous day. This followed news that its subsidiary, SB Energy, would join a $33 billion natural gas project near Portsmouth, Ohio, as announced by the Trump administration. The project is part of Japan’s $550 billion investment pledge in the U.S., which comes alongside a trade agreement that increased tariffs on Japanese goods by 15%.

Other Asia-Pacific Markets

- Australia’s S&P/ASX 200 climbed 0.4% to 8,993.20.

- India’s Sensex edged up by 0.1%.

- Bangkok’s SET index rose 0.5%.

- New Zealand’s S&P/NZX 50 slipped 0.7%.

Wall Street Recap

On Tuesday, U.S. stocks fluctuated between gains and losses. The S&P 500 inched up 0.1% to 6,843.22, the Dow Jones Industrial Average also rose 0.1% to 49,553.19, and the Nasdaq composite added 0.1% to 22,578.38.

Corporate Movers

Paramount Skydance was among the top performers, jumping 4.9% after Warner Bros. Discovery announced it would allow Paramount to submit a final bid to acquire the company, as Paramount seeks to outbid Netflix.

Warner Bros. Discovery shares gained 2.7%, while Netflix rose 0.2%.

On the downside, General Mills tumbled 7% after cautioning that consumer sentiment was weakening. The company, known for brands like Cheerios and Pillsbury, lowered its profit outlook for 2026, anticipating steeper declines than previously forecast.

Recent surveys have indicated diminished confidence among U.S. consumers, who are grappling with persistent inflation, a sluggish job market, and concerns over tariffs.

Major technology stocks weighed on the market, with Alphabet falling 1.2%. Nvidia’s performance was volatile, alternating between dragging the market down and providing support.

Last week, shares of software and other companies dropped as investors reassessed which firms might lose out if artificial intelligence transforms their industries.

AI Investment Sparks Market Volatility

The market has shifted dramatically from last year, when optimism about AI fueled repeated record highs for U.S. indexes. Now, sectors such as software, legal services, and trucking have seen investor sentiment sour amid fears that AI-driven competitors could erode their customer base.

Even companies investing heavily in AI are under scrutiny. Global fund managers have expressed concerns that firms may be overspending on AI infrastructure and chips, requiring significant returns to justify these investments. For instance, Alphabet has indicated its AI and related expenditures could reach $180 billion this year, nearly double last year’s figure.

“We’re seeing a market that at once fears AI could upend everything and, at other times, doubts it will deliver much at all. This tension is causing significant swings in individual stocks, even among companies with massive balance sheets,” commented Stephen Innes of SPI Asset Management.

A recent Bank of America survey found a record number of global fund managers believe companies are “overinvesting,” which could eventually lead to reduced spending on chips from firms like Nvidia.

Commodities and Currency Update

- Early Wednesday, U.S. benchmark crude oil increased by 20 cents to $62.53 per barrel, while Brent crude rose 24 cents to $67.66 per barrel.

- The U.S. dollar strengthened to 153.54 yen from 153.29 yen. The euro slipped to $1.1845 from $1.1854.

- Gold prices advanced 0.9%, and silver climbed 2.2%.

- Bitcoin dropped 1.2% to approximately $67,700.

Reporting by Stan Choe and Matt Ott, AP Business Writers.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

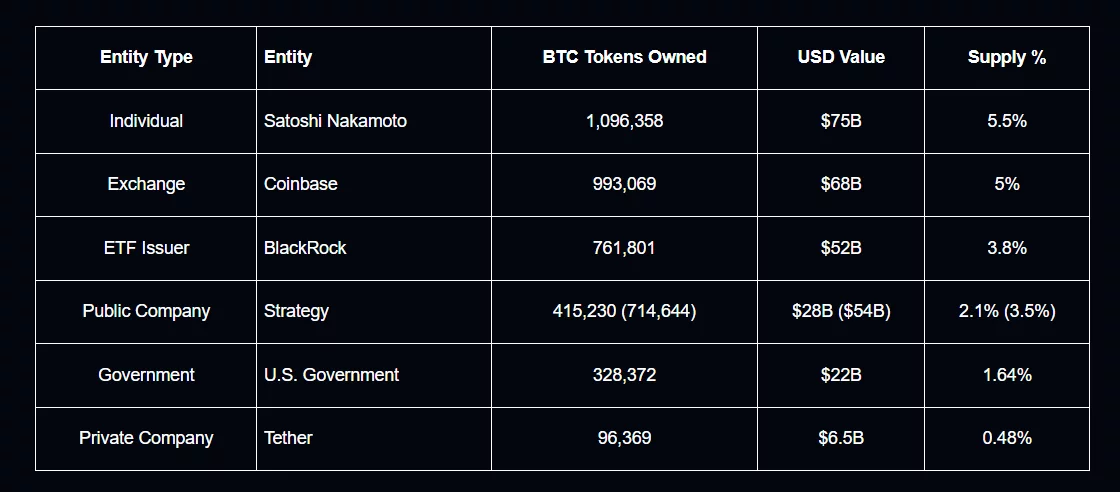

Bitcoin price prediction as Arkham data reveals who controls BTC supply