BTCS to pay out loyalty in ETH to deter ‘predatory short-sellers’

Ethereum treasury firm BTCS Inc. will issue a one-time Ether dividend payment and a loyalty payment, totaling $0.40 per share in ETH, to reward shareholders and limit “predatory short-selling.”

“These payments are designed to reward our long-term shareholders and empower them to take control of their investment by reducing the ability of their shares to be lent to predatory short-sellers,” the Bitcoin mining-turned Ethereum firm said on Monday.

BTCS says it would be the first publicly traded company to issue a dividend in ETH — a move seemingly received well by investors as BTCS shares rose 10.4% on the day.

ETH “Bividend” to be paid in September

The ETH dividend — dubbed the “Bividend” — of $0.05 per share will be paid on Sept. 26, while the $0.35 per share “Loyalty Payment” will be paid in ETH to those holding the shares until Jan. 26, 2026. The loyalty payment will be offered to all shareholders except officers, directors and employees, the company noted.

Source: Benjamin Hunter

Source: Benjamin Hunter

The former Bitcoin mining firm is looking to stand out amid a crowded field of 69

ETH$4,264treasury entities competing to amass the largest ETH holdings.

Ether treasury firms have been a key catalyst behind Ether’s price rally from around $1,465 to $4,775 over the past four months.

BTCS eyes top 10 in ETH treasury race

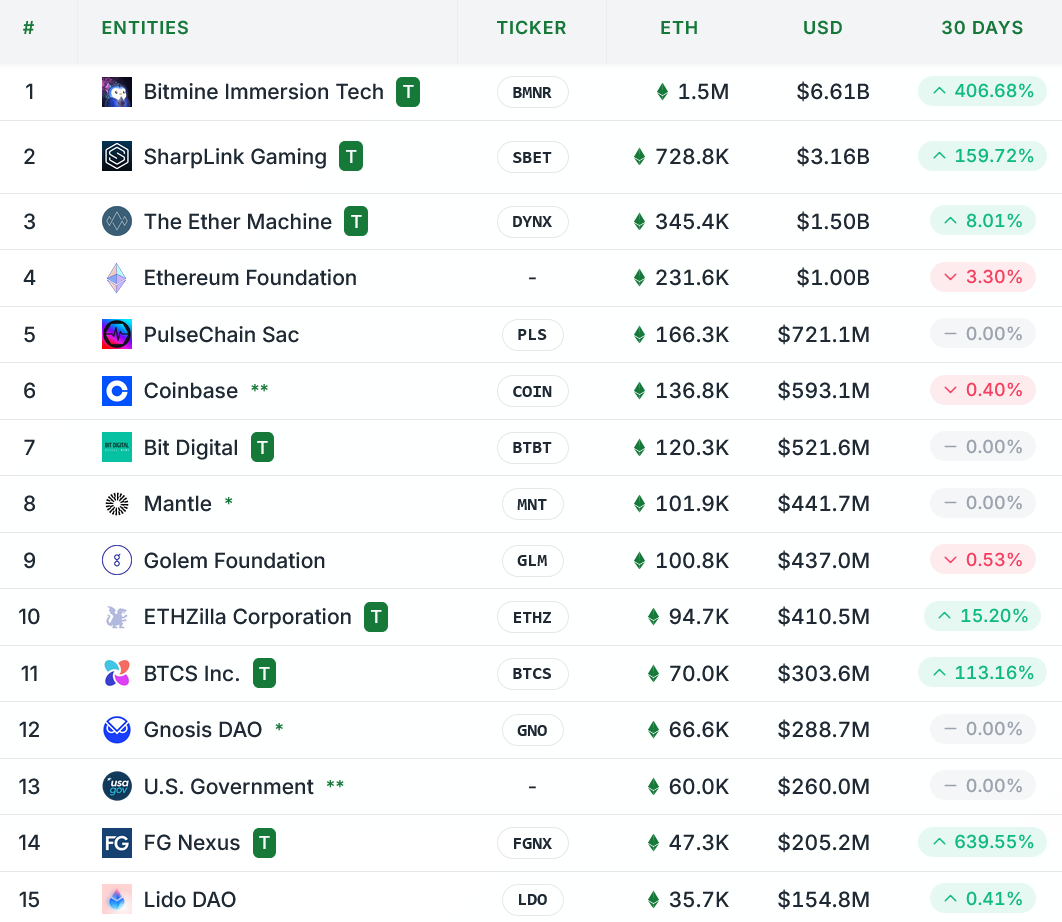

Bitmine Immersion Tech and SharpLink Gaming lead the race, with 1.5 million ETH and 728,800 ETH, respectively, while BTCS sits 11th at 70,000 ETH worth over $303 million, StrategicETHReserve data shows.

Top 15 largest entities by ETH holdings. Source: StrategicETHReserve.xyz

Top 15 largest entities by ETH holdings. Source: StrategicETHReserve.xyz

BTCS has been leveraging decentralized finance — such as borrowing on Aave — and staking since at least 2022, but only started aggressively accumulating ETH over the last few months.

It has funded purchases through at-the-market equity offerings and issuing convertible notes, similar to strategies adopted by its competitors.

BTCS partially recovers after tumbling from July high

BTCS shares rose 10.4% on the news to $4.87 on Monday, clawing back some lost ground since reaching a 2025 high of $6.57 on July 18, Google Finance data shows.

The Nasdaq-listed firm now boasts a market cap of $233 million.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Only The Federal Government Has The Power To Regulate Prediction Markets: CFTC

Soluna adds 6MW at Texas site

Why Did Auddia Stock Surge Over 90% Overnight?