News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily|Tech Stocks Rise for Two Consecutive Days; Nvidia Q4 Revenue Soars 75%; Circle Surges 35% (February 26, 2026)2Bitcoin’s upcoming $10.5B options expiry may end bear market: Here’s how3Bitcoin, Ethereum and Solana rally as analysts flag pause in ‘10 a.m. dump’ after Jane Street lawsuit

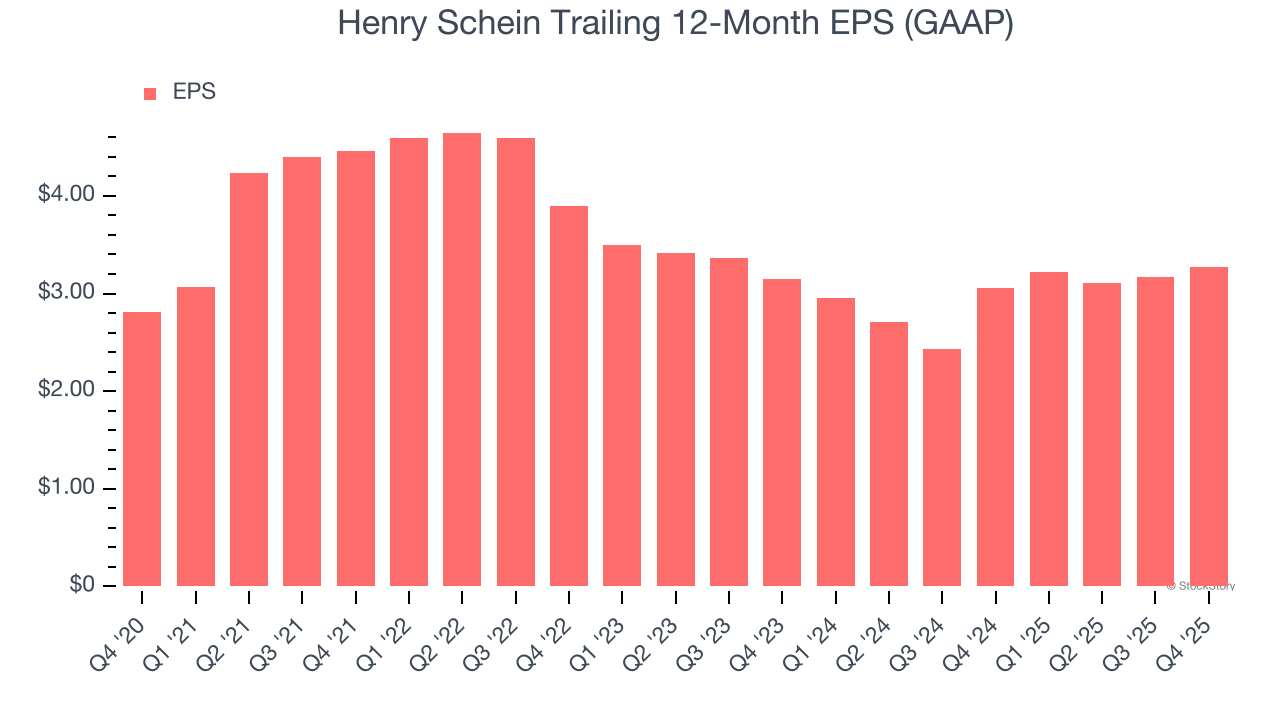

Henry Schein's (NASDAQ:HSIC) Q4 CY2025 Sales Beat Estimates

Finviz·2026/02/24 13:00

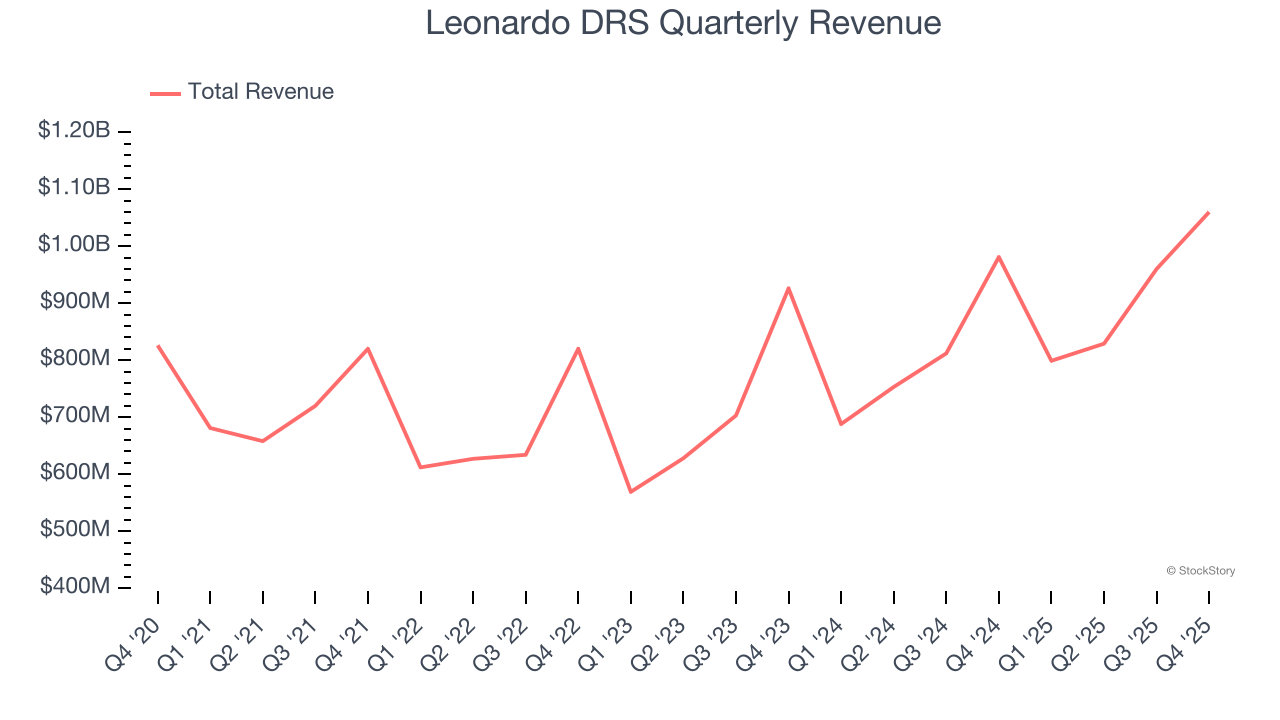

Leonardo DRS (NASDAQ:DRS) Delivers Impressive Q4 CY2025

Finviz·2026/02/24 12:57

EXCLUSIVE: Penny Stock Nexalin Advances Pivotal Trial Aiming To Tackle Severe Insomnia

Finviz·2026/02/24 12:54

Repligen: Fourth Quarter Earnings Overview

101 finance·2026/02/24 12:51

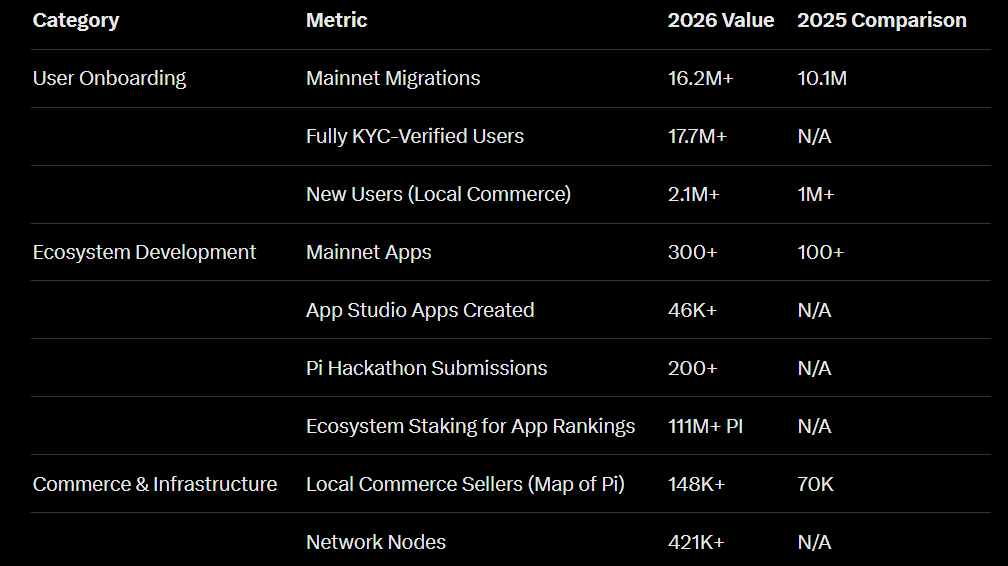

Pi Network marks 1-year open mainnet milestone with Pi Coin at all-time lows

Cryptopolitan·2026/02/24 12:48

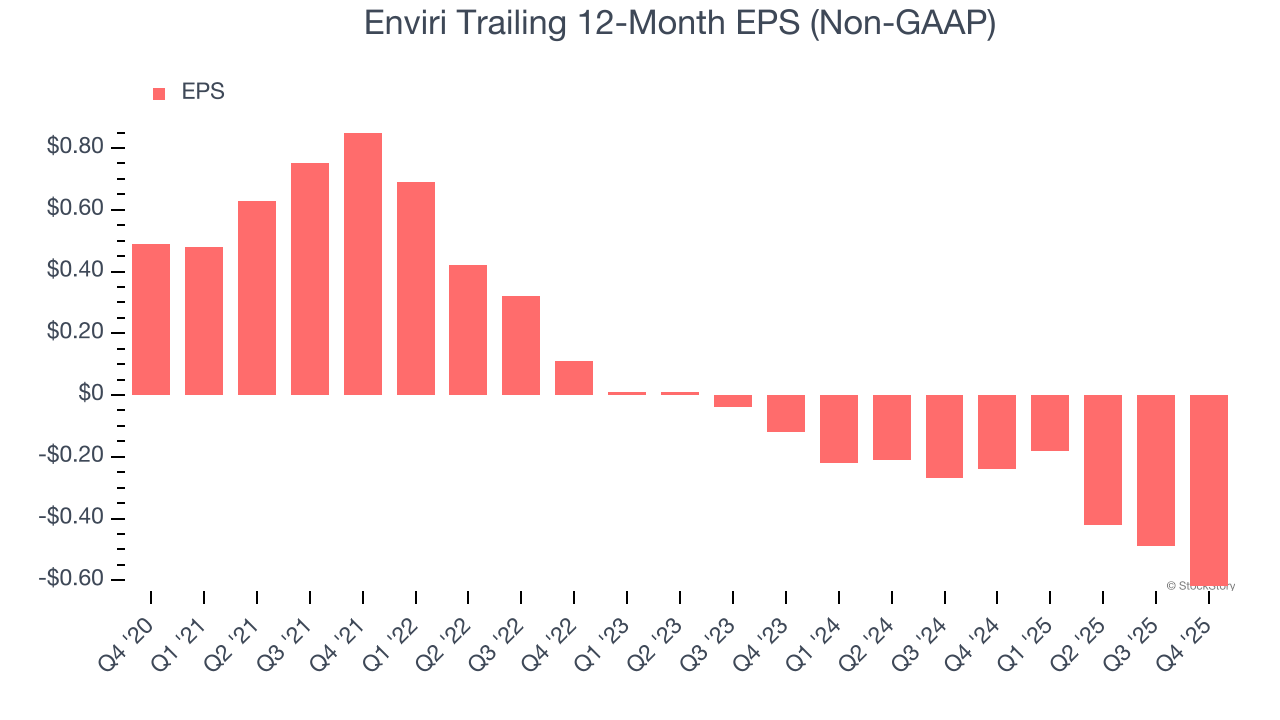

Enviri's (NYSE:NVRI) Q4 CY2025 Sales Top Estimates

Finviz·2026/02/24 12:48

Why XRP is Down Today-According to ChatGPT, Claude, and Grok

CoinEdition·2026/02/24 12:45

Bitcoin Price Prediction: ETF Exodus Pushes BTC Toward 200-Week MA At $58,500

CoinEdition·2026/02/24 12:45

Protara's Experimental Bladder Cancer Drug Shows Encouraging Results

Finviz·2026/02/24 12:45

DXY: ING expects the range-bound trend to persist

101 finance·2026/02/24 12:42

Flash

00:32

An OTC whale holding over $572 million in assets sent 23,500 ETH to FalconXAccording to Odaily, Onchain Lens monitoring shows that the OTC whale "0xfb7" sent 23,500 ETH ($47.47 million) to FalconX for sale and loan repayment. Currently, this whale holds: - 4,000 cbBTC ($269 million) - 120,380 stETH ($243.27 million) - 29,727 WETH ($60.16 million) Borrowed $97.26 million USDT from Aave.

00:25

Arkham: LinkedIn founder currently holds $6.1 million worth of EthereumChainCatcher reported, according to market sources, LinkedIn founder Reid Hoffman currently holds Ethereum worth $6.1 million in his known addresses, and also owns a Cryptopunk NFT purchased last year for 150 ETH.

00:16

BlockTower Capital founder: Market makers mainly influence intraday volatility; the main reason for BTC’s pullback is early holders sellingAccording to Odaily, BlockTower Capital founder Ari Paul stated that market makers may indeed engage in short-term operations during weak market conditions, such as slightly moving MSFT or BTC by about 2% to trigger stop-losses. However, such actions are typically intraday games, with prices often reverting within seconds or minutes, and have limited impact on the long-term trends of highly liquid assets like bitcoin ETF. He pointed out that the main reason for the current BTC decline is that early holders have sold tens of thousands of BTC, while market buying power has been insufficient to absorb the supply. Ari Paul believes that while large-scale long-term manipulation is not entirely impossible, it is relatively unlikely and carries high risks. In most cases, market movements that deviate from expectations should not be simply attributed to "manipulation"; investors should optimize their own analytical frameworks. At the same time, compared to "downward manipulation," "upward pushing" is more common across various asset classes.

News