World Liberty Financial's WLFI token becomes tradeable following near-unanimous approval

Key Takeaways

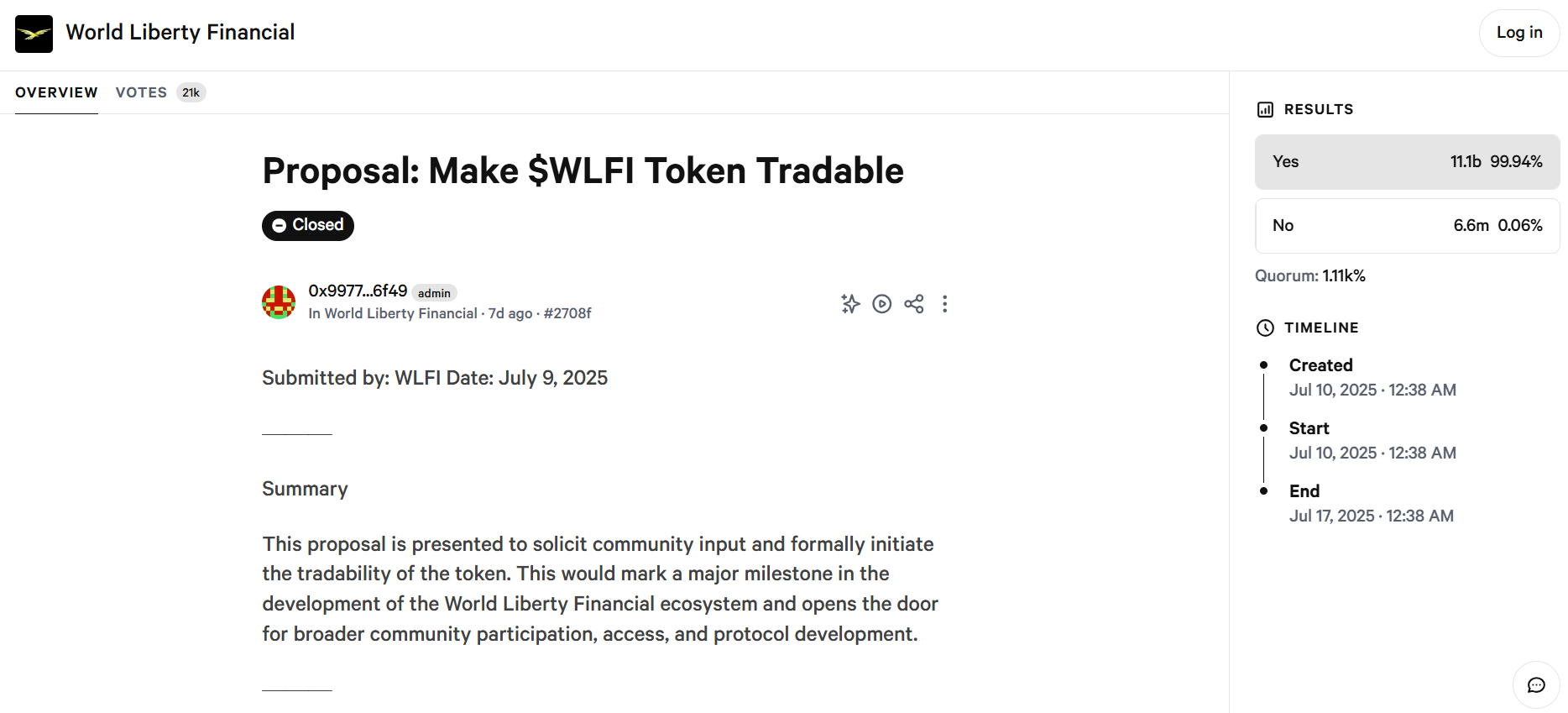

- World Liberty Financial’s proposal to enable trading of its WLFI token concluded on Wednesday, with 99.9% approval from token holders.

- The token is part of a DeFi platform launched last fall by the Trump family and partners.

With 99.9% approval in a governance vote concluded today, World Liberty Financial’s WLFI token is becoming tradeable. This also means that the project will shift to an open-participation model.

The token, tied to the DeFi venture backed by the Trump family, was initially sold last fall. Backers were drawn by Trump’s association and hopes for price appreciation.

With trading now enabled, market forces can determine WLFI’s price, potentially boosting liquidity and attracting wider investor interest. Trump’s family earns 75% of the initial sale revenues. As of last year, Trump held approximately 16 billion tokens via DT Marks DEFI LLC.

Critics, including Sen. Elizabeth Warren and Rep. Maxine Waters, warn of potential conflicts of interest, given Trump’s influence over crypto regulation. The White House says Trump’s assets are held in a trust managed by his children, though the arrangement’s terms remain undisclosed.

WLFI has not been designated a security by the SEC and currently operates outside of typical investment regulations.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Household debt is overwhelming people in the U.S. Here’s how you can respond

Traders, LayerZero flipped bullish – ZRO eyes $2.00, but THESE risks remain

Kinross Gold's 2025 Performance and BofA's Target Price: Analyzing Through a Commodity Equilibrium Lens

Ethereum Accelerates Its Transition to Quantum Resistance