a16z crypto division invests $50 million in Jito for token allocation

PANews, October 16—According to Fortune, a16z (Andreessen Horowitz)'s crypto division has invested $50 million in the Solana ecosystem protocol Jito, acquiring an allocation of Jito tokens. Brian Smith, Executive Director of the Jito Foundation, described this deal as the largest single commitment to Jito by an investor, emphasizing that the terms include "long-term alignment," with the tokens not being available for short-term sale and subject to a certain discount. Earlier this year, a16z also invested in LayerZero ($55 million) and EigenLayer ($70 million) through token transactions. Jito is a liquid staking and transaction prioritization tool for Solana.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Sui’s “Sui Bank” Process: Treasury Allocations and Stablecoin Flow

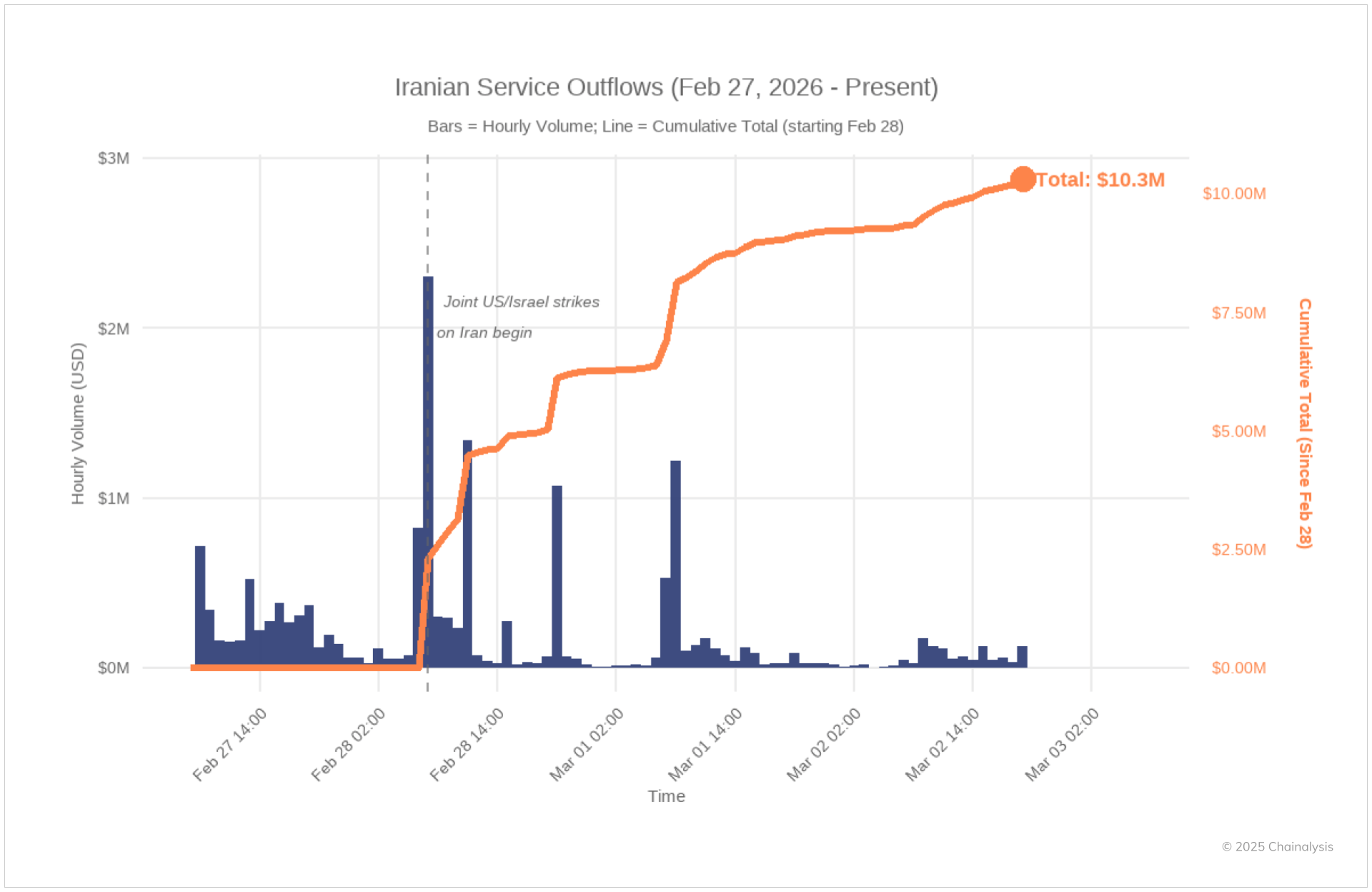

Iran’s largest crypto exchange shows no clear signs of capital flight: TRM

Passage refused: Closure of Hormuz continues to drive oil prices higher