News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitcoin ETFs rebound with $166.5M inflows despite BTC price dip2Crypto Allocation in Asia: BlackRock’s Stunning $2 Trillion Prediction Reveals Institutional Shift3Solana Extends Losses Below $88 as Crypto Market Downturn Deepens

Strive Launches $950M Plan to Boost Bitcoin Treasury

Cryptotale·2025/09/15 23:05

Tether plans stablecoin for the US market (USAT)

CryptoValleyJournal·2025/09/15 22:57

Polymarket is booming: An overview of 10 ecosystem projects

A range of third-party ecosystems has emerged around Polymarket, including data/dashboards, social experiences, front-end/terminal, insurance, and AI agents.

链捕手·2025/09/15 22:53

Symbiotic, Chainlink, and Lombard launch industry-first layer for cross-chain Bitcoin transfers

Cryptobriefing·2025/09/15 22:33

Bitcoin price drop to $113K might be the last big discount before new highs: Here’s why

Cointelegraph·2025/09/15 21:45

Rate Cut Roulette: What 0, 25, or 50 bps Means for Bitcoin and Altcoins

Markets await the Fed’s September 17 policy call, with 0, 25, or 50 bps cuts on the table. Bitcoin and altcoins brace for volatility as traders weigh liquidity and risk.

BeInCrypto·2025/09/15 21:44

Trump Predicts a "Significant Rate Cut" by the Federal Reserve!

AICoin·2025/09/15 21:08

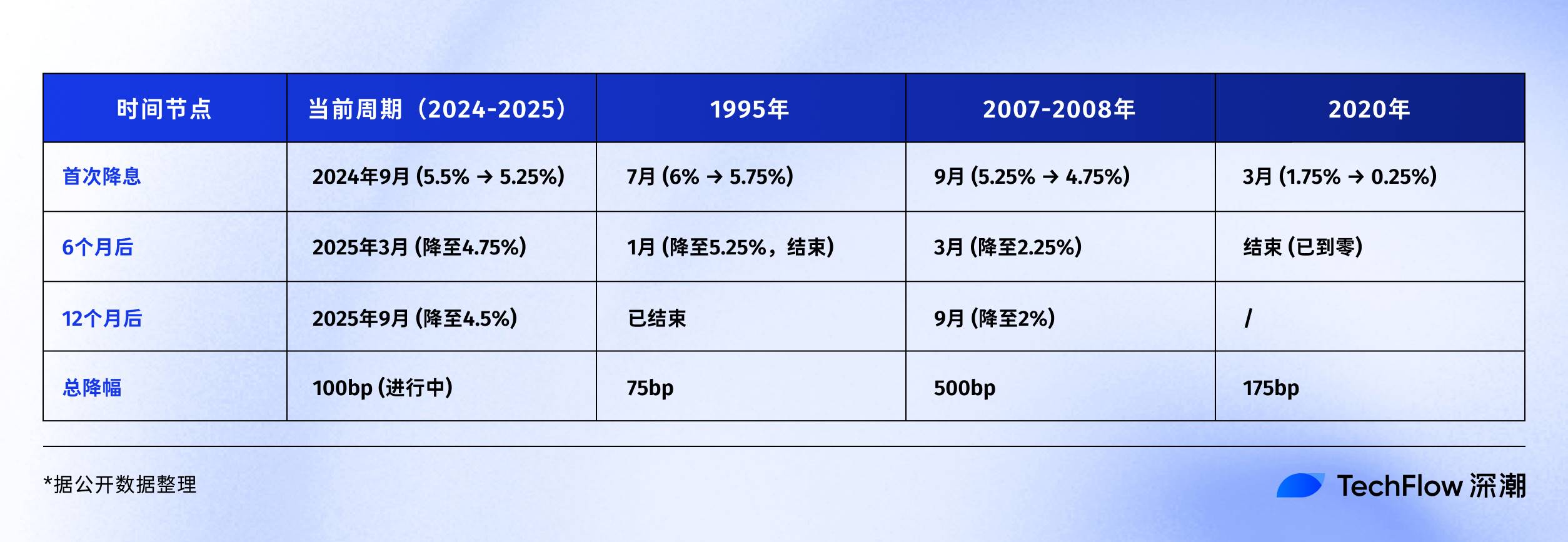

Reviewing the Fed's rate-cutting cycle: What’s next for Bitcoin, the stock market, and gold?

If history rhymes, the next 6-12 months could be a critical window.

深潮·2025/09/15 20:59

Will Tesla and xAI merge? Hedge fund tycoon: It feels inevitable

Positive remarks from SkyBridge Capital founder Anthony Scaramucci have further fueled expectations of a possible merger between Tesla and xAI.

ForesightNews·2025/09/15 20:43

Capital B Expands Bitcoin Holdings to 2,249 BTC, Yield Hits 1,536%

coinfomania·2025/09/15 20:12

Flash

03:00

An address traded 5,089 ETH within 23 hours, earning over $520,000 in profit.Foresight News reported, according to monitoring by @ai_9684xtpa, that the address starting with 0x2d4 accumulated 5,089.56 ETH at an average price of $1,953.65 over the past 23 hours, worth approximately $9.943 million, precisely buying at the low point before ETH rebounded. Subsequently, 9 hours ago, this address sold 4,000 ETH at a short-term high of $2,058.91, worth about $8.235 million, making a profit of $421,000. Currently, the remaining 1,089.56 ETH still has an unrealized profit of $104,000.

02:59

The **CLARITY Act** Stalemate Reaches Fever Pitch, Banks and Crypto Industry Dig In, White House Calls for Compromise by End of MonthBlockBeats News, February 14th, the deadlock over stablecoin yields in the U.S. Senate's Crypto Market Structure Bill (the "CLARITY Act") has now escalated, with the crypto camp insisting that user rewards are indispensable.

This week, despite urging from Trump administration officials to seek a compromise, another White House meeting between Wall Street bankers and crypto executives ended in failure. The banking side took a hard line, arguing that any form of stablecoin yield or reward is unacceptable, stating that such yields would threaten the core of the U.S. banking system—the deposit business. They outlined their position in a one-page paper titled "Principle of Yield and Interest Prohibition."

The Digital Chamber took a tough stance and on Friday released its own set of principles, supporting the terms outlined in the Senate Banking Committee's draft regarding acceptable reward scenarios. The document made it clear that as long as it does not automatically trigger regulatory rulemaking, the banking proposal for a "two-year study on stablecoin impact on deposits" is acceptable.

Cody Carbone, CEO of the Digital Chamber, stated, "We want policymakers to understand that we see this as a compromise." Through this document, the industry organization in writing indicated its willingness to give up any static holding rewards similar to interest on a bank savings account. Carbone pointed out that since last year's "GENIUS Act" is already the law, the crypto industry's willingness to forgo holding rewards is a significant concession, but rewards for customers in activities such as trading should be retained. Banks should return to the negotiating table.

"If they don't negotiate, then the status quo remains with rewards," Carbone said, "If they do nothing and simply demand a blanket ban, this matter will not end." He hopes that after the recent unsuccessful White House meeting, this new document can restart negotiations.

The Digital Chamber's principles document specifically emphasizes the need to protect two types of reward scenarios: rewards related to providing liquidity and rewards that promote ecosystem participation, believing that these two provisions in Section 404 of the draft are crucial for DeFi.

It is reported that the White House has requested a compromise to be reached by the end of this month. Despite the banking side not seeming to concede in multiple meetings, Trump's crypto advisor, Patrick Witt, said that a new round of meetings may be scheduled next week.

02:35

Gemhead Capital completes a $5 million strategic investment in BihuoProBlockBeats News, February 14, Gemhead Capital announced the completion of a $5 million strategic investment in the crypto data infrastructure project BihuoPro. Both parties stated that they will further cooperate around crypto market sentiment data modeling and institutional-grade signal infrastructure. According to the introduction, BihuoPro positions itself as a "private domain financial data + sentiment consensus engine + tradable signal provider," dedicated to structuring behavioral and public opinion information scattered across communities and private domains, and building an indicator system that directly serves quantitative and trading decision-making. Its core approach is to map the "person–event–asset" relationship onto a unified graph and output sentiment and consensus signals for institutions. BihuoPro stated that in the future, it will continue to advance its global technology and compliance strategy, and enhance its data service capabilities for quantitative institutions, market makers, and high-net-worth traders.

News