Incyte Corp. (INCY) Reports Q4 2025 Revenue Growth of 28% to $1.51B Driven by Jakafi and Opzelura Sales

Incyte Corporation (NASDAQ:INCY) is one of the best NASDAQ growth stocks to buy for the next 2 years. On February 10, Incyte Corporation reported that the company’s Q4 2025 revenue climbed 28% to $1.51 billion, while full-year sales reached $5.14 billion. The company’s growth was largely propelled by its flagship product, Jakafi, which achieved annual sales of $3.093 billion, and the rapid expansion of Opzelura in the atopic dermatitis and vitiligo markets.

The company’s core business, excluding Jakafi, grew by 53% year-over-year in the final quarter. Key contributors included the hematology and oncology franchise, featuring Niktimvo and Monjuvi, which saw a 121% quarterly revenue surge. Incyte’s R&D efforts also reached a new level of maturity in 2025, with timely regulatory submissions for Jakafi XR and povercinib. Management expects this momentum to continue into 2026, forecasting core business growth of over 30% as the company moves towards a goal of 14 pivotal clinical trials by year-end.

Incyte Corporation (NASDAQ:INCY) now aims to nearly double its business size through a combination of internal innovation and strategic business development. While the company anticipates a mid-single-digit sales increase for Jakafi in 2026, it is heavily investing in next-gen treatments, such as its KRAS program and frontline DLBCL therapies.

Incyte Corporation (NASDAQ:INCY) is a biopharmaceutical company that discovers, develops, and commercializes therapeutics in the US, Europe, Canada, and Japan. The company has collaboration and license agreements with Novartis, Lilly, and Syndax.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

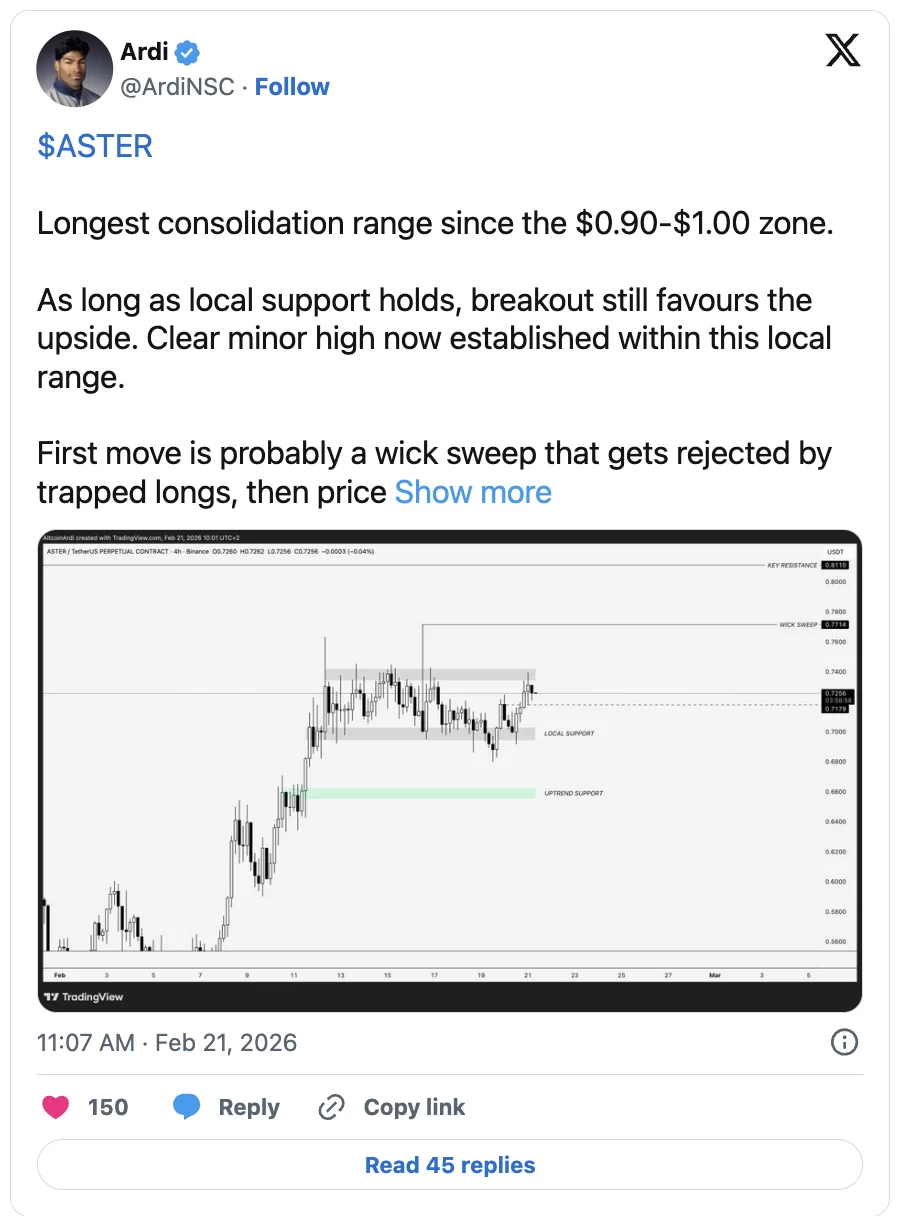

ASTER Holds Steady as Traders Eye Breakout from Prolonged Consolidation

Bitcoin Price News Feb 2026 as Frenzy Builds Around DeepSnitch AI’s 300x Bet on AI Interface, While Solana and Mantra Surge

ECB’s Panetta States That Tariffs Have Hurt the US More Than Other Countries

BMO Reaffirms Bullish View on Equinix (EQIX) amid Strong Operational Performance