Did Bitcoin Creator Satoshi Turn Bullish on Ripple XRP Before Anyone Else?

A new debate has surfaced in the crypto community after claims emerged that Satoshi Nakamoto, the mysterious creator of Bitcoin, once mentioned Ripple and XRP in early email exchanges. The alleged emails, said to date back to 2009, describe Ripple as “interesting” for offering a different approach to trust in digital transactions.

The claims argue that Satoshi acknowledged Ripple’s model as one of the few alternatives to centralized systems. Supporters argue this shows that Ripple and the XRP Ledger were part of the wider conversation around digital currencies at Bitcoin’s birth. Some even go further, speculating that Satoshi believed Ripple could complement Bitcoin’s role in the financial system.

BOOOOOOOOOOOOOOOOOOOOM!!!

Satoshi Nakamoto wrote this about @Ripple / #XRP a few years ago!

💥XRP IS A DONE DEAL💥 pic.twitter.com/jXiMB4PzlP

However, many users in the crypto space have pushed back, saying the emails could be fabricated or taken out of context. Critics note that no official records, archives, or credible links have confirmed the correspondence. Without proof, the alleged connection between Satoshi and Ripple remains unverified.

This has not stopped the discussion from spreading quickly across online forums and social media. Ripple supporters view the claims as validation of the project’s long-standing role in blockchain development. Bitcoin advocates, on the other hand, warn against rewriting history without solid evidence.

As of now, no official statement has been issued by Ripple, Bitcoin Core developers, or any recognized authority in the space. Until a verified source emerges, whether Satoshi Nakamoto ever mentioned Ripple or XRP remains uncertain. For now, the claim stands as speculation rather than fact, fueling yet another mystery in the story of Bitcoin’s origins

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

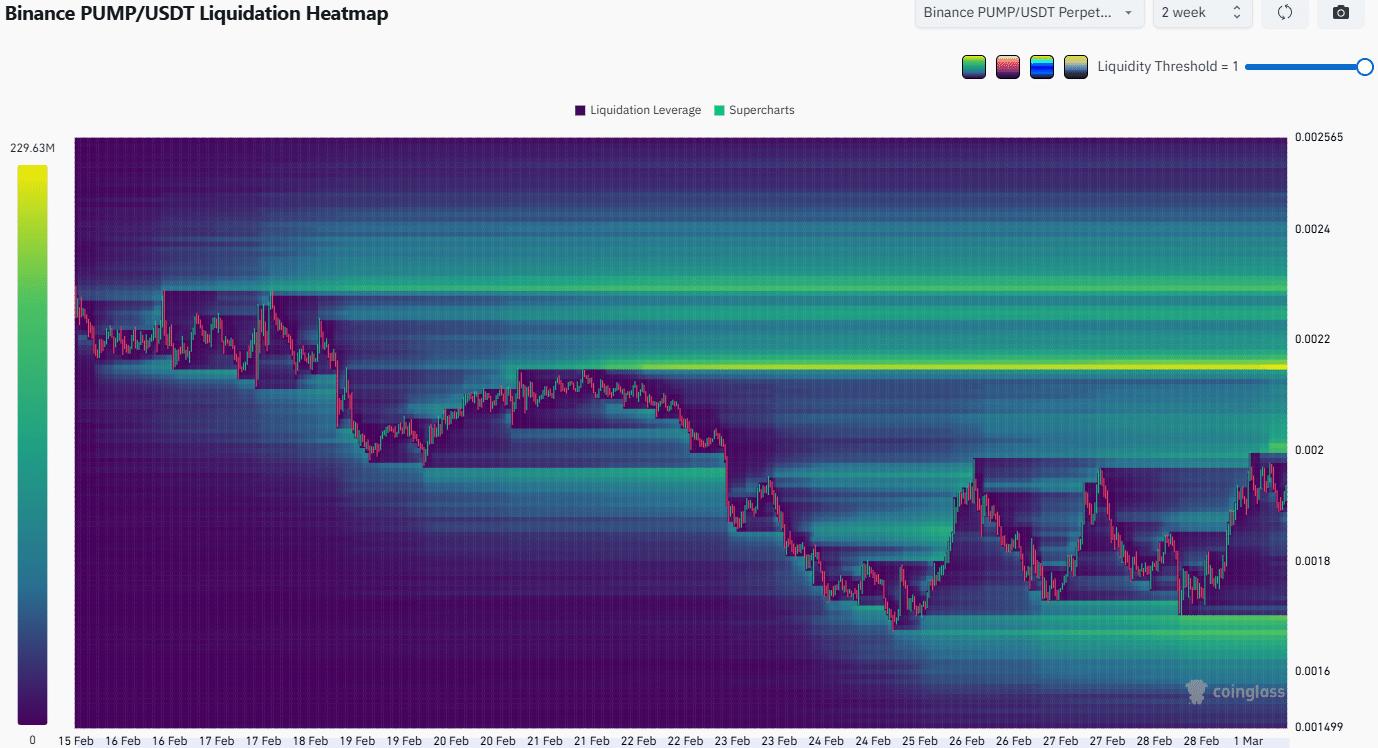

PUMP: Indecisive price action keeps traders on edge

Canadian Dollar weakens as safe-haven flows boosts USD; Oil surge caps gains for USD/CAD

Iran Attacks Reveal the Grim Downside of the Prediction Market Age