News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily|Tech Stocks Rise for Two Consecutive Days; Nvidia Q4 Revenue Soars 75%; Circle Surges 35% (February 26, 2026)2Bitcoin’s upcoming $10.5B options expiry may end bear market: Here’s how3Bitcoin, Ethereum and Solana rally as analysts flag pause in ‘10 a.m. dump’ after Jane Street lawsuit

Advertising powerhouse WPP plans to reduce expenses by £500 million through a major transformation

101 finance·2026/02/26 09:58

Bitcoin's $69K Rebound: Flow Analysis of the $507M ETF Inflow and Mining Stress

101 finance·2026/02/26 09:57

LSEG Announces £3 Billion Share Repurchase Amid Elliott's Call for Reform

101 finance·2026/02/26 09:51

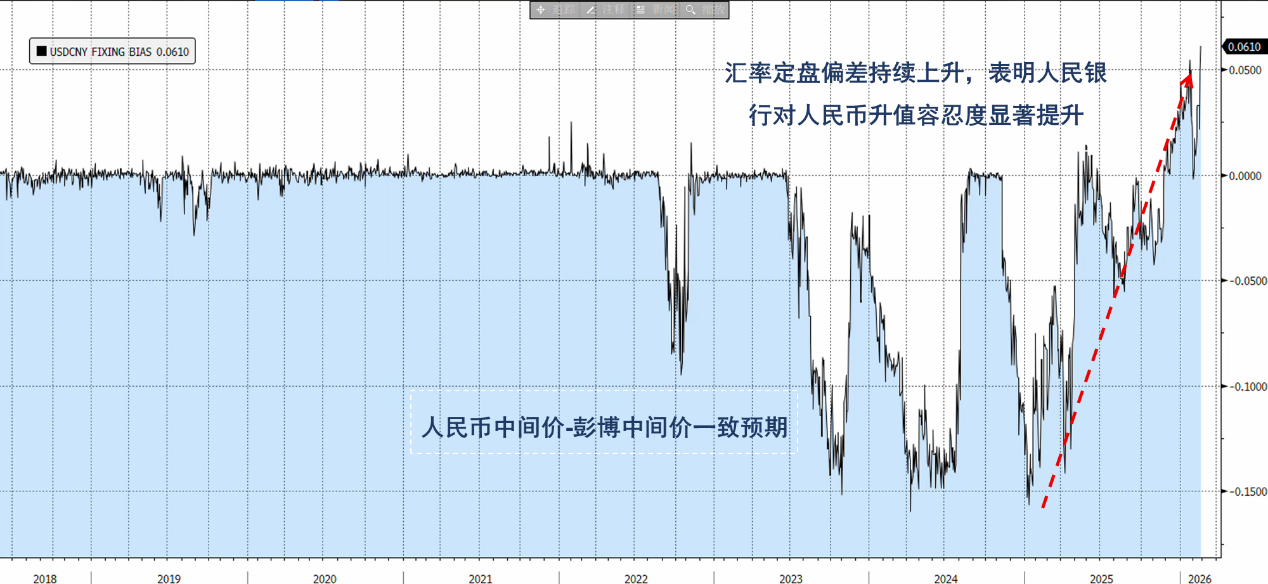

Yuan Continues to Rise, Achieving Its Longest Run of Gains Since 2010

101 finance·2026/02/26 09:48

Bitcoin ETFs post highest net inflows in three weeks, attracting more than $506 million

The Block·2026/02/26 09:42

Breaks Through 6.85! How to Understand the Strong Rally of the RMB?

华尔街见闻·2026/02/26 09:38

5 Thought-Provoking Analyst Inquiries From Lemonade’s Fourth Quarter Earnings Discussion

101 finance·2026/02/26 09:33

Gold is poised to build strength above 5200 and set a new monthly high

汇通财经·2026/02/26 09:28

Walmart Q4 Earnings Conference: Five Key Analyst Inquiries

101 finance·2026/02/26 09:24

Flash

21:13

Plug Power has reached a definitive agreement worth $132.5 million with Stream Data Centers, marking the launch of the company’s strategic infrastructure optimization plan totaling up to $275 million.This protocol is the first key step in the overall plan, aiming to enhance operational efficiency and strategic synergy by optimizing infrastructure layout.

21:04

The three major U.S. stock indexes closed mixed.The three major U.S. stock indexes closed mixed, with the Nasdaq down 1.18%, the S&P 500 down 0.54%, and the Dow Jones up 0.04%. Nvidia fell more than 5%.

20:56

Grant Cardone plans to tokenize $5 billion worth of company real estate assetsReal estate investor Grant Cardone stated that his company, Cardone Capital, is exploring blockchain-based tokenization methods to manage $5 billion worth of real estate assets. Previously, Cardone Capital had purchased bitcoin and expanded its digital asset portfolio. Although real estate tokenization is developing rapidly, regulatory hurdles and insufficient secondary market liquidity remain major challenges.

News