Cardano Inflows Jump to 3-Month High, But Are Big Holders Blocking A Rebound?

Cardano sees strong inflows and renewed investor interest, but whale sell-offs worth $120 million are limiting ADA’s recovery potential.

Cardano’s price has struggled to regain upward momentum despite strong investor activity following the recent market recovery.

While retail participants have continued to show confidence, a concerning trend has emerged among whales. Their steady selling pressure poses a potential risk to ADA’s short-term recovery prospects.

Some Cardano Investors Are Hopeful

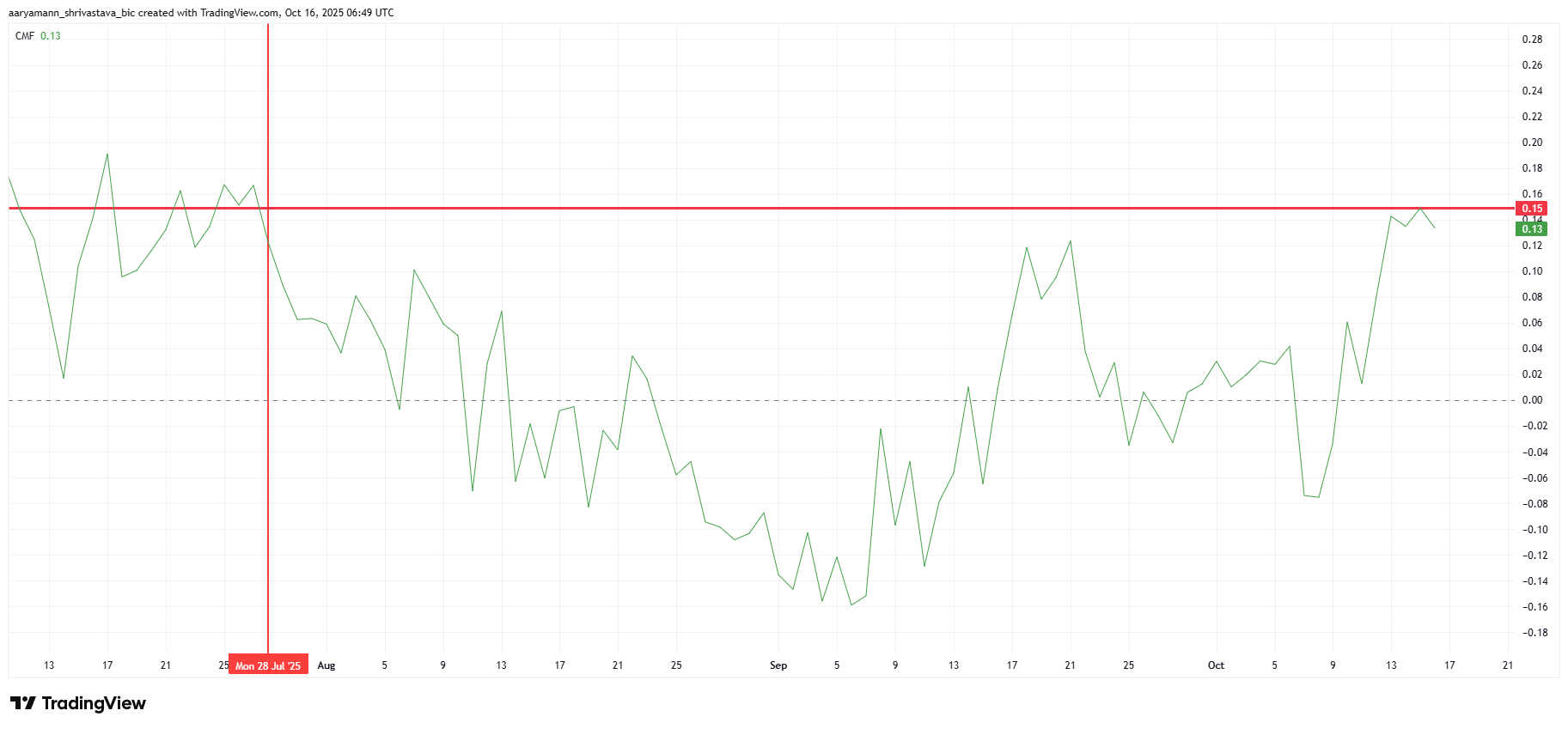

The Chaikin Money Flow (CMF) indicator for Cardano shows a sharp increase, signaling strong inflows of capital into the asset. Currently at a three-month high, this suggests that investors are actively buying ADA at discounted prices after the market crash. Historically, such spikes in CMF indicate renewed accumulation phases that often precede recovery.

Despite this encouraging development, ADA’s price has yet to reflect a significant upside move. The heavy buying pressure from smaller investors is being offset by distribution from larger holders.

Cardano CMF. Source:

TradingView

Cardano CMF. Source:

TradingView

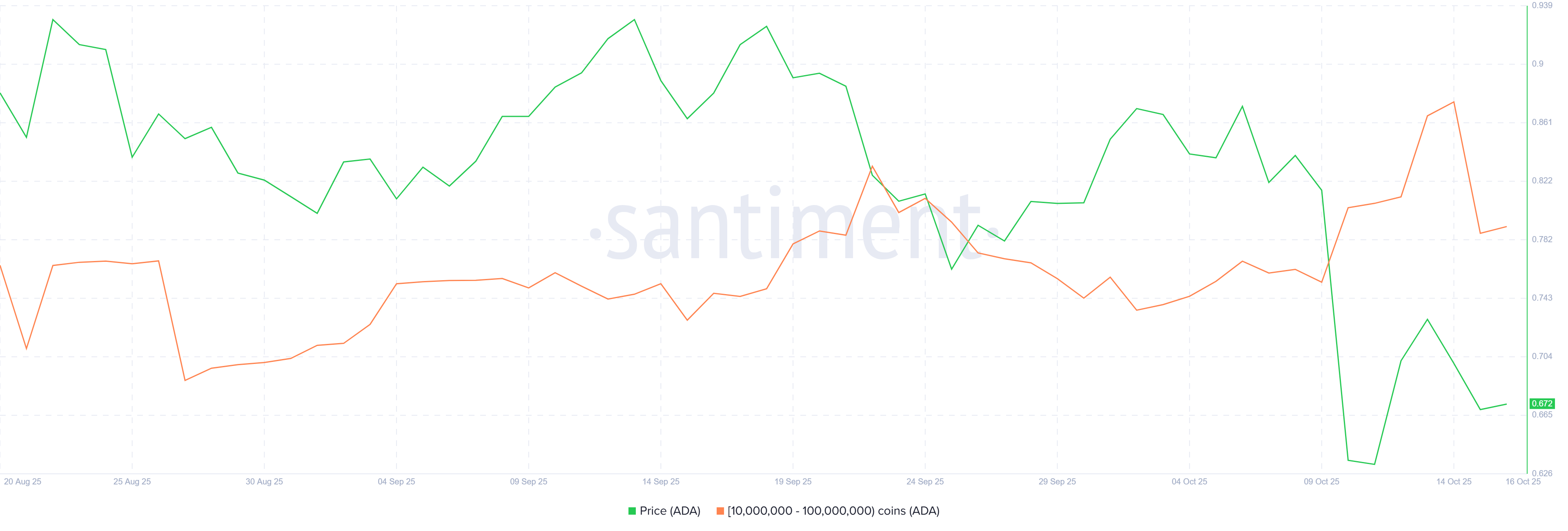

Large holders have been offloading their holdings over the past 24 hours. Addresses holding between 10 million and 100 million ADA have sold roughly 180 million tokens, valued at more than $120 million. Though not an overwhelming amount compared to the total supply, the selling activity is strong enough to stall price recovery.

Whale movements often act as early indicators of sentiment shifts, and their recent sell-off shows a lack of confidence in short-term gains. While the broader market is still absorbing increased inflows, ADA’s failure to hold key levels could result in further selling pressure.

Cardano Whale Holdings. Source:

Santiment

Cardano Whale Holdings. Source:

Santiment

ADA Price Could Take A Hit

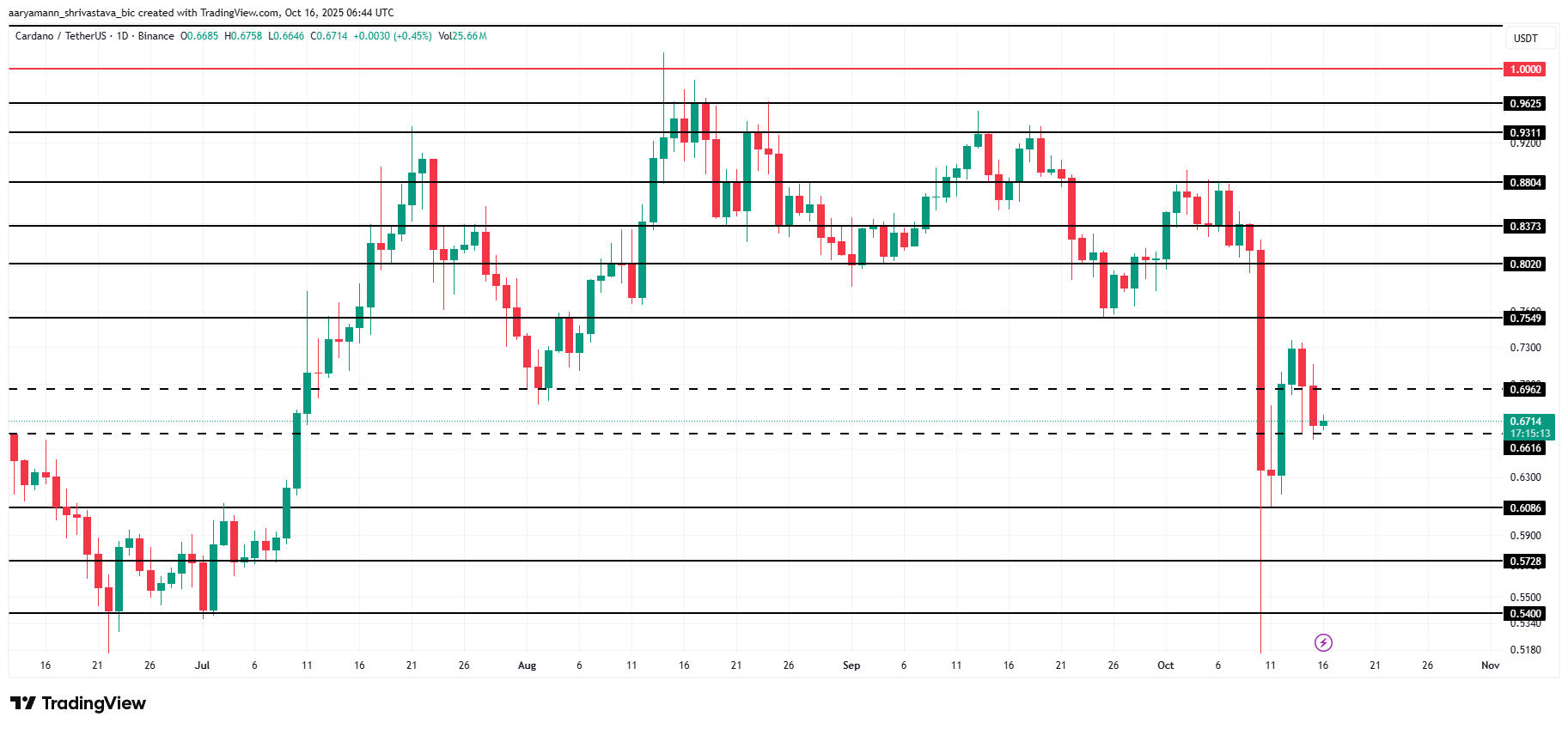

Cardano’s price currently hovers above the $0.66 support level but risks slipping below it if bearish momentum continues. A drop under this line could push ADA down to $0.60 in the coming days.

Continued whale selling could exacerbate downward pressure even if inflows remain strong. Persistent profit-taking from large holders would make sustained recovery more difficult.

Cardano Price Analysis. Source:

TradingView

Cardano Price Analysis. Source:

TradingView

However, if ADA manages to hold $0.66 and attract renewed buying interest, the altcoin could rise above $0.69 and potentially reach $0.75. Such a move would invalidate the bearish outlook and mark the start of a short-term rebound.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Pound Sterling weakens to near 1.3300 as geopolitical risks bolster US Dollar

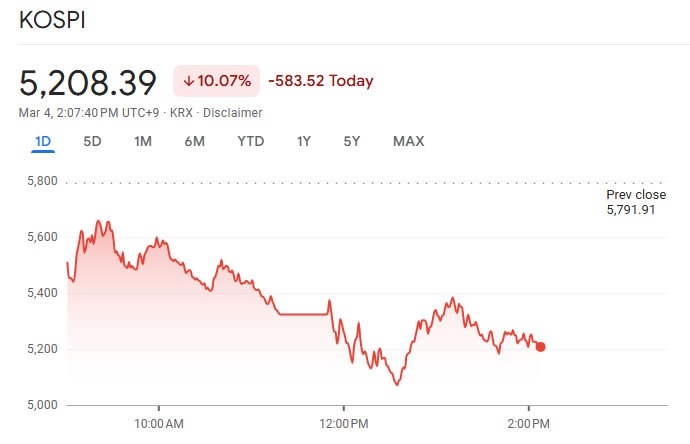

Korea halts trading as key indexes drop 10% on Middle East crisis

DigitalOcean's Agentic Inference Cloud: Creating the Infrastructure for Deploying AI in Production