\n

\n \n

\n

Agora CEO Nick van Eck anticipates a surge in stablecoin usage for business transactions, with Agora’s AUSD at the forefront, as reported in early 2026.

\n

This expansion could streamline enterprise payments, potentially altering business finance dynamics and enhancing stablecoin stability.

\n

Agora’s CEO on Stablecoin Usage

\n

Agora’s CEO, Nick van Eck, predicts a rise in stablecoin usage within enterprise payments. This shift by Agora, initially a decentralized finance-focused company, aligns with van Eck’s vision for payroll and business transactions.

\n \n

Nick van Eck, the founder of Agora, emphasizes the role of stablecoins in businesses, specifically highlighting AUSD. The company’s total value locked has increased by 60% following recent decentralized finance launches.

\n

\n “Our focus is shifting from DeFi to enterprise applications, enhancing payroll and B2B payments.” — Nick van Eck, CEO and Founder, Agora \n

\n

Enterprise Applications and Impact on Businesses

\n

The drive towards enterprise applications may prompt significant changes for businesses relying on traditional currency. Industries may soon integrate stablecoins into payroll and B2B payments, underscoring a shift in financial operations.

\n

Financial influence is clear as Agora experiences growth. This alteration in financial transactions could additionally encourage scrutiny from regulatory bodies, seeking to balance innovation and compliance.

\n

Stablecoins in Market Adaptation

\n

Enterprises incorporating stablecoins may adapt more efficiently to market needs. This transformation might enhance competitive edges for businesses ready to implement new financial technologies.

\n

Analyzing historical patterns suggests that stablecoin adoption could spur technological advancements. By examining data and trends, experts foresee potential economic shifts, marking significant progress in digital currency integration across sectors.

\n

Provident Financial Services (NYSE:PFS), a regional banking institution, is scheduled to release its latest financial results this Tuesday after the markets close. Here’s a summary of what to watch for.

\n\nIn the previous quarter, Provident Financial Services slightly surpassed Wall Street’s revenue projections, posting $221.7 million in revenue—a 5.3% increase compared to the same period last year. While the company managed to edge past analysts’ tangible book value per share forecasts, its earnings per share matched expectations, resulting in a mixed performance overall.

\n\nFor the current quarter, analysts anticipate that Provident Financial Services will generate $223.5 million in revenue, reflecting an 8.6% year-over-year increase. This growth rate is notably slower than the 79.4% surge seen in the corresponding quarter a year ago. Adjusted earnings per share are projected to reach $0.56.

\n\nOver the past month, most analysts have maintained their forecasts for the company, indicating expectations for steady performance as earnings approach. Notably, Provident Financial Services has fallen short of revenue estimates on two occasions in the last two years.

\n\nSeveral competitors in the regional banking sector have already shared their fourth-quarter results, offering some context for Provident’s upcoming report. ServisFirst Bancshares achieved a 20.7% year-over-year revenue increase, exceeding analyst expectations by 5%. Dime Community Bancshares also outperformed, with revenue rising 24.5% and beating estimates by 5.2%. Following these announcements, ServisFirst Bancshares’ stock climbed 14.6%, while Dime Community Bancshares saw a 12.5% gain.

\n\nInvestor confidence in regional banks has been positive lately, with the sector’s average share price rising 2.6% over the past month. Provident Financial Services’ stock has increased by 1.7% during the same period. Heading into earnings, the consensus analyst price target for Provident stands at $23.13, compared to its current price of $20.57.

\n\nAt StockStory, we recognize the value of investing in major trends. Companies like Microsoft (MSFT), Alphabet (GOOG), Coca-Cola (KO), and Monster Beverage (MNST) have all benefited from powerful growth drivers. In line with this approach, we’ve identified an emerging, profitable growth stock poised to benefit from the rise of AI—and you can access our research on it for free.

","contentId":"12560605167750","contentText":"Provident Financial Services Set to Announce Earnings Provident Financial Services (NYSE:PFS), a regional banking institution, is scheduled to release its latest financial results this Tuesday after the markets close. Here’s a summary of what to watch for. Recent Performance Overview In the previous quarter, Provident Financial Services slightly surpassed Wall Street’s revenue projections, posting $221.7 million in revenue—a 5.3% increase compared to the same period last year. While the company managed to edge past analysts’ tangible book value per share forecasts, its earnings per share matched expectations, resulting in a mixed performance overall. Outlook for the Upcoming Quarter For the current quarter, analysts anticipate that Provident Financial Services will generate $223.5 million in revenue, reflecting an 8.6% year-over-year increase. This growth rate is notably slower than the 79.4% surge seen in the corresponding quarter a year ago. Adjusted earnings per share are projected to reach $0.56. Provident Financial Services Total Revenue Analyst Sentiment and Historical Trends Over the past month, most analysts have maintained their forecasts for the company, indicating expectations for steady performance as earnings approach. Notably, Provident Financial Services has fallen short of revenue estimates on two occasions in the last two years. Peer Comparisons in Regional Banking Several competitors in the regional banking sector have already shared their fourth-quarter results, offering some context for Provident’s upcoming report. ServisFirst Bancshares achieved a 20.7% year-over-year revenue increase, exceeding analyst expectations by 5%. Dime Community Bancshares also outperformed, with revenue rising 24.5% and beating estimates by 5.2%. Following these announcements, ServisFirst Bancshares’ stock climbed 14.6%, while Dime Community Bancshares saw a 12.5% gain. Investor Sentiment and Price Targets Investor confidence in regional banks has been positive lately, with the sector’s average share price rising 2.6% over the past month. Provident Financial Services’ stock has increased by 1.7% during the same period. Heading into earnings, the consensus analyst price target for Provident stands at $23.13, compared to its current price of $20.57. Exploring Thematic Investment Opportunities At StockStory, we recognize the value of investing in major trends. Companies like Microsoft (MSFT), Alphabet (GOOG), Coca-Cola (KO), and Monster Beverage (MNST) have all benefited from powerful growth drivers. In line with this approach, we’ve identified an emerging, profitable growth stock poised to benefit from the rise of AI—and you can access our research on it for free.","createTime":"1769397120310","detailId":"4341606","id":"4341606","imgUrlsList":[],"imgUrlsStr":"","labelTypeList":[],"labelVos":[],"labels":"","languageId":"0","likeCount":0,"myLike":0,"originAuthor":"","originPublishTime":"1769396970000","originUrl":"https://finance.yahoo.com/news/earnings-watch-provident-financial-services-030218628.html","pageType":6,"pathSuffix":"","profileImg":"","readCount":72,"relatedCoinList":[],"relatedCoins":"MSFT,LINK,A","retweetsCount":"0","retweetsCountV2":0,"sectionId":"12508313407178","sectionName":"","showTime":"1769396970000","siteImg":"https://img.bgstatic.com/multiLang/web/cfe162fef73d2e018d93ed311c178bb6.jpeg","sourceName":"101 finance","title":"Earnings To Monitor: Provident Financial Services (PFS) Will Announce Q4 Results Tomorrow","translateStatus":0,"videoUrlsList":[],"videoUrlsStr":"","vip":0}]],"dataUpdateCount":1,"dataUpdatedAt":1769754299948,"error":null,"errorUpdateCount":0,"errorUpdatedAt":0,"fetchFailureCount":0,"fetchFailureReason":null,"fetchMeta":null,"isInvalidated":false,"status":"success","fetchStatus":"idle"},"queryKey":["detailsQuery","/how-to-buy/vaulta/greenland"],"queryHash":"[\"detailsQuery\",\"/how-to-buy/vaulta/greenland\"]"}]}

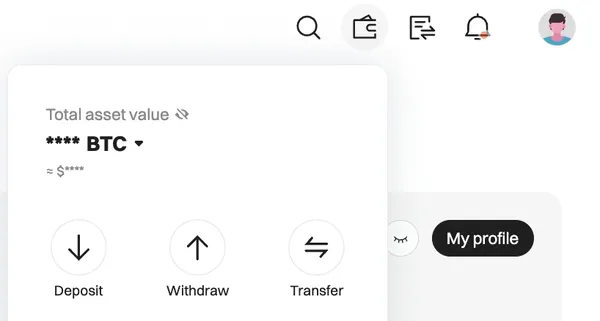

Credit/Debit in the Buy Crypto tab of the Bitget app

Credit/Debit in the Buy Crypto tab of the Bitget app Credit/Debit in the Buy Crypto tab of the Bitget websiteSelect your preferred fiat currency, enter the amount you wish to spend, link your credit card, and then complete your payment with zero fees.

Credit/Debit in the Buy Crypto tab of the Bitget websiteSelect your preferred fiat currency, enter the amount you wish to spend, link your credit card, and then complete your payment with zero fees. Add a new card to complete your payment on the Bitget app

Add a new card to complete your payment on the Bitget app Enter your bank card details to complete your payment on the Bitget websiteFor Diners Club/Discover card, click Buy Crypto > [Third Party] in the top navigation bar to place your Vaulta order.How to buy crypto with credit/debit card

Enter your bank card details to complete your payment on the Bitget websiteFor Diners Club/Discover card, click Buy Crypto > [Third Party] in the top navigation bar to place your Vaulta order.How to buy crypto with credit/debit card