Hong Kong–listed China Financial Leasing to raise $11 million for crypto investment platform

Quick Take China Financial Leasing Group plans to raise $11.1 million through a share placement to fund the development of its crypto investment platform. The company’s stock jumped 25% as of 2 p.m. on Monday in Hong Kong.

China Financial Leasing Group, a Hong Kong-listed investment firm, has announced plans to raise HK$86.7 million ($11.1 million) through a share placement to Innoval Capital, as it intends to build a cryptocurrency and artificial intelligence investment platform.

In a Sunday filing with the Hong Kong Stock Exchange, the company said Innoval Capital is set to purchase 69.38 million new shares at HK$1.25 per share under their subscription agreement. The deal represents roughly 20% of the company's existing share capital and 16.7% of its enlarged base post-placement.

"The company intends to focus on establishing a Crypto-AI digital asset investment platform in the group, investing in digital asset exchanges (including stablecoins, BTC, ETH, RWA, NFT, DEFI, Depin and other new digital assets), and building a digital asset management platform," the company said in the filing.

The subscriber, Innoval Capital, is a British Virgin Islands–incorporated investment firm founded by Antalpha CEO Moore Xin Jin, a veteran in the crypto and fintech sectors. Jin leads Nasdaq-listed Antalpha Platform Holding Company (ANTA), which manages assets exceeding $1.6 billion, according to the filing.

China Financial Leasing Group noted that its attempt to build a crypto platform aligns with the Hong Kong government's June policy statement on developing crypto assets. The company said it aims to evolve into an "innovative digital asset investment holding group" by integrating AI and blockchain technologies.

The company's stock jumped 25% as of 2:00 p.m. on Monday in Hong Kong, according to Yahoo Finance data, with the market still open. The stock has a market cap of around HK$555 million ($71.3 million).

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

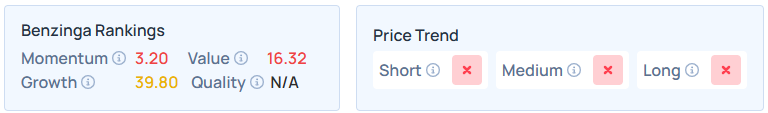

Progressive’s Narrow Moat Faces Test as Rising Claims Costs Challenge 10.7 Forward P/E Discount

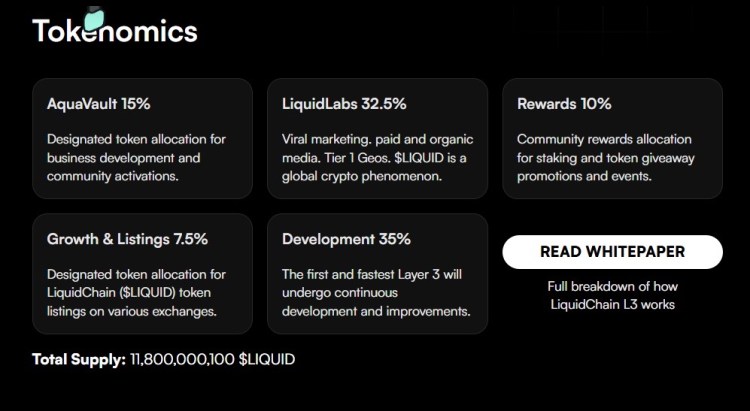

Best Crypto to Buy in a Bear Market? LiquidChain’s Cross-Chain Model Stands Out