News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitcoin whales participate in V-shaped accumulation, offsetting 230K BTC sell-off2Ethereum: Why Fundstrat sees $1.7K as a possible ETH bottom3ProShares' stablecoin-ready ETF generates record $17 billion in day-one trading volume

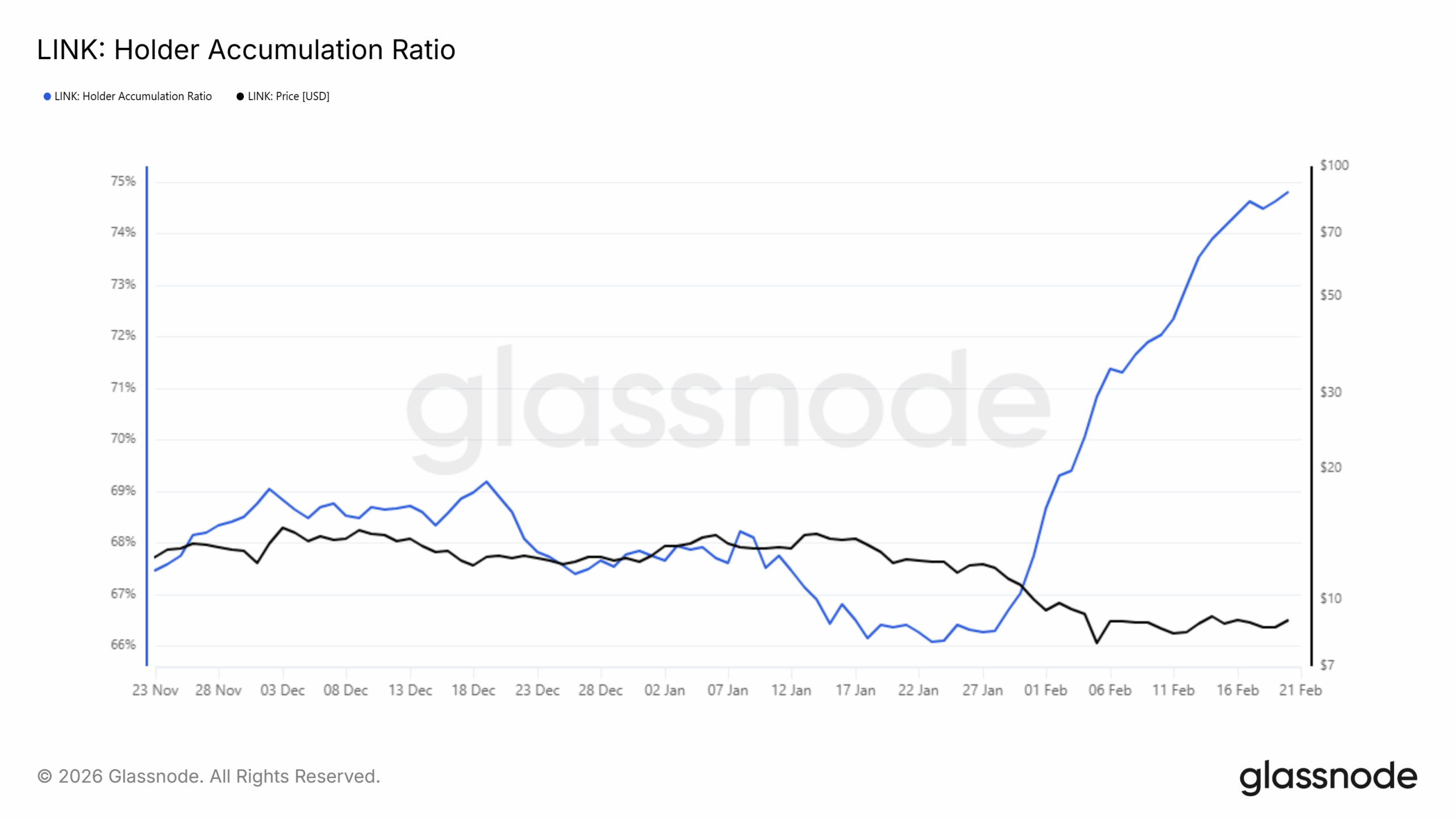

Is LINK capitulation still ahead? Investors should watch THIS bearish signal

AMBCrypto·2026/02/22 07:03

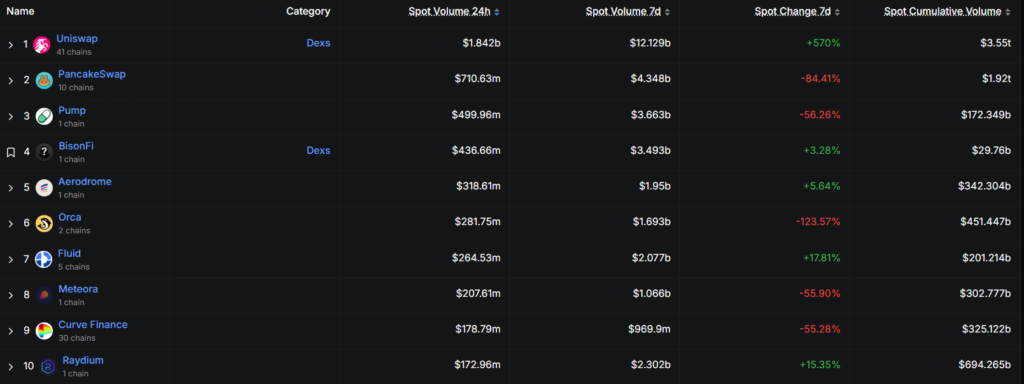

PUMP: Insider sales hit $25mln – Why THESE 2 metrics suggest supply floor

AMBCrypto·2026/02/22 05:03

50% of Bitcoin's past 24 months ended in gains: Economist

Cointelegraph·2026/02/22 03:27

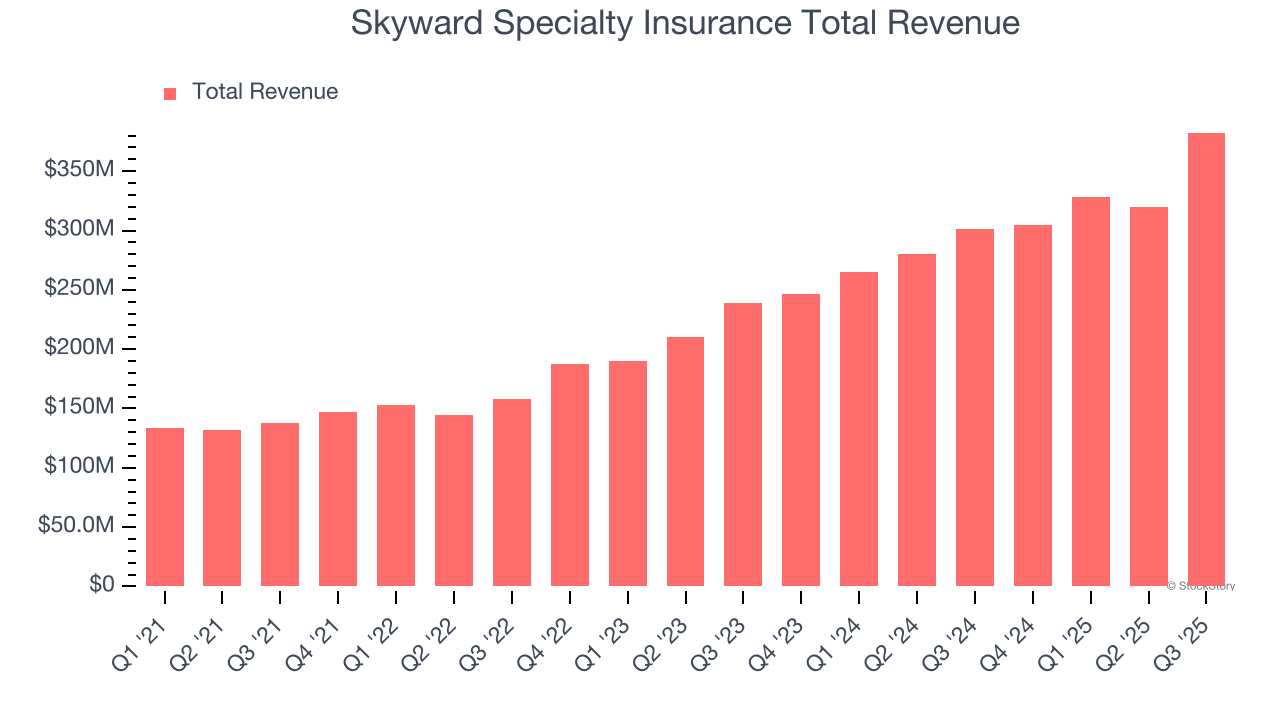

Skyward Specialty Insurance (SKWD) Q4 Earnings: What To Expect

Finviz·2026/02/22 03:12

Addus HomeCare Earnings: What To Look For From ADUS

Finviz·2026/02/22 03:09

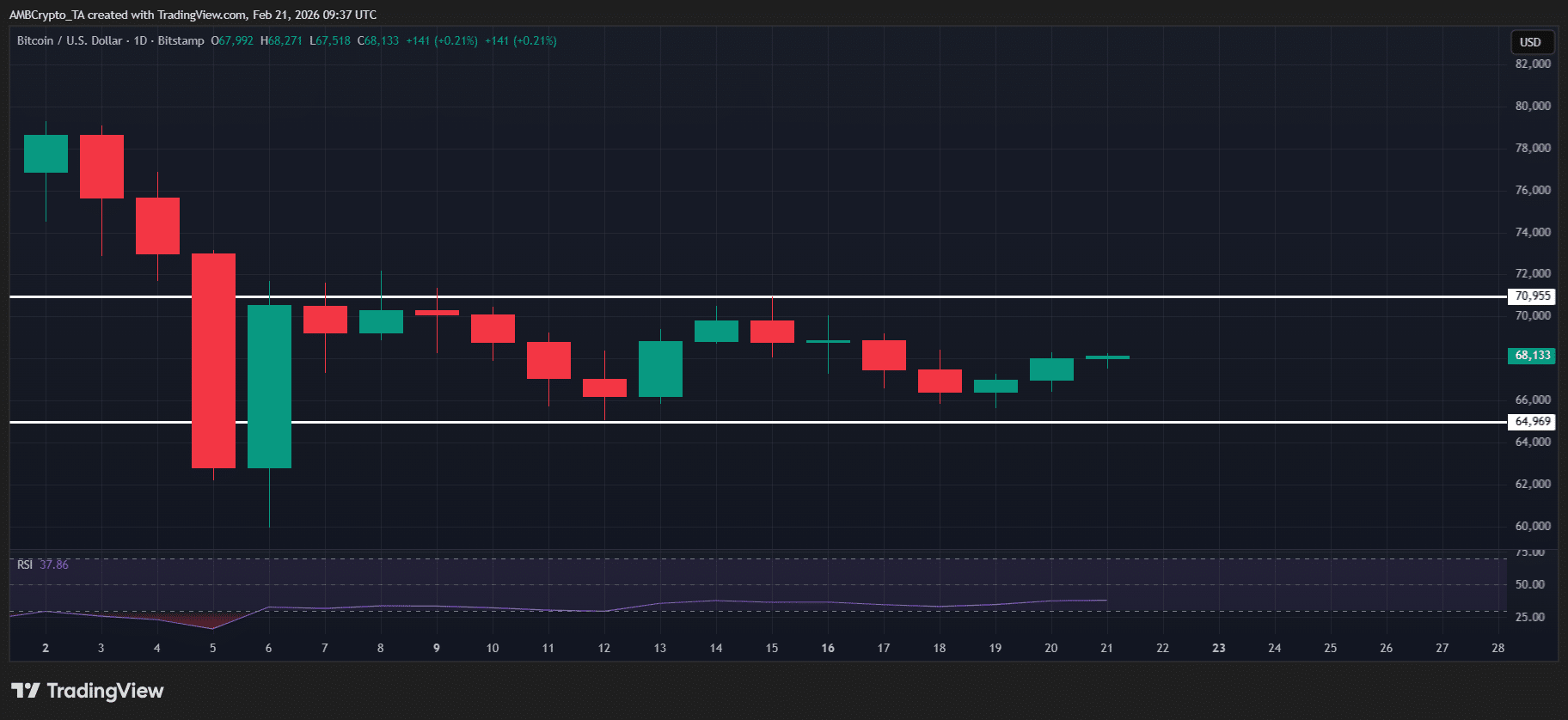

Bitcoin: How $335M whale move tests BTC as inflation looms

AMBCrypto·2026/02/22 03:03

The Atlantic: The Supreme Court’s Humiliating Gift to Trump

美股ipo·2026/02/22 02:48

Flash

07:05

Next Week's Macro Outlook: Intensive Speeches from Federal Reserve Officials, Nvidia Earnings and Geopolitical Risks in FocusBlockBeats News, February 22 — As uncertainty surrounding Trump's tariff policies may trigger a new round of turmoil, coupled with increasing signs that the US may take military action against Iran, the world's largest company by market capitalization, Nvidia, will release its financial report next Wednesday. Investors may face a new round of market volatility driven by headline news. The following are the key points the market will focus on in the coming week (all times UTC+8): Monday 21:00 (UTC+8), Federal Reserve Governor Waller delivers a speech; Tuesday 21:00 (UTC+8), 2027 FOMC voting member and Chicago Fed President Goolsbee delivers a speech; Tuesday 22:00 (UTC+8), Boston Fed President Collins delivers opening remarks at an event; 2027 FOMC voting member and Atlanta Fed President Bostic delivers a speech; Tuesday 22:10 (UTC+8), Federal Reserve Governor Waller delivers a speech; Tuesday 22:35 (UTC+8), Federal Reserve Governor Lisa Cook delivers a speech on AI; Wednesday 4:15 (UTC+8), Richmond Fed President Barkin and Boston Fed President Collins jointly attend a panel discussion; Thursday 2:20 (UTC+8), 2028 FOMC voting member and St. Louis Fed President Musalem delivers a speech on the role of the Federal Reserve; Thursday 21:30 (UTC+8), US Initial Jobless Claims for the week ending February 21; Friday 21:30 (UTC+8), US January PPI year-on-year and month-on-month data.

06:45

Crypto Fear Index rises to 9, market remains in "extreme fear" stateBlockBeats News, February 22, according to Alternative data, today’s Crypto Fear & Greed Index is 9 (compared to 8 yesterday), indicating that the market remains in an “extreme fear” state. Note: The Fear & Greed Index ranges from 0 to 100 and includes the following indicators: volatility (25%) + market trading volume (25%) + social media popularity (15%) + market surveys (15%) + bitcoin’s dominance in the overall market (10%) + Google trend analysis (10%).

06:09

Head of Port of Los Angeles: U.S. President's Tariff Increases Heighten Business UncertaintyThe Executive Director of the Port of Los Angeles, Gene Seroka, stated that in the face of uncertain policy directions, it is difficult for companies to make long-term strategic plans regarding talent, investment, and technology. He expects that the U.S. economy will face a "bumpy road" ahead, and consumers may feel the pressure brought by rising prices. (CCTV)

News