News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Trump Ends Government Shutdown; Software Stocks Hit by AI Tools; Nvidia Plans Massive Investment in OpenAI (February 4, 2026)2BitMine adds 41,000 ETH to its balance sheet, while its unrealized losses amount to $6B3XRP price prediction: What the loss of the $1.77 swing low means for you

Billionaire Backers Expected to Present Hurdles for Incoming OCBC CEO Tan

101 finance·2026/02/05 00:21

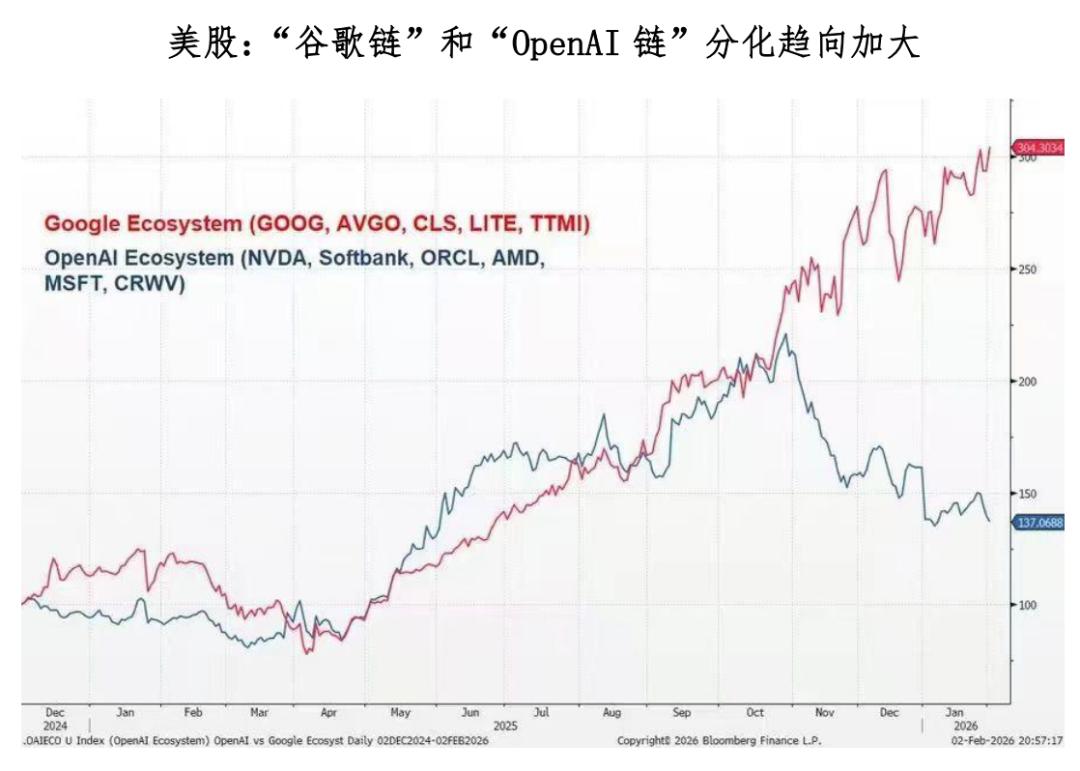

US Dollar: Changes Emerging in the US Stock Market

BFC汇谈·2026/02/05 00:02

Alphabet refuses to discuss the AI partnership between Google and Apple, even with its investors

101 finance·2026/02/04 23:51

Saks Off 5th to close most of its stores. Check which locations are affected.

101 finance·2026/02/04 23:39

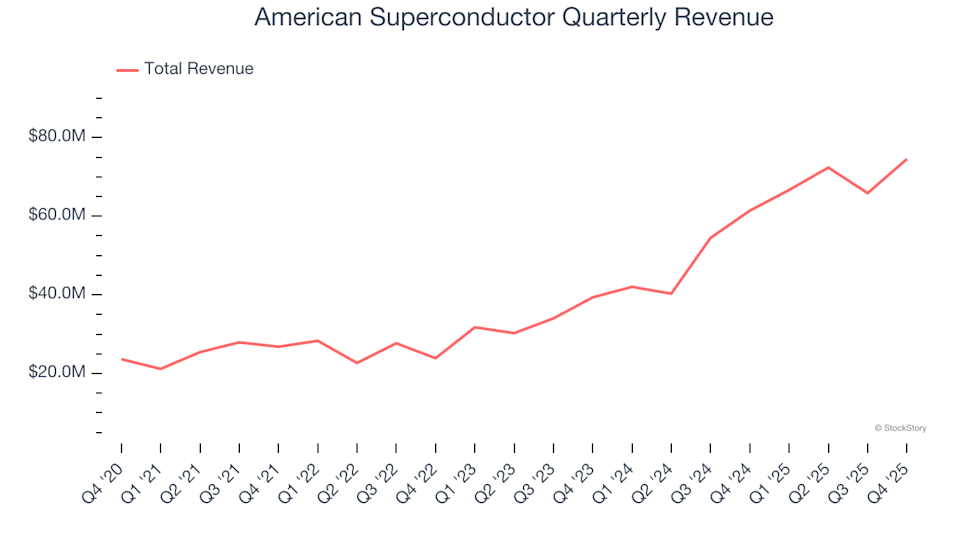

American Superconductor (NASDAQ:AMSC) Posts Strong Q4 CY2025 Results, Shares Surge 19.7%

101 finance·2026/02/04 23:24

Flash

00:57

Berkshire utility urges Oregon appeals court to limit wildfire damage compensationGlonghui, February 5th|PacifiCorp on Wednesday urged an Oregon appeals court to overturn a ruling that exposes the Berkshire Hathaway-owned utility to potential wildfire liabilities of $52 billion. The Portland, Oregon-based utility rejected claims from thousands of state residents who accused the company of negligence for failing to shut off power lines during a windstorm over Labor Day weekend in 2020, which allegedly sparked wildfires. PacifiCorp argued that the trial judge erred by allowing victims of four separate wildfires (each more than 100 miles (161 kilometers) apart) to sue together in a class action, including damages from a fifth wildfire that was blamed on lightning. The utility also stated that the judge should not have allowed the jury to award compensation for "non-economic" losses such as emotional distress, as well as property damage. "This is a tragedy," PacifiCorp attorney Theodore Boutrous told a three-judge panel at the Oregon Court of Appeals when discussing the wildfires. "The question is, how do we resolve these cases efficiently? This is not the way to solve the problem." Berkshire acquired PacifiCorp for $5.1 billion in 2006.

00:55

Trend Research under Yilihua has its liquidation price lowered to $1,640, still holding 463,000 ETH with an unrealized loss of $474 million.BlockBeats News, on February 5, according to on-chain data analyst Yujin's monitoring, since the afternoon of February 1, Trend Research has cumulatively reduced its position by stop-loss, selling 188,500 ETH over the past four days at an average price of $2,263 (approximately $426 million), and repaid $385 million USDT to reduce leverage. Currently, the liquidation prices of several of its ETH lending positions have dropped to the range of $1,576 to $1,682, mainly concentrated around $1,640. Current holdings: 463,000 ETH (approximately $998 million), with an average cost of $3,180 per ETH Loss: $647 million (realized loss of $173 million, unrealized loss of $474 million) Leverage borrowing: $625 million

00:54

Galaxy Digital: Clients Sold About $9 Billion Worth of Bitcoin Not Due to "Quantum Computing Risks"According to Odaily, Alex Thorn, Head of Research at Galaxy Digital, stated that a recent sale of approximately $9 billion worth of bitcoin by a Galaxy client was not motivated by concerns over so-called "quantum computing risks." He pointed out that although Galaxy Digital founder and CEO Mike Novogratz had mentioned that some in the market view quantum computing as one of the explanations for bitcoin's price weakness, Novogratz himself does not agree with this view.

News