Analyst Sees Upside to $5,440 for Booking Holdings Inc. (BKNG)

We recently published an article titled 10 Best Cruise Stocks to Buy Right Now.

On February 10, Gordon Haskett analyst Robert Mollins upgraded Booking Holdings Inc. (NASDAQ:BKNG) to Buy from Hold with a $5,440 price target, citing what he views as an overreaction by investors to concerns surrounding artificial intelligence–driven competitive pressures. The analyst emphasized Booking’s durable competitive advantages, global scale, and defensive characteristics, identifying the stock as the firm’s highest-conviction idea and suggesting the risk-reward profile has become increasingly favorable.

For Q4 2025, Booking Holdings Inc. (NASDAQ:BKNG) is expected to report revenue of approximately $6.11 billion, representing 11.73% year-over-year growth, while consensus earnings per share of $48.23 imply 16.08% growth compared to the prior year. The earnings estimate has risen modestly over the past 30 days, and the company has exceeded consensus expectations in each of the last four quarters, delivering an average earnings surprise of 18.21%. Consistent outperformance, upward estimate revisions, and double-digit projected growth reinforce confidence in Booking’s execution and support further multiple re-rating as competitive concerns ease.

Booking Holdings Inc. (NASDAQ:BKNG) founded in 1997 and headquartered in Norwalk, Connecticut, operates leading online travel reservation platforms, including Booking.com, Priceline, and Rentalcars.com, offering global accommodation, transportation, and related travel services.

While we acknowledge the potential of BKNG as an investment, we believe certain AI stocks offer greater upside potential and carry less downside risk. If you’re looking for an extremely undervalued AI stock that also stands to benefit significantly from Trump-era tariffs and the onshoring trend, see our free report on the best short-term AI stock.

READ NEXT: 8 Up and Coming Streaming Companies and Services and 11 Best Canadian Growth Stocks to Buy According to Hedge Funds.

Disclosure: None.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

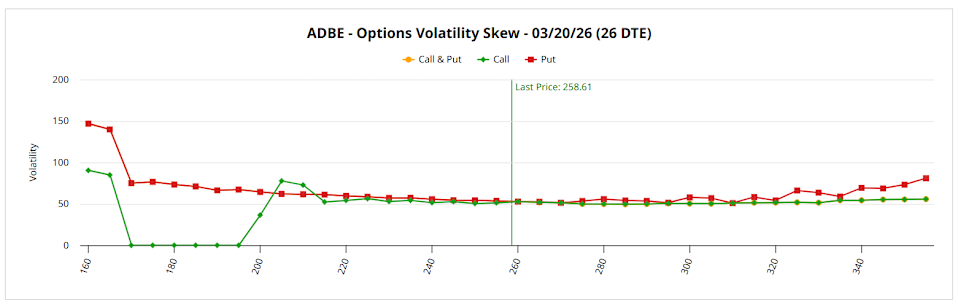

Adobe (ADBE) Shares Have Taken a Hit, Yet Savvy Investors Stay Confident

Scaramucci: 'Yes, We're in a Bear Market,' So Get Bitcoin

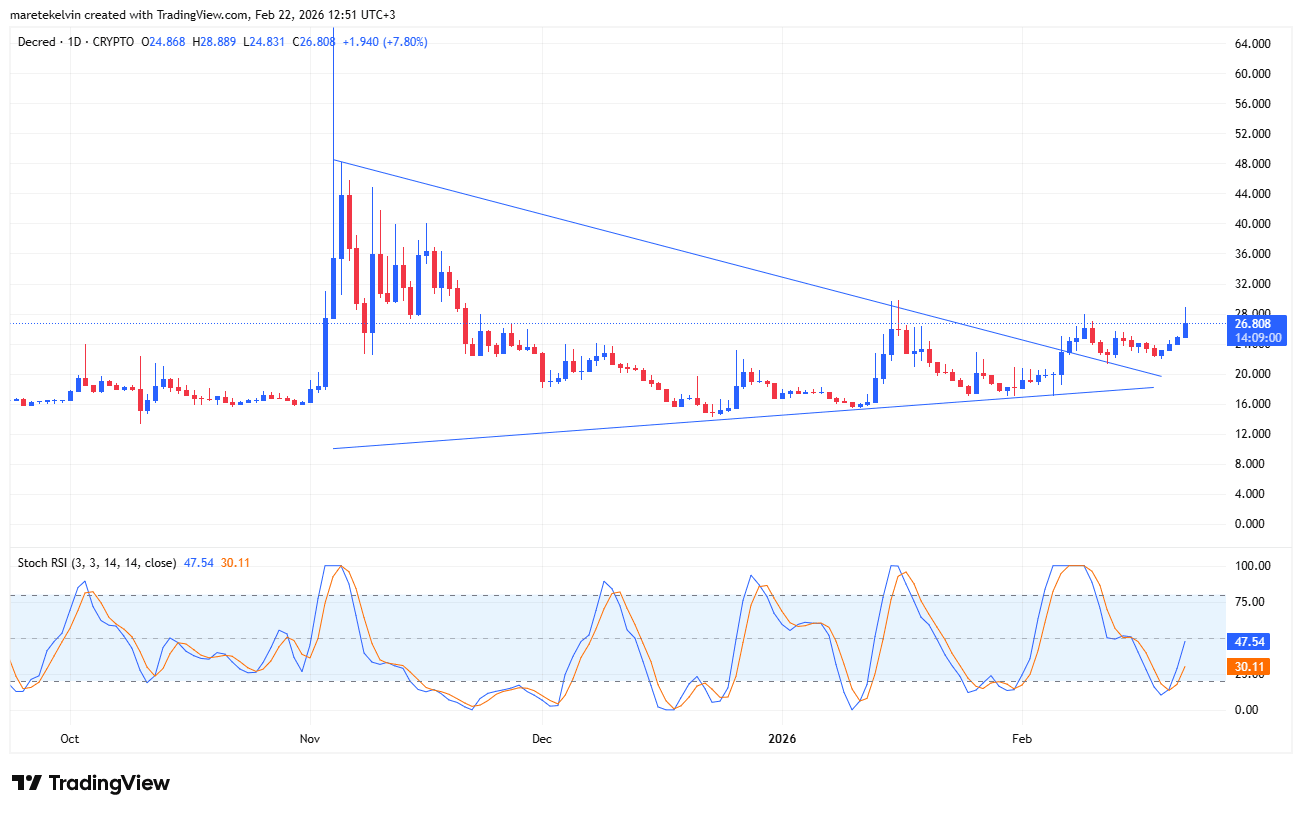

Decred surges 14% – What DCR’s current breakout suggests