PancakeSwap’s Chinese X account hacked to promote meme coinCAKE price unfazed

Crypto scammers have hijacked the official Chinese-language X account of PanCakeSwap to promote a dubious meme coin dubbed “Sir Pancake.”

- PacakeSwap’s Chinese-language X account was hacked on Oct. 8.

- The attacker promoted a scam meme coin dubbed Sir Pancake.

- Community members continued trading the token after the scammers sold.

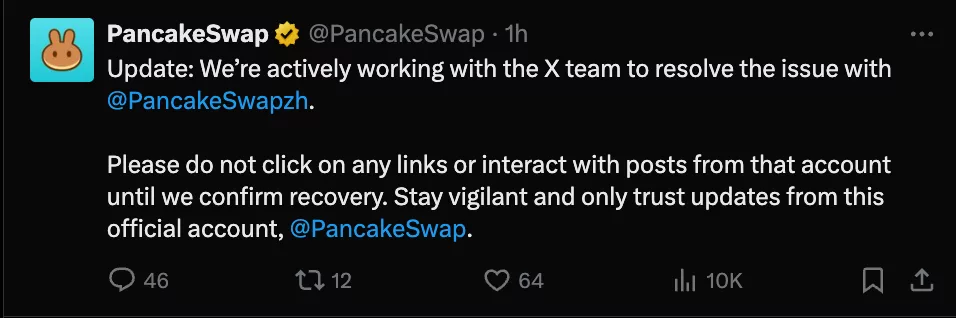

PancakeSwap confirmed the breach during the morning Asian hours on Oct. 8, and warned users to avoid interacting with any links posted on the account.

“Our team is investigating to resolve the issue. Updates will be shared only through this official account @PancakeSwap,” the PancakeSwap team wrote on X. In a subsequent update, the team said they were working with X to resolve the issue.

PancakeSwap on X | Source: PancakeSwap on X

PancakeSwap on X | Source: PancakeSwap on X

crypto.news reached out to PancakeSwap for further details, but had not heard back.

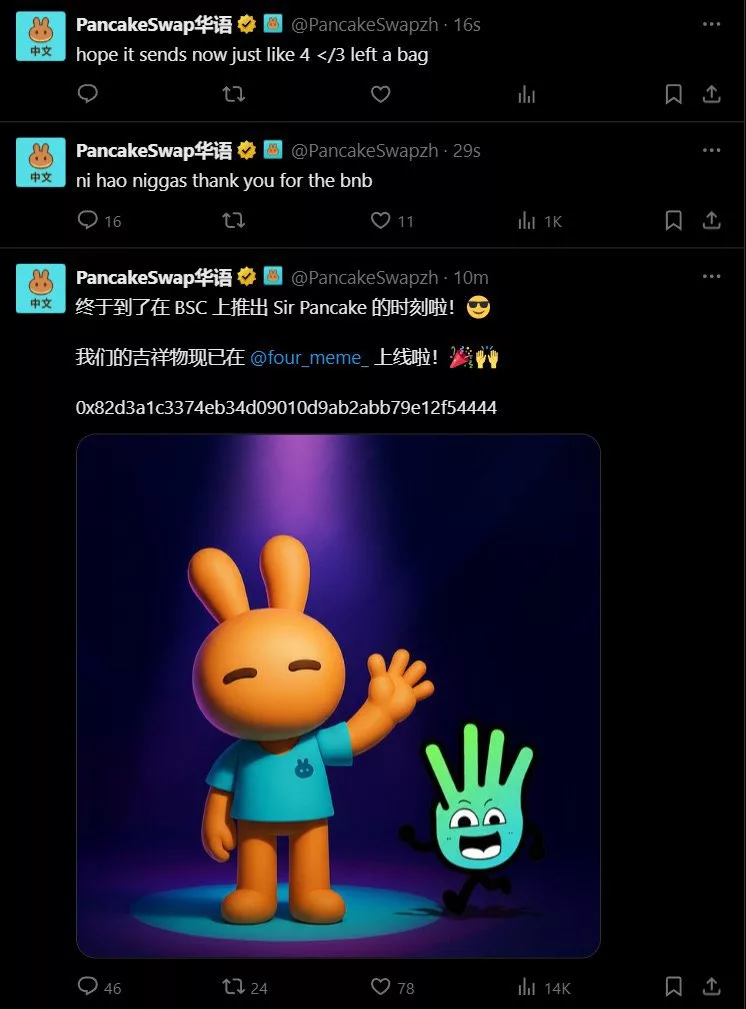

In a series of now-deleted posts, the attacker promoted a fraudulent token, which reportedly managed to hit trading volumes as high as $20 million right after launch, according to some community members.

A scam token promoted on the official PancakeSwap Chinese X account | Source: Dale

A scam token promoted on the official PancakeSwap Chinese X account | Source: Dale

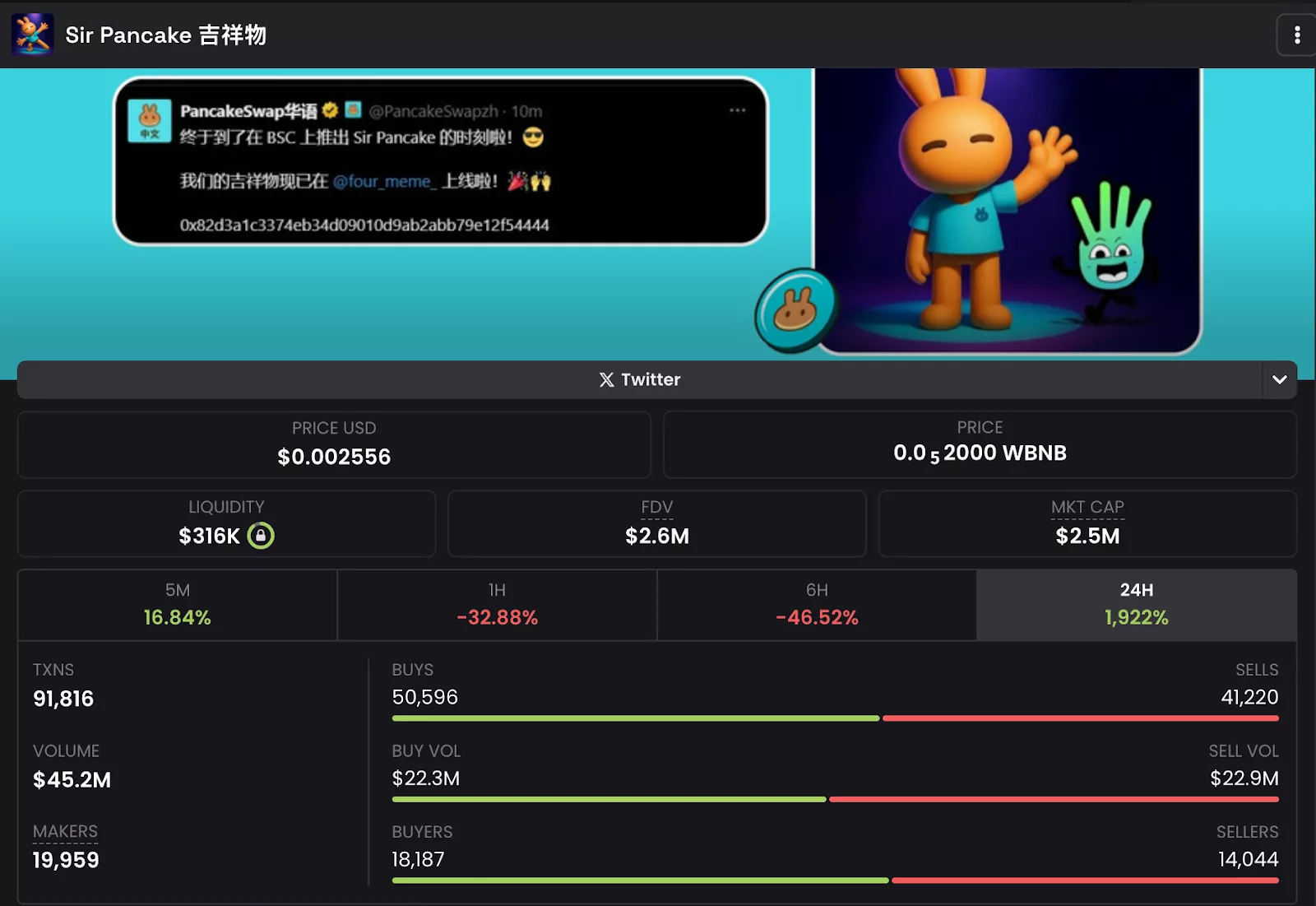

At the time of writing, data from Dexscreener showed the token down over 50% in the past 6 hours, with a market cap of approximately $2.6 million. Meanwhile, its trading stood at $45.2 million, which means users were actively trading the meme coin.

Sir Pancake on-chain trading metrics | Source: Dexscreener

A similar incident transpired last week when attackers hijacked the BNB Chain X account to promote a memecoin dubbed “4” and orchestrated a rug pull. However, community members rallied behind the token after the Binance team regained control, and the meme coin rallied nearly 500% after.

CAKE price unfazed

Security incidents such as these often tend to weigh on investor sentiment, but holders of CAKE, PancakeSwap’s native token, seemed unfazed, notably due to the protocol’s strong performance over the past weeks.

PancakeSwap ( CAKE ) rallied to an intraday high of $4.50 before losing some of those gains to trade near $4.34 at press time. However, it was still up over 10% in the past 24 hours.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana Price Stuck Below $90 as March Catalysts Threaten Market Volatility

India’s Pronto legitimizes domestic assistance as its valuation surges eightfold in less than a year

PBOC sets USD/CNY reference rate at 6.9088 vs. 6.9236 previous

State Street Gains 0.65% as Trading Volume Plummets 44% to 280M, Stock Ranks 484th in Daily Activity