News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily|Tech Stocks Rise for Two Consecutive Days; Nvidia Q4 Revenue Soars 75%; Circle Surges 35% (February 26, 2026)2Bitcoin’s upcoming $10.5B options expiry may end bear market: Here’s how3Bitcoin, Ethereum and Solana rally as analysts flag pause in ‘10 a.m. dump’ after Jane Street lawsuit

Riot Platforms, Inc. (RIOT) Is Gaining Attention: Key Information to Consider Before Investing

101 finance·2026/02/26 15:04

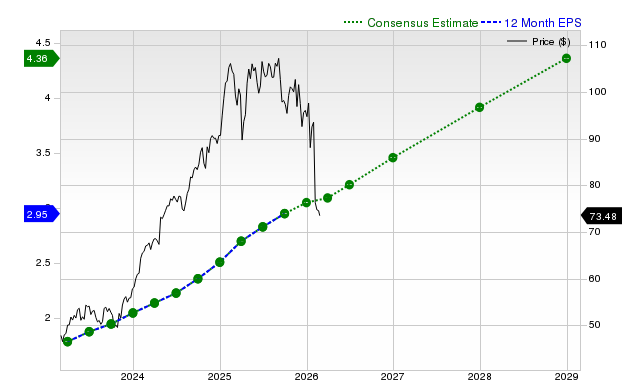

Here’s What You Should Understand Besides the Reasons Analog Devices, Inc. (ADI) is Gaining Attention

101 finance·2026/02/26 15:04

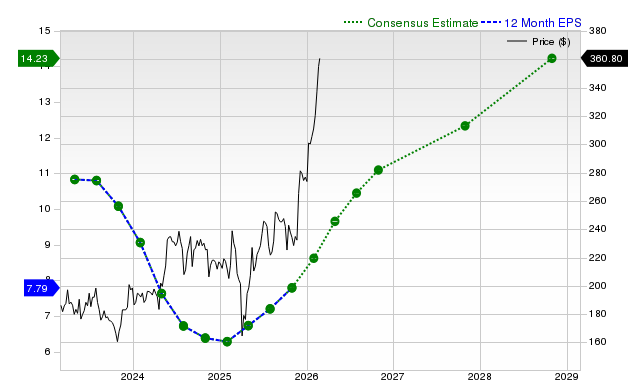

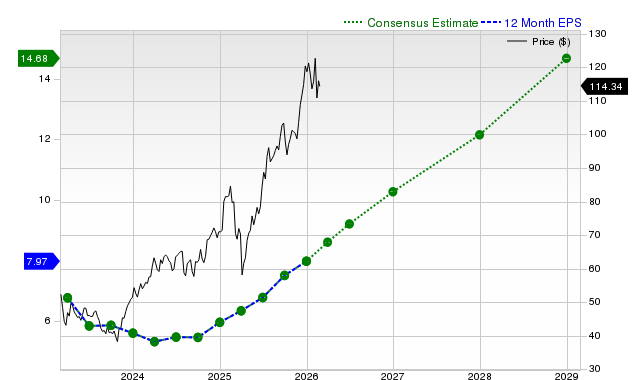

Boston Scientific Corporation (BSX) Is Gaining Attention: Key Information to Consider Before Investing

101 finance·2026/02/26 15:04

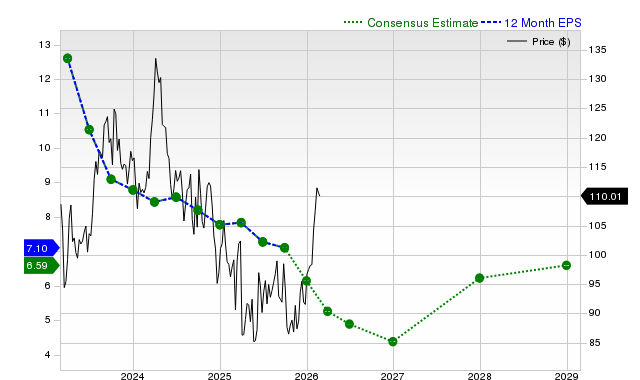

ConocoPhillips (COP) is Drawing Interest from Investors: Key Information You Need to Know

101 finance·2026/02/26 15:04

Petroleo Brasileiro S.A.- Petrobras (PBR) Is Gaining Attention: Key Information to Consider Before Investing

101 finance·2026/02/26 15:04

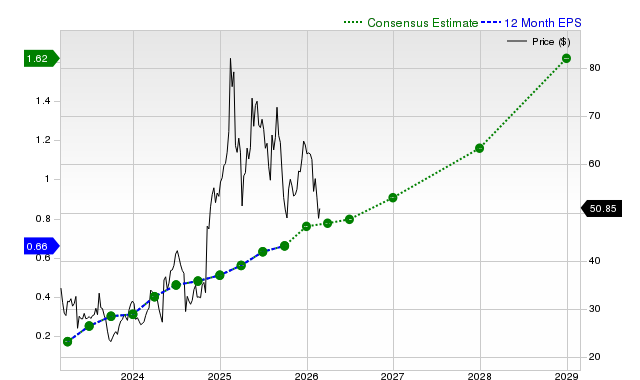

Investors Are Actively Looking Into Dutch Bros Inc. (BROS): Here’s What You Should Be Aware Of

101 finance·2026/02/26 15:04

Citigroup Inc. (C) Is Gaining Attention: Key Information to Consider Before Investing

101 finance·2026/02/26 15:04

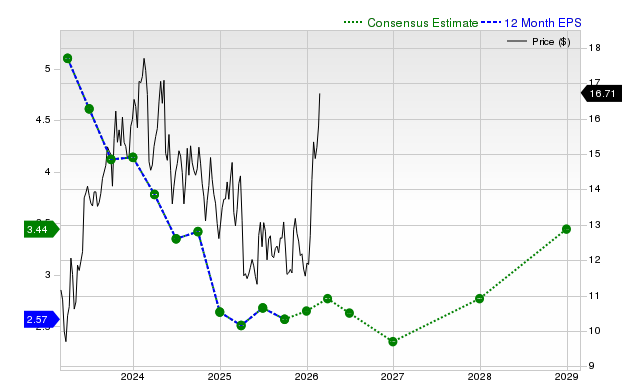

Carnival Corporation (CCL) is Drawing Interest from Investors: Important Information You Need to Know

101 finance·2026/02/26 15:04

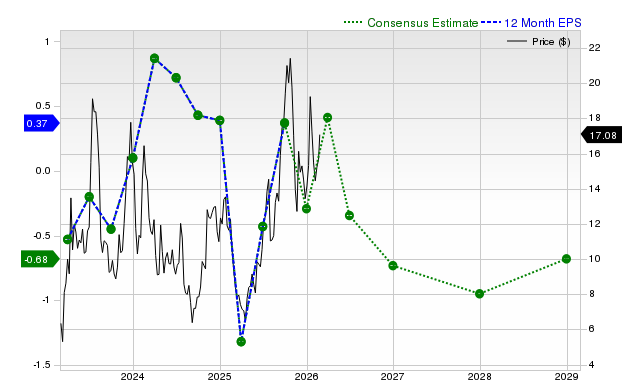

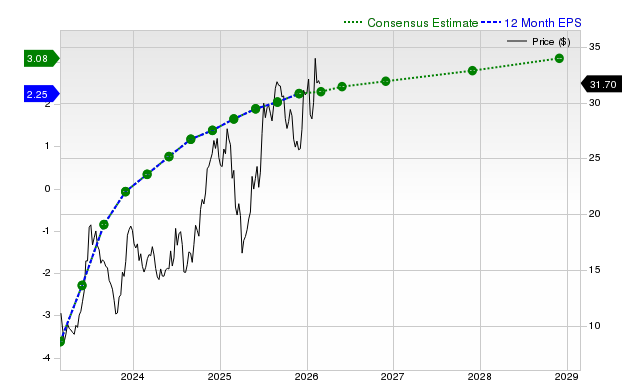

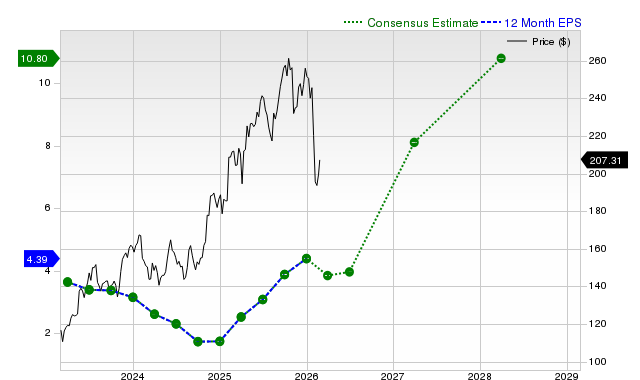

Is Take-Two Interactive Software, Inc. (TTWO) a Good Investment at This Time?

101 finance·2026/02/26 15:04

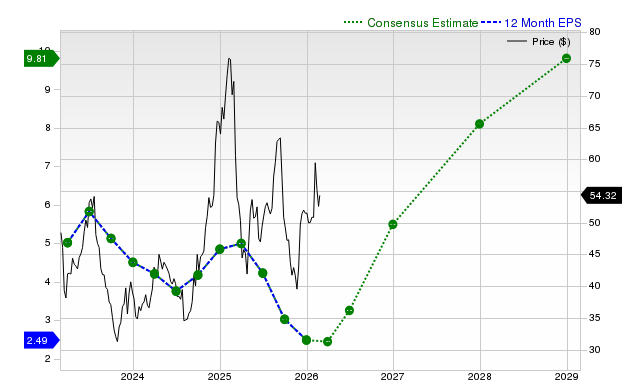

Alaska Air Group, Inc. (ALK) is Drawing Interest from Investors: Here’s What You Need to Know

101 finance·2026/02/26 15:04

Flash

01:12

US Stocks Move | Duolingo plunges over 21% in after-hours trading as daily active user growth hits four-year low and Q1 earnings guidance falls short of expectationsGlonghui, February 27|Language learning platform Duolingo (DUOL.US) plunged more than 21% in after-hours trading, closing at $92.37. In terms of news, Duolingo announced that its revenue for the fourth quarter last year increased by 35% year-on-year to $282.9 million, and adjusted EBITDA was $84.3 million, both exceeding market expectations. During the period, daily active users grew by 30% year-on-year to 52.7 million, marking the slowest growth rate in four years. In addition, the company expects daily active user growth to be around 20% in 2026, far below the previous growth rate of over 40%. Looking ahead to the first quarter, the company expects revenue of $288.5 million and adjusted EBITDA of about $73.6 million, both below the market consensus of $291.8 million and $84 million, respectively. For the full year, the company expects revenue to be between $1.2 billion and $1.22 billion, also below the market expectation of $1.26 billion. Duolingo will increase its investment in artificial intelligence to drive subscriber growth, which will slow short-term profit growth and profit margins. (Glonghui)

01:10

WSJ: TFH partners with Gap, Visa, and Tinder to promote World ID human verification productAccording to Odaily, the development team behind Worldcoin, Tools for Humanity (TFH), is collaborating with Gap, Visa, and Tinder to promote the implementation of its “World ID” human identity verification product. The report states that some Gap stores in San Francisco have already deployed “Orb” devices to collect users’ facial and iris information in order to generate World ID. At the same time, TFH plans to launch a payment card related to Visa, allowing users holding World ID to make purchases using digital assets. The dating app Tinder is also testing this identity system in Japan to verify that users are real individuals and that their age information is accurate. TFH stated that the Orb device converts facial and iris images into anonymous digital identifiers stored on the user’s device, and the company itself does not retain the original biometric data. Its business model intends to generate revenue by charging applications for verification services. (The Wall Street Journal)

01:01

BTC current market dominance rises to 53.50%BTC rises, with a 24-hour trading volume of $42 billions, a circulating market cap of $1.34 trillions, and a market dominance increase of 0.05%. Data is for reference only.

News