Analyst: Bitcoin's Historic Breakout Fails to Confirm, May Face About 13%-24% Downside

Technical analyst Katie Stockton, founder of Fairlead Strategies, noted that Bitcoin's failure to hold above $100,000 for more than a few days has left the historic breakout ‘unconfirmed’ and opens up a potentially weaker scenario for Bitcoin in the short-term, stating that short-term bullish momentum is weak and there is a new daily countertrend signal that supports a downside for Bitcoin in the coming weeks. Bullish momentum is weak, and there is a new daily countertrend signal that supports bitcoin consolidating in the coming weeks before continuing its uptrend. The two support levels that investors should be looking at are the 20-day moving average of $97,233 as of Tuesday morning and the 50-day moving average of $85,342, which suggests that bitcoin could see a downside of around 13 percent. If the 50-day moving average also fails, Katie Stockton pointed to $73,800 as the next possible level for bitcoin, which represents a potential downside of about 24 percent.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Saturday Spread: Leveraging a Lesser-Known Signal to Evaluate Genuine Market Risk

Ripple Releases Whitepaper for Banks to Buy and Sell Crypto

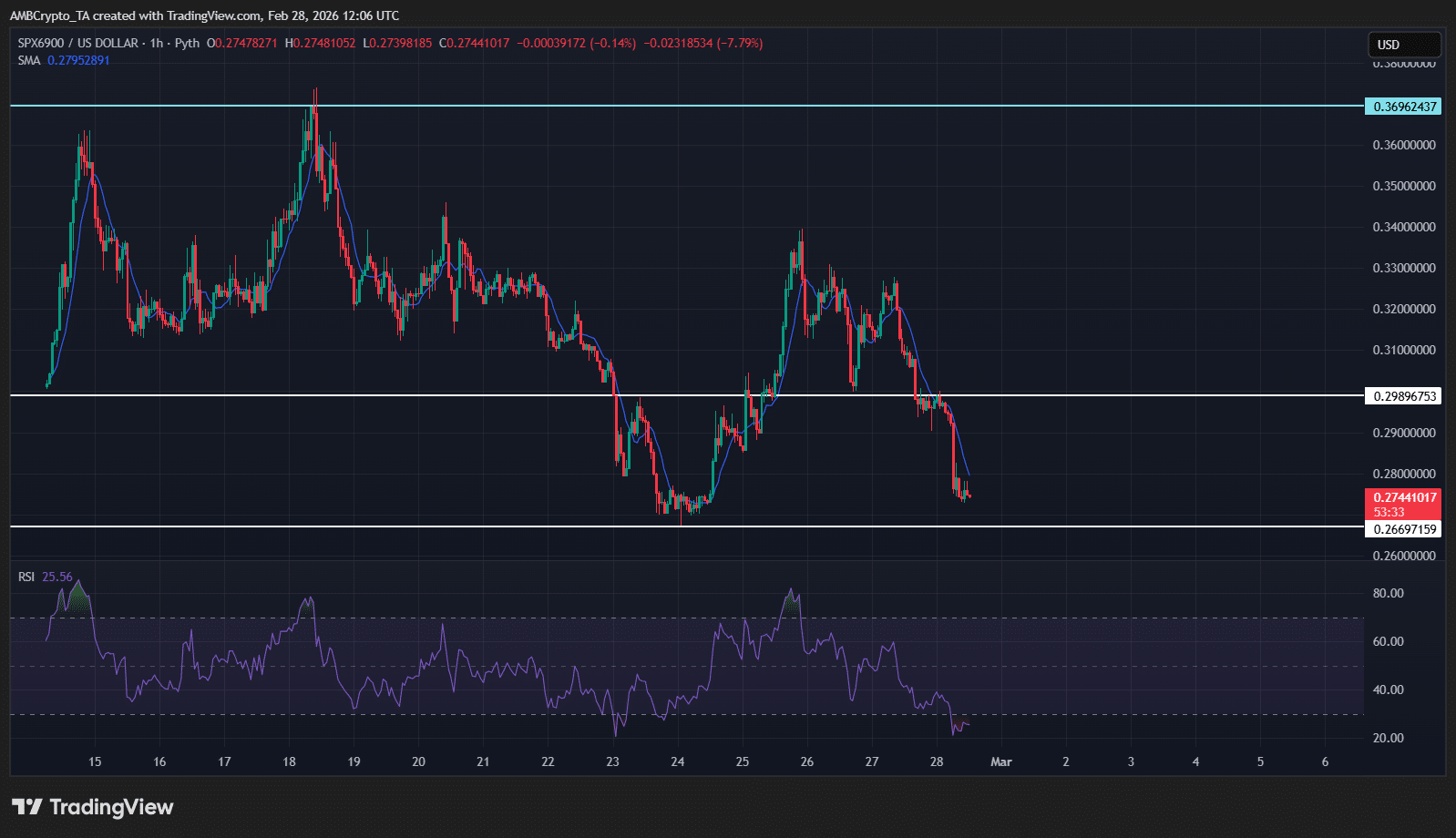

Assessing SPX6900’s 55% crash – Why SPX bulls need $0.27 to hold

Cheniere Energy: An Institutional Conviction Buy Amidst Sector Rotation