XRP price prediction: This indicator hints at 640% rally

With XRP flying high as investors react to the resolution of the Securities and Exchange Commission (SEC) case, on-chain data suggests that more upside for the asset might be on the horizon.

This projected rally is rooted in the fact that XRP’s Market Value to Realized Value (MVRV) ratio has formed a golden cross, a technical pattern that occurs when the short-term MVRV ratio moves above its long-term 200-day moving average (MA).

This rare event has occurred only twice in recent years, and both times it preceded major rallies, as observed by cryptocurrency trading analyst Ali Martinez in an X post on August 8.

According to the expert, the last two times this pattern appeared, XRP soared 630% and 54%, respectively.

Notably, the MVRV ratio measures how overvalued or undervalued an asset is compared to its “fair value” based on historical acquisition prices.

If XRP were to repeat its best historical performance of a 640% surge, the token could climb from its current price of $3.30 to around $24.42, a new record high that would push its market cap to $1.45 trillion, ranking it as the second-largest cryptocurrency, assuming Ethereum (ETH) records minimal growth over the same period.

XRP’s warning signal

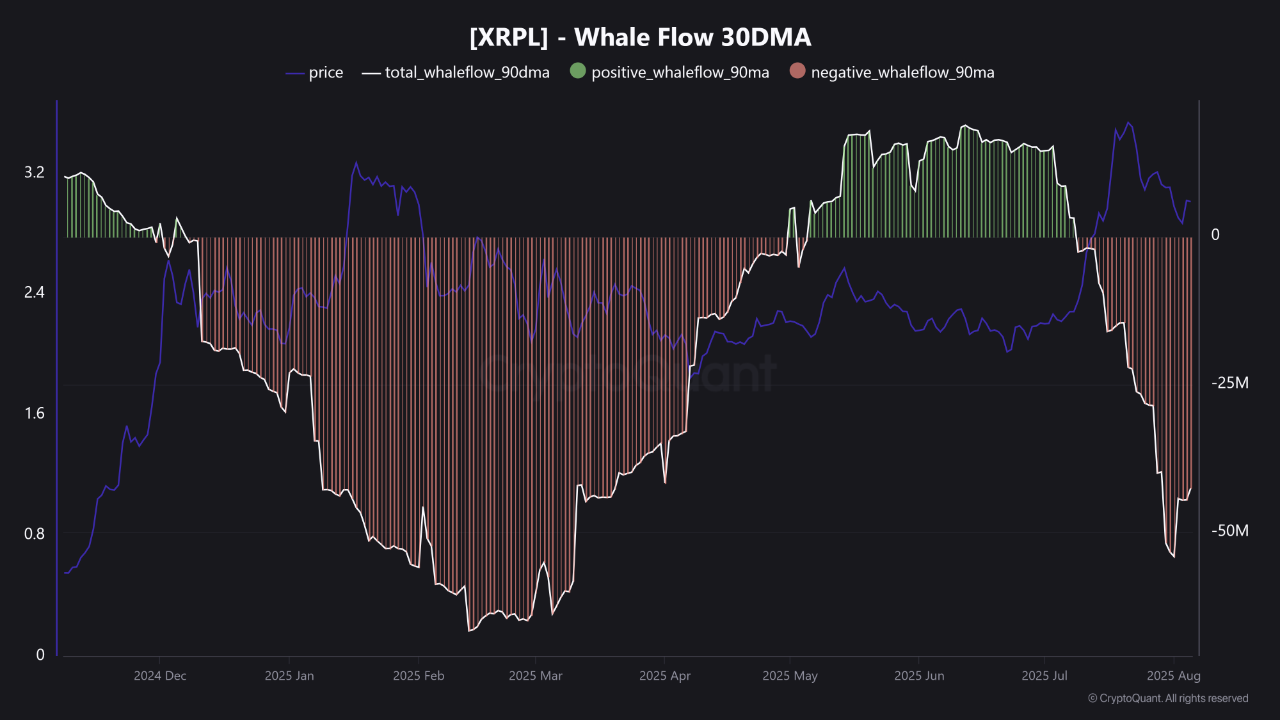

Meanwhile, XRP investors should be alert to any potential price reversal. To this end, data shared by The Enigma Trader indicates that the asset’s 90-day moving average whale flow has turned negative, signaling heavy outflows from large holders.

This shift mirrors patterns seen in January to February, when persistent whale distribution coincided with a local price peak followed by a correction. While the current downturn is shorter and less severe than earlier in the year, the alignment between whale selling and price weakness remains notable.

Without a sustained return of positive whale flows, typically above 5 million XRP per day, the market risks staying under structural selling pressure.

Overall, it remains to be seen how this metric will play out and impact XRP’s price. This development comes as the SEC formally closed its case against Ripple over unregistered securities sales.

On August 7, Ripple and the SEC agreed to drop appeals of Judge Analisa Torres’ fine and her ban on XRP sales to institutional investors.

XRP price analysis

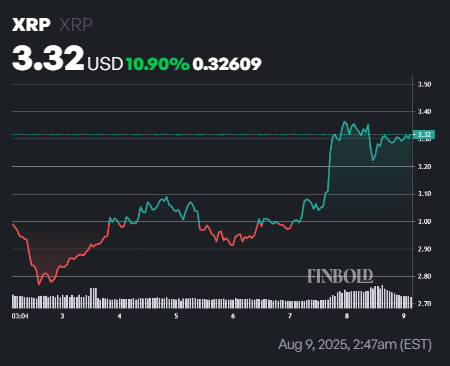

By press time, XRP was trading at $3.32, up 0.65% in the past 24 hours and nearly 11% higher over the past week.

For now, XRP needs to hold above the $3.30 level for a near-guaranteed shot at reaching $3.50, provided broader market conditions remain bullish.

Featured image via Shutterstock

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

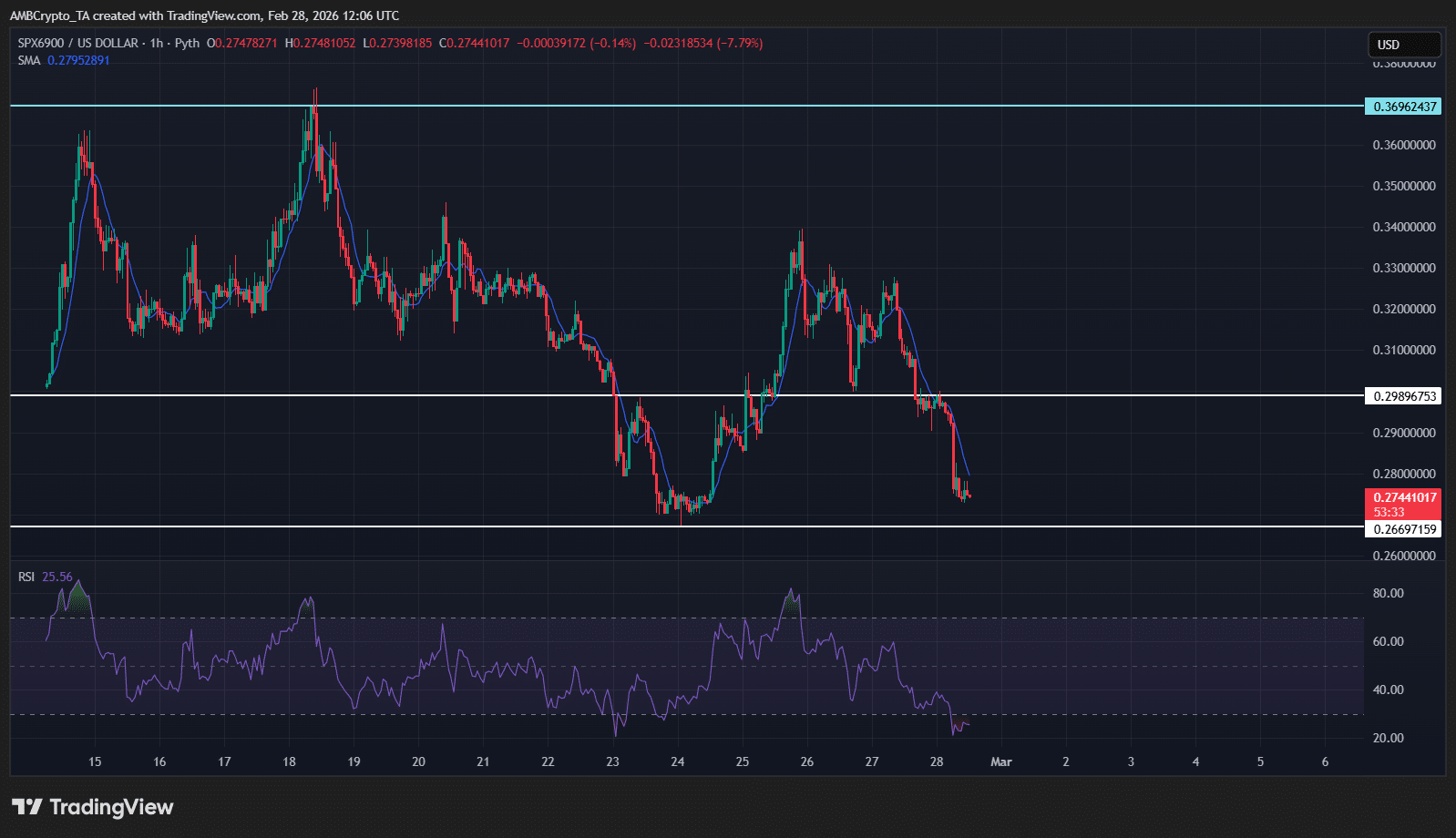

Assessing SPX6900’s 55% crash – Why SPX bulls need $0.27 to hold

Cheniere Energy: An Institutional Conviction Buy Amidst Sector Rotation

又一美联储理事呼吁:谨慎对待进一步降息!