Serious Hacking Suspicion in Altcoin Listed on Major Exchanges: Price Dropped, Developers Issued a Statement

The project team released a statement regarding the claims regarding Pendle (PENDLE), which caused a brief panic in the cryptocurrency market.

Market sources had claimed that the protocol had been hacked, with hackers withdrawing over $1 million in assets. Following this development, the Pendle team issued an official statement confirming that the protocol had not been hacked and that all funds were safe.

Authorities stated that the issue stemmed from an on-chain wallet, not the protocol itself. The wallet in question was reportedly emptied, and the attacker was selling by minting PT/YT.

Following the news, the price of PENDLE fluctuated sharply. The token quickly dropped by nearly 10% to $4.13. Following the project's official announcement, it recovered to $4.50.

At the time of writing, PENDLE is trading at $4.47, according to CoinMarketCap data. The token has fallen 4.53% in the last 24 hours, with a market capitalization of $759.41 million. PENDLE is listed on major exchanges such as Coinbase, Binance, Upbit, and Bybit.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Low Likelihood, Significant Expense: The Macroeconomic Impact of Withdrawing from CUSMA

IRS proposes mandatory electronic crypto tax forms

Robinhood Sets Itself Apart From Wall Street by Issuing Dividends Ahead of Schedule

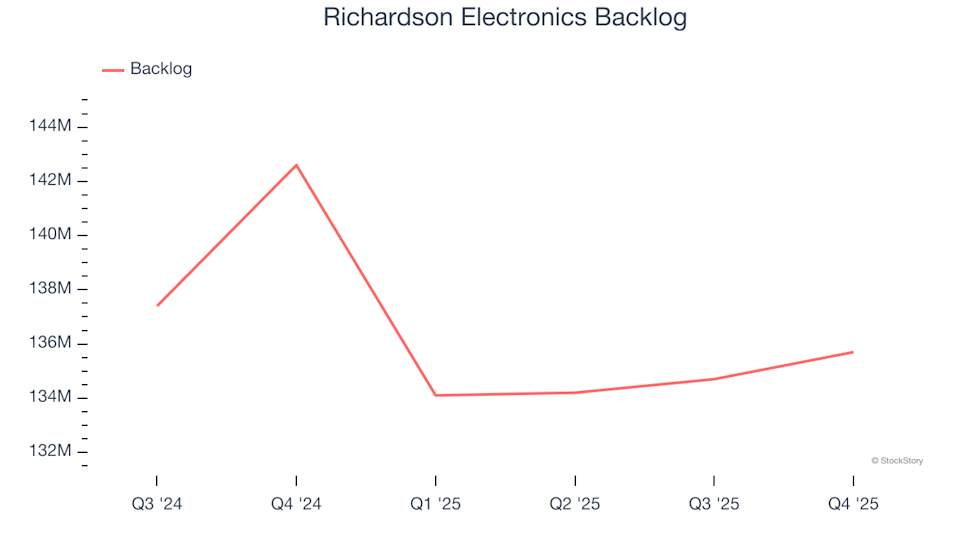

Richardson Electronics (RELL): Should You Buy, Sell, or Keep After Q4 Results?