News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Trump Ends Government Shutdown; Software Stocks Hit by AI Tools; Nvidia Plans Massive Investment in OpenAI (February 4, 2026)2BitMine adds 41,000 ETH to its balance sheet, while its unrealized losses amount to $6B3XRP price prediction: What the loss of the $1.77 swing low means for you

Google’s latest quarterly report showcases the company’s growing dominance as a leading force in the AI era.

101 finance·2026/02/04 21:57

Crown Castle: Fourth Quarter Earnings Overview

101 finance·2026/02/04 21:57

Digi International: Fiscal First Quarter Earnings Overview

101 finance·2026/02/04 21:39

E.l.f. Beauty: Overview of Fiscal Third Quarter Earnings

101 finance·2026/02/04 21:39

MicroStrategy Stock Loss: Devastating 60% Plunge Hits 11 US State Pension Funds

Bitcoinworld·2026/02/04 21:36

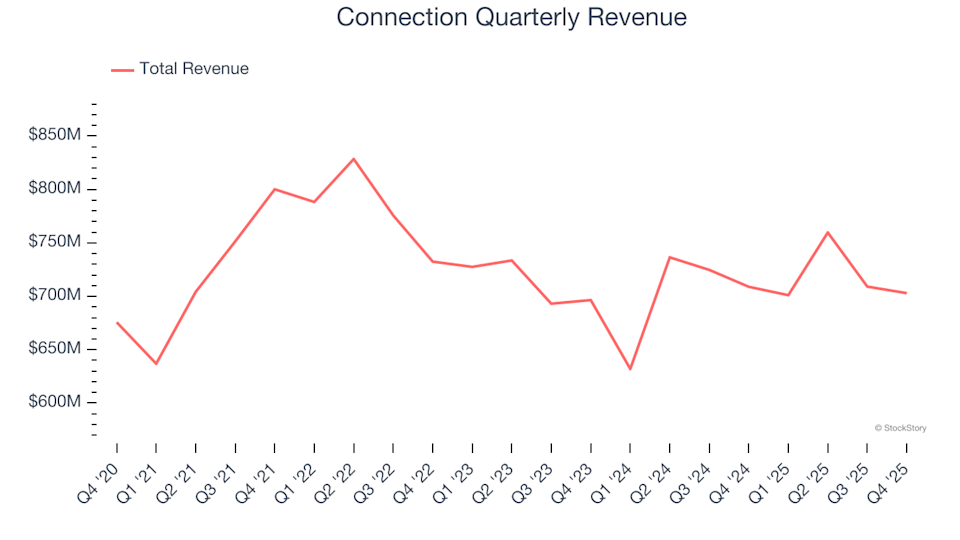

Connection (NASDAQ:CNXN) Falls Short of Q4 CY2025 Revenue Projections

101 finance·2026/02/04 21:33

CME Considers Introducing Its Own Token as Around-the-Clock Crypto Fund Trading Approaches

101 finance·2026/02/04 21:33

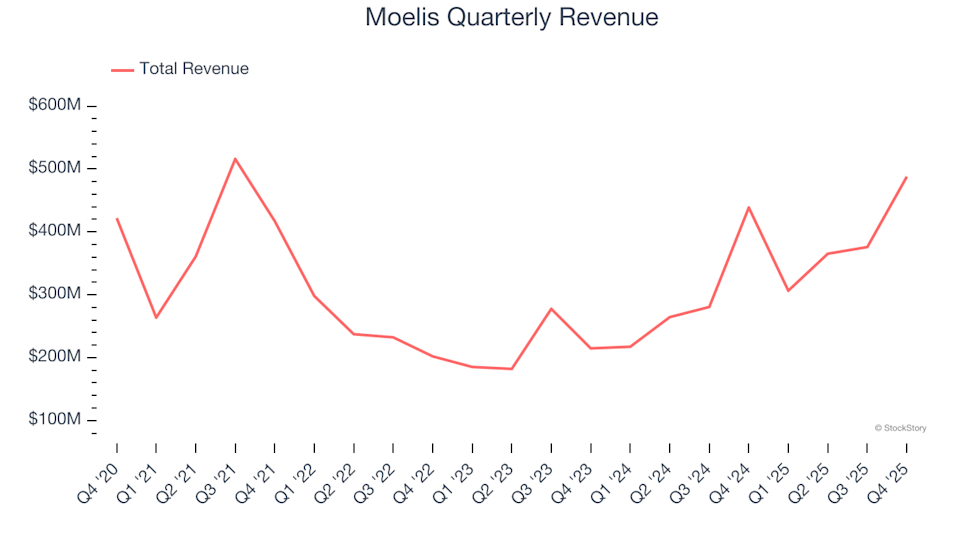

Moelis (NYSE:MC) Delivers Impressive Q4 Results for CY2025

101 finance·2026/02/04 21:33

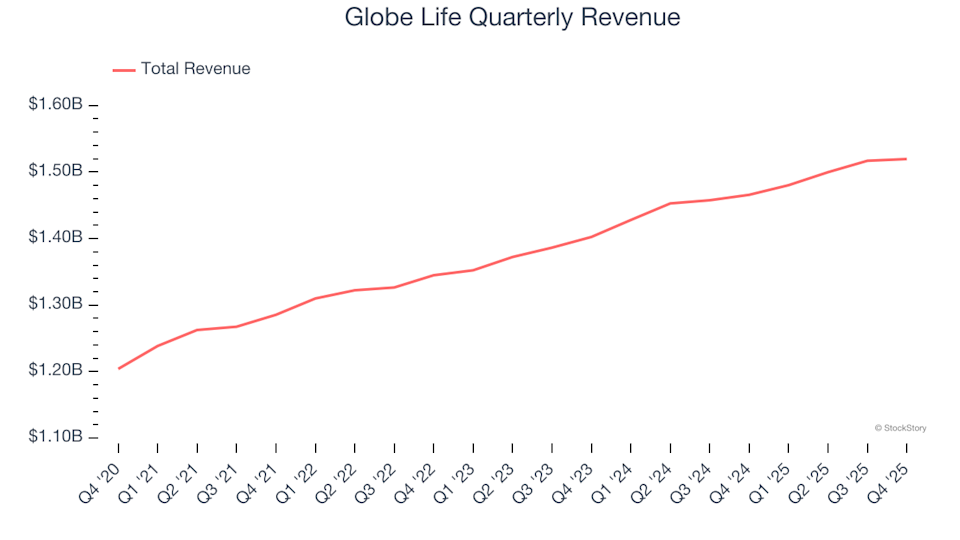

Globe Life (NYSE:GL) Announces Q4 CY2025 Earnings With Sales Falling Short of Analyst Expectations

101 finance·2026/02/04 21:33

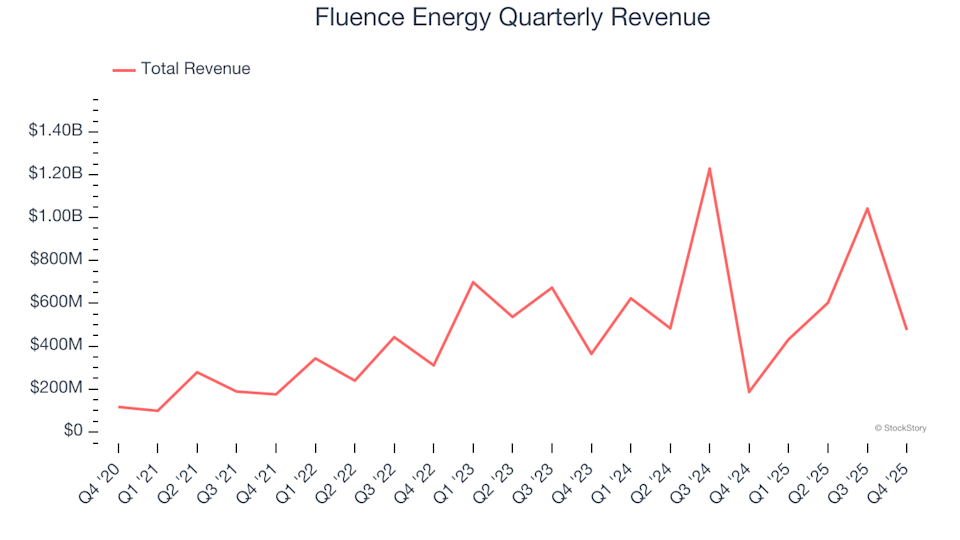

Fluence Energy (NASDAQ:FLNC) Falls Short of Q4 CY2025 Revenue Projections, Shares Decline 11.5%

101 finance·2026/02/04 21:33

Flash

21:52

BNB falls below 700 USDTForesight News reports that according to Bitget market data, BNB has fallen below 700 USDT, currently trading at 699.70 USDT, with a daily decline of 7.35%.

21:34

The Federal Reserve finalizes annual stress test scenarios and maintains current capital requirements until 2027The Federal Reserve Board on Wednesday finalized the assumptions for its annual stress test scenarios to ensure that large banks can continue lending to households and businesses during a severe economic downturn. These scenarios are largely consistent with the proposals put forward in October 2023. In addition, the Federal Reserve voted to maintain the current Stress Capital Buffer requirements until 2027, at which point new requirements will be calculated based on public feedback. Vice Chair Michelle W. Bowman stated that this move will improve the transparency and fairness of the models. This year’s stress test will assess the resilience of 32 banks under a global severe recession scenario, including an unemployment rate rising to 10%, a 30% drop in housing prices, and a 39% decline in commercial real estate prices.

20:57

Long-term US Treasury yields rise by more than 2 basis pointsJinse Finance reported that on Wednesday (February 4) at the close of trading in New York, the yield on the US 10-year Treasury rose by 1.20 basis points to 4.2775%. The yield on the 2-year Treasury fell by 0.82 basis points to 3.5614%, continuing to decline since 22:45 (GMT+8); the yield on the 30-year Treasury rose by 2.07 basis points to 4.9149%. The yield spread between the 2-year and 10-year Treasuries widened by 2.027 basis points to 71.410 basis points. The yield on the 10-year Treasury Inflation-Protected Securities (TIPS) rose by 1.74 basis points to 1.9305%, with a surge following the release of the ADP private employment report at 21:15 (GMT+8), and a significant pullback after the release of the ISM Non-Manufacturing Index at 23:00 (GMT+8); the yield on the 2-year TIPS rose by 1.70 basis points to 0.7483%; the yield on the 30-year TIPS rose by 2.12 basis points to 2.6365%.

News