Crypto Funds Receive $3,3 Billion in One Week, AuM Reaches $239 Billion

- Cryptocurrency funds register $3,3 billion in inflows

- Bitcoin leads fundraising with US$2,4 billion this week

- Ethereum and Solana Show Recovery with Strong Institutional Inflows

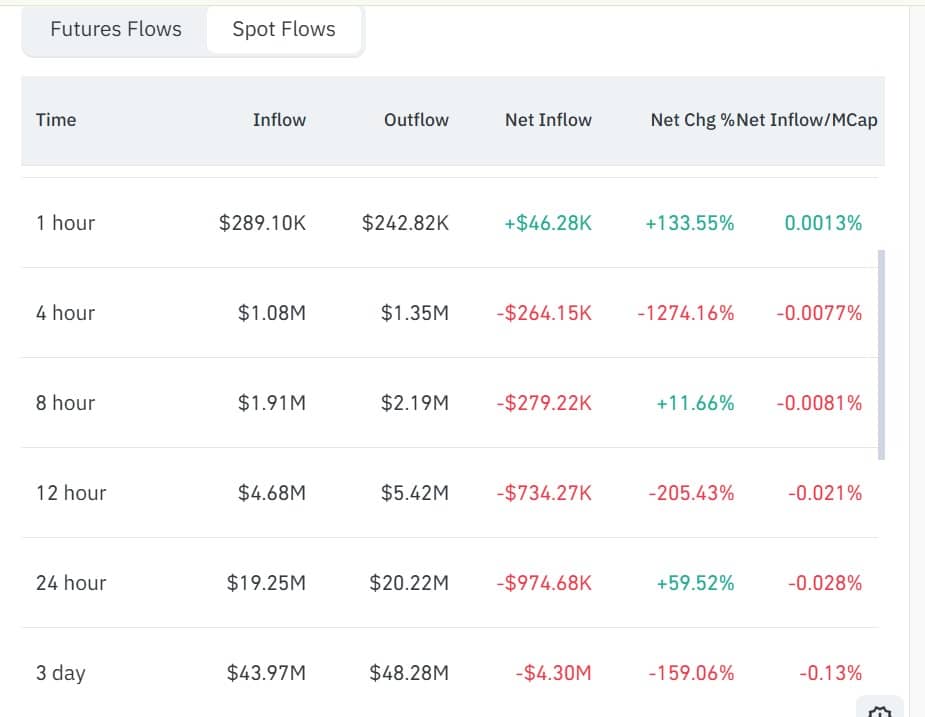

Cryptocurrency investment products have seen strong inflows again, accumulating US$3,3 billion in net inflows in the last week, according to CoinShares report The positive result follows outflows of US$352 million in the previous period and was driven by weaker US macroeconomic data that increased expectations of interest rate cuts.

According to James Butterfill, head of research at CoinShares, sentiment strengthened with the rise of Bitcoin and Ethereum, which rose 2,5% and 5%, respectively. "Traders are now fully pricing in three rate cuts by the end of the year," he said.

With asset appreciation and new inflows, total assets under management (AuM) in the funds reached US$239 billion, the highest level since the record US$244 billion set in August.

The biggest highlight was Bitcoin-based products, which raised $2,4 billion, the largest inflow since July. In the US, spot Bitcoin ETFs accounted for $2,3 billion of this amount, led by BlackRock's IBIT, which alone raised just over $1 billion.

Ethereum products also showed recovery after eight consecutive days of outflows, accumulating US$646 million in inflows, with US$637,6 million going to spot ETFs for the cryptocurrency in the US.

Solana, meanwhile, performed impressively, with the largest daily inflow in its history recorded last Friday: $145 million. Over the week, the network raised $198 million, highlighting growing interest in alternatives beyond BTC and ETH.

Regionally, the US dominated the flow with US$3,2 billion in inflows, followed by Germany with US$160,2 million, Canada with US$14,1 million, and Hong Kong with US$5,4 million. Switzerland was the only country to register outflows, totaling US$92,1 million.

During the same period, CoinShares announced plans to go public in the US through a $1,2 billion merger with Vine Hill, a special purpose acquisition company, which will allow it to list its shares on Nasdaq.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

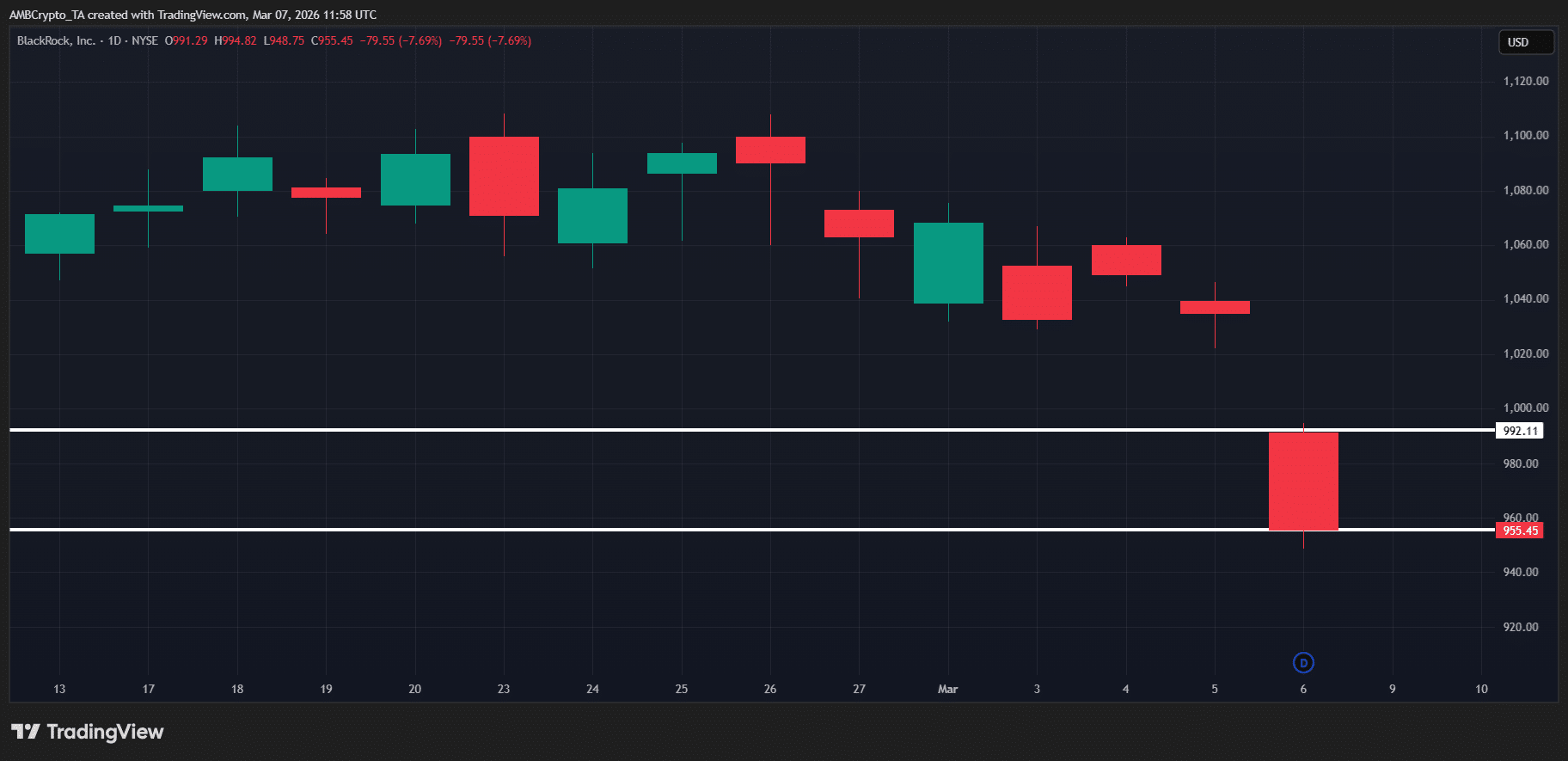

$1.2B liquidity warning – How BlackRock could ‘rock’ the crypto market

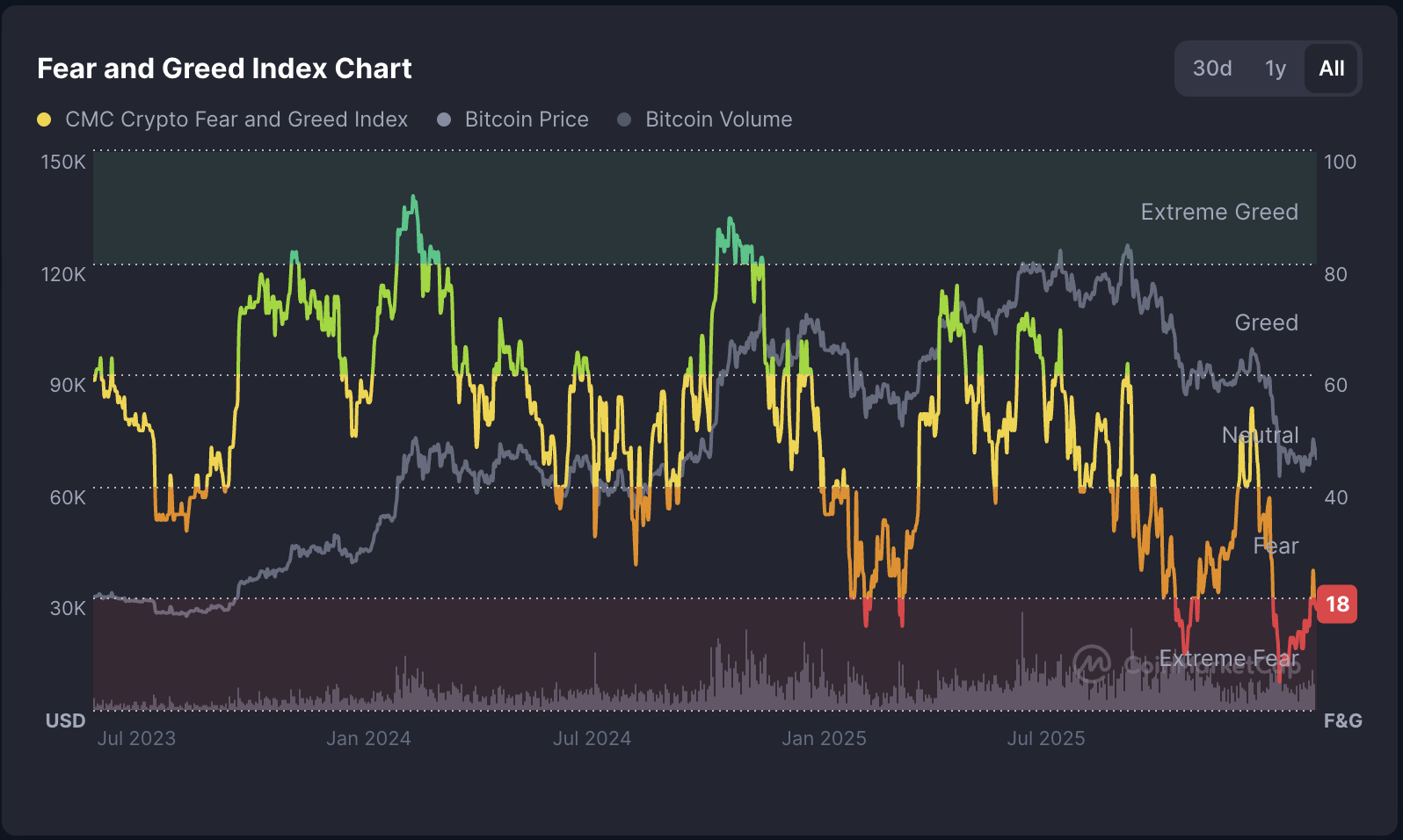

Crypto Fear and Greed Index falls back down to 'extreme fear' levels

Assessing if Zcash’s $200 support is at risk after ZEC falls by 8%

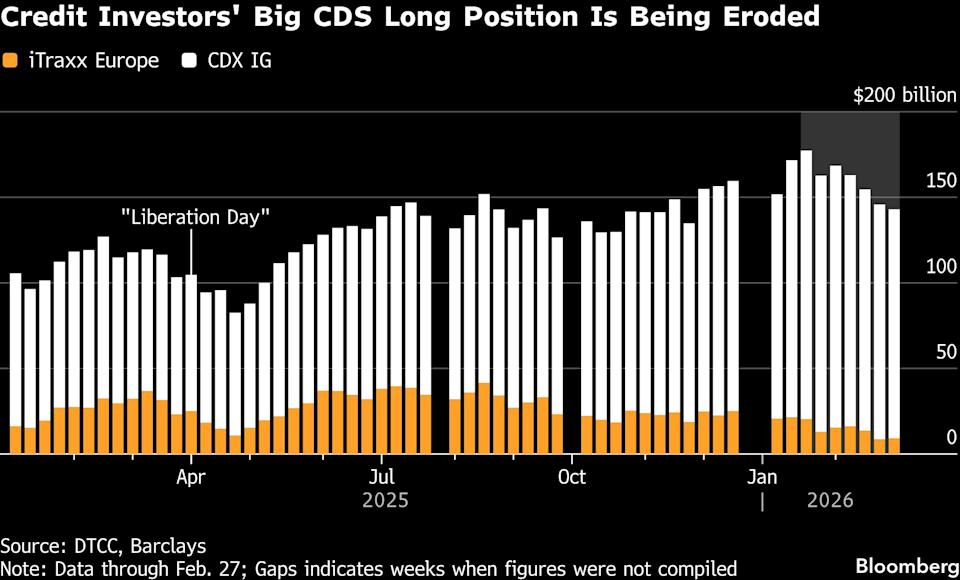

Traders Rush to Acquire Derivatives Amid Rising Risks: Credit Weekly