IRS Digital Assets Chief Trish Turner Exits After Three Month Tenure

Trish Turner resigned from her role as head of the Internal Revenue Service digital assets division after serving just three months in the position. According to Cointelegraph, Turner announced her departure through a LinkedIn post on Friday, expressing appreciation for her 20-year career with the tax agency.

Turner stated she navigated complex challenges and built lasting programs during her tenure. She helped establish the foundation for the IRS digital asset strategy as cryptocurrency shifted from niche to mainstream adoption. The veteran tax official will transition to the private sector, joining crypto tax firm Crypto Tax Girl as tax director.

Her exit follows the departure of two other senior crypto officials earlier this year. Sulolit "Raj" Mukherjee and Seth Wilks, private-sector experts recruited to lead the IRS crypto unit, left their positions in May after approximately one year in their roles. Turner was appointed to lead the division following their resignations.

Critical Timing Creates Administrative Challenges

Turner's departure occurs at a pivotal moment for cryptocurrency taxation enforcement in the United States. CoinDesk reports that the IRS faces a potential surge in crypto-related tax filings as new reporting requirements take effect.

The agency recently implemented the new Form 1099-DA requirement, which mandates cryptocurrency brokers report customer transactions starting with the 2025 tax year. Millions of taxpayers will receive these forms in early 2026, representing a substantial increase in crypto-related tax documentation. Previously, only about 3 million taxpayers disclosed cryptocurrency transactions, though the actual number of crypto holders is believed to be much higher.

We reported earlier this year that global tax frameworks are evolving rapidly, with new reporting requirements taking effect across multiple jurisdictions. The IRS introduced Form 1099-DA for cryptocurrency exchanges to report transactions, representing a major shift in how digital asset taxation is administered at the federal level.

Turner's resignation creates uncertainty about leadership continuity as these changes roll out. The digital assets office has experienced significant turnover, with three senior officials departing within eight months. This personnel instability coincides with budget cuts affecting the broader IRS workforce, with the agency losing over 20,000 positions under current administration policies.

Broader Compliance Framework Faces Mounting Pressure

The cryptocurrency industry confronts increasing regulatory scrutiny as tax authorities worldwide implement new oversight mechanisms. Research from IFC Review indicates that approximately 60 percent of cryptocurrency wealth remains unreported to tax authorities, based on data from Norwegian taxpayers.

Tax compliance challenges stem from the decentralized and pseudonymous nature of cryptocurrency transactions. Unlike traditional financial assets with established third-party reporting systems, cryptocurrency operates across multiple platforms and jurisdictions with limited government oversight. Tax authorities rely heavily on self-reporting, creating substantial gaps in revenue collection.

The European Union will implement the Directive on Administrative Cooperation (DAC8) in January 2026, requiring cryptocurrency service providers to report user transaction data to tax authorities. Similar frameworks are under development globally, including the OECD's Crypto-Asset Reporting Framework scheduled for 2027 implementation.

These international developments place additional pressure on US tax policy coordination. Cryptocurrency transactions can cross borders instantly, requiring cooperation between multiple tax jurisdictions. The IRS digital assets division plays a central role in these international compliance efforts, making stable leadership essential for effective policy implementation.

Turner expressed confidence about moving to the private sector, stating that digital assets have shifted from niche issues to core regulatory focus. Her transition reflects broader industry trends as former government officials join cryptocurrency companies to help navigate evolving compliance requirements. The growing complexity of crypto taxation has created significant demand for expertise in both regulatory interpretation and practical implementation.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

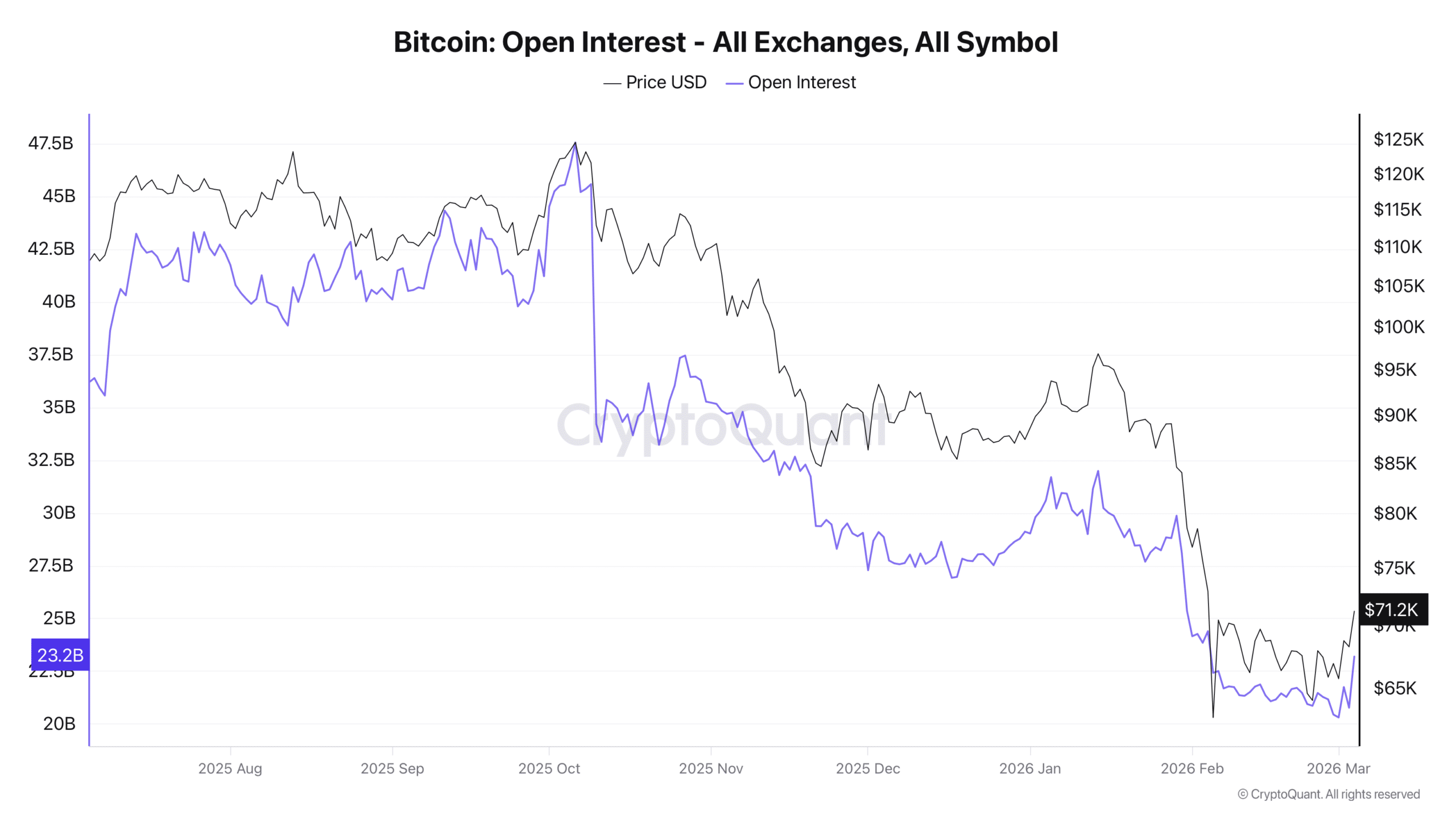

Bitcoin: Shorts still dominate BTC – But buyers are fighting back

Big Tech Joins White House Energy Pledge as Iran Tensions Threaten Higher Costs

The Key to Cryptocurrency Mainstream Adoption: Custody and Licensing, Not Price