News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

- XRP Trust (XRPI) offers indirect crypto exposure via futures, highlighting behavioral biases shaping asset allocation in uncertain markets. - Its non-diversified structure (32.8% top holdings) amplifies herding behavior, while futures introduce counterparty risks and asymmetric volatility impacts. - Strategic allocation frameworks recommend 5-10% exposure, macro-conditioned rebalancing, and hedging with gold/FinTech ETFs to mitigate behavioral risks. - Regulatory shifts and geopolitical tensions undersco

- INIT token plummeted 35.87% in 24 hours after a 222.22% 7-day surge, marking extreme short-term volatility. - Market sentiment shifts, liquidity changes, and macroeconomic factors triggered the sharp price reversal. - Technical indicators showed overbought conditions and bearish moving average divergence before the crash. - A backtesting strategy aims to exploit INIT's volatility by targeting overbought/oversold thresholds systematically.

- Three 2025 meme coins—LILPEPE, LBRETT, and BFX—gain traction with Layer 2 infrastructure, scarcity, and multi-asset trading platforms. - LILPEPE’s presale sells 26.5% of tokens at $0.0021, backed by CertiK audit and $0.10–$2 price forecasts by 2025. - BFX’s $0.021 presale offers 30x–1000x ROI potential via a unified crypto/stock/forex trading app, raising $6.2M in early funding. - SHIB and PEPE face structural challenges (oversupply, no utility), losing 21% and 60% respectively in recent months. - Invest

- Ozak AI, a blockchain-AI fintech project, raised $2.4M in Stage 5 presale by selling 815M $OZ tokens at $0.01 each. - The platform combines AI-driven predictive analytics, automated trading, and real-time insights via tools like Ozak Data Vault. - Strong retail and institutional investor participation validates its value proposition in the 2025 crypto market. - Funds will accelerate platform development, AI model scaling, and DeFi integration through upcoming Ozak Stream Network.

- Ethereum's 2025 surge stems from $4.1B ETF inflows, SEC utility token reclassification, and 29.6% staking rate unlocking $43.7B in assets. - On-chain growth shows 1.74M daily transactions (43.83% YoY) with Layer 2 solutions handling 60% volume at $3.78 per transaction. - Institutional adoption includes 1.5M ETH ($6.6B) staked by corporate treasuries and 388,301 ETH added by advisors, tightening liquidity. - Pectra/Dencun upgrades reduced gas fees by 90%, enabling 10,000 TPS at $0.08, pushing DeFi TVL to

- The Fed faces stagflation-lite in 2025, balancing 3% inflation against 4.5% unemployment amid tariff-driven costs and weak global demand. - Maintaining 4.25-4.50% rates, policymakers split on potential 50-basis-point cuts as tariffs strain price stability and competitiveness. - Defensive consumer stocks (e.g., Costco, utilities) gain favor for stable demand, supply chain resilience, and pricing power amid economic uncertainty. - Companies like Kraft Heinz adapt to tariffs via domestic production and inno

- Stellar (XLM) forms a bullish inverse head and shoulders pattern since 2025, with a $0.48–$0.50 neckline as a critical breakout threshold. - Institutional accumulation at $0.39–$0.43 and historical backtests show a 261% aggregate return, validating the pattern's risk-reward asymmetry. - Macroeconomic tailwinds include Fed rate cuts, 57.20% Bitcoin dominance, and institutional altcoin allocations (15–35%), amplified by Stellar's PayPal/Visa partnerships. - Protocol 23 upgrades and $440M in tokenized asset

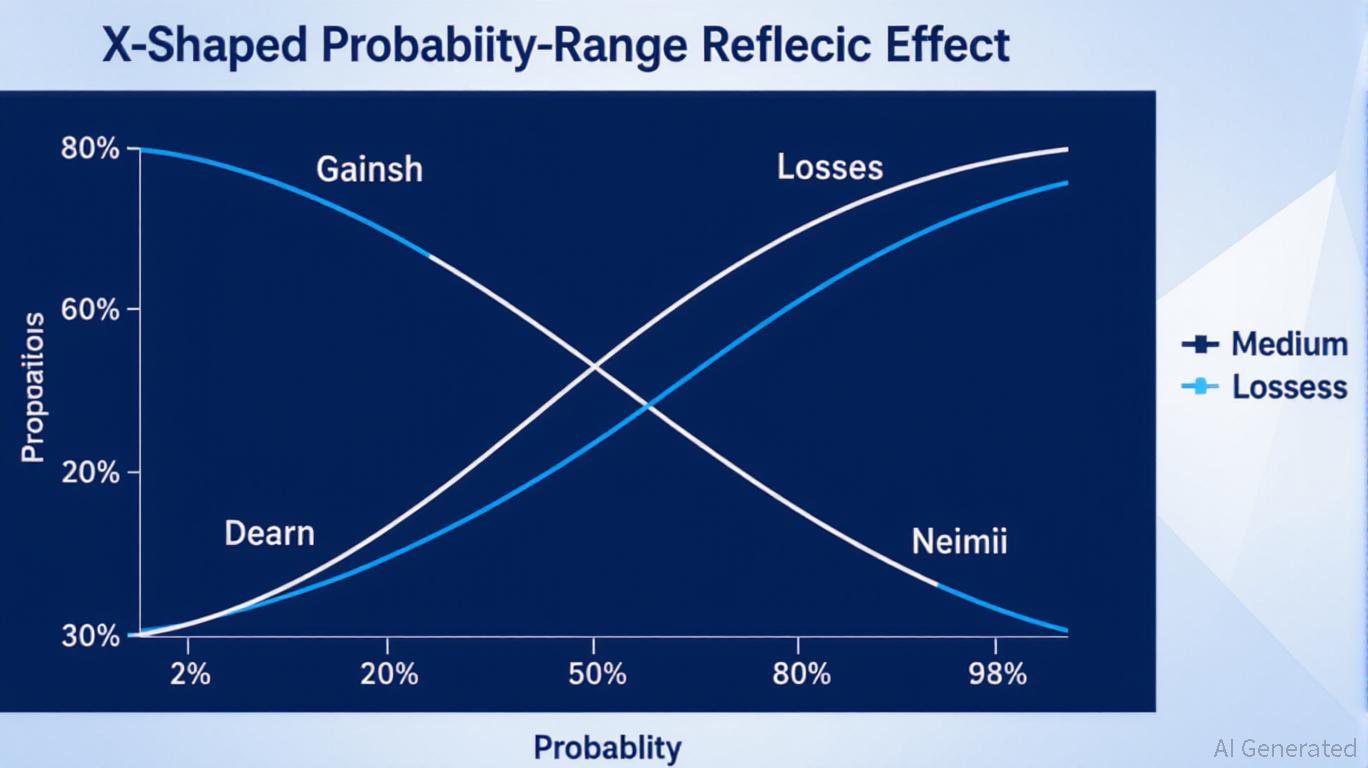

- The probability-range reflection effect (UXRP) extends prospect theory, revealing how investors' risk preferences shift across six domains based on probability levels and gain/loss contexts. - Low-probability losses trigger risk-seeking behavior (e.g., distressed assets), while high-probability gains favor risk-averse choices (e.g., stable dividends), shaped by non-linear probability weighting. - Domain-specific strategies emerge: investment domains prioritize index funds in high-probability gains and sp

- The Crypto Fear & Greed Index shows conflicting readings (39 "Fear" vs. 50 "Neutral") on August 30, 2025, reflecting market uncertainty. - Divergent methodologies highlight volatility, whale liquidations, and macro risks like delayed Fed cuts versus stable trading volumes and social media activity. - Historically, "Fear" signals oversold conditions, but current "Neutral" readings caution against over-optimism, requiring multi-indicator analysis. - Contrarian strategies suggest DCA, options hedging, and a