BlackRock Launches GENIUS Act-Aligned Fund To Support Stablecoin Reserve Demand

Asset management titan BlackRock is launching a regulatory-compliant fund to support stablecoin reserve demand.

BlackRock, which has over $10 trillion in assets under its management, says it’s introducing a money market fund aligned with the GENIUS Act as a means of meeting the growing demand of the stablecoin market.

The firm says its new BlackRock Select Treasury Based Liquidity Fund (BSTBL) has a goal of increasing liquidity for its clients while being within the framework of the US Genius Act, which passed earlier this year and created clear regulatory guidelines for stablecoins.

As stated by Jon Steel, BlackRock’s global head of product and platform within its cash management business,

“We’re seeing increasing demand from stablecoin issuers and clients seeking innovative, compliant reserve management solutions. Our BSTBL money market fund builds on our history of innovation through products and marks an exciting new chapter for our cash management business.

We’re thrilled to deliver a fund that meets the evolving needs of our clients and we believe it positions BlackRock as one of the reserve asset managers of choice for the digital payments ecosystem.”

Last month, data from the crypto analytics platform Arkham revealed that BlackRock purchased $1 billion worth of Bitcoin ( BTC ), the top crypto asset by my market cap, in just one week, signaling that institutional interest in digital assets is ramping up.

BTC is trading for $106,612 at time of writing, a 1.8% decrease during the last 24 hours.

Check Price Action

Surf The Daily Hodl Mix

Featured Image: Shutterstock/mim.girl/Fotomay

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

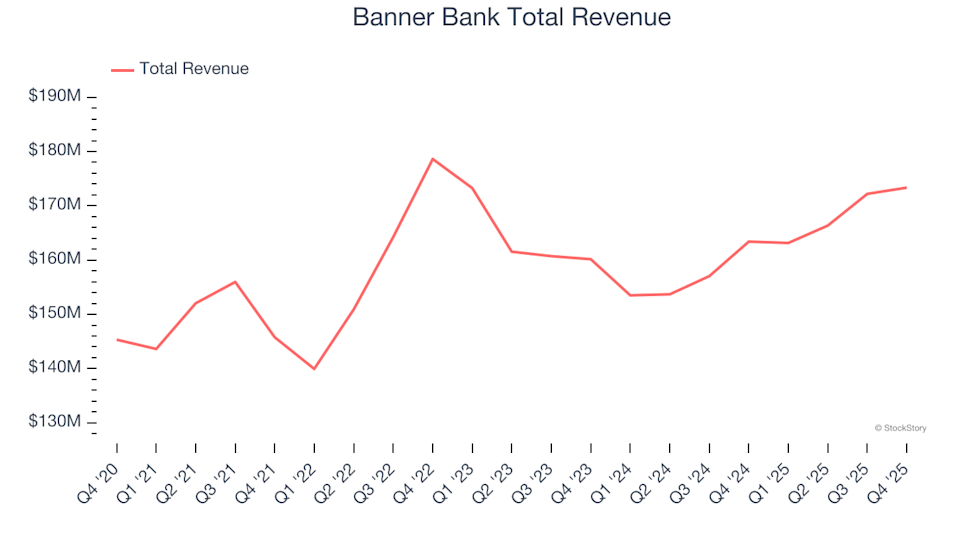

Victors and Underperformers in Q4: How Banner Bank (NASDAQ:BANR) Compared to Other Regional Bank Stocks

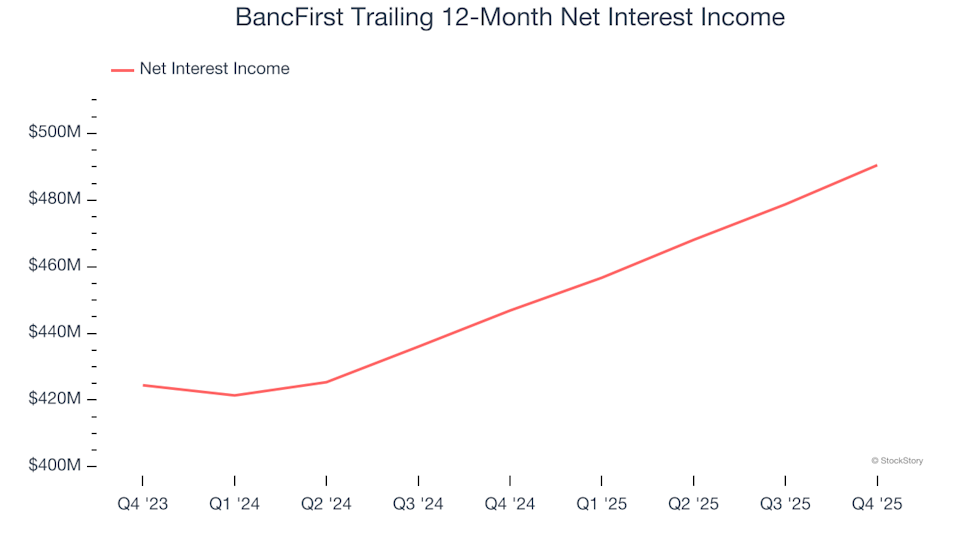

3 Reasons Why BANF is a Risky Choice and One Alternative Stock Worth Buying

3 Reasons Why BANF Carries Risk and One Alternative Stock Worth Considering

Silver Price Forecast: XAG/USD jumps above $82.00 amid Iran conflict, US jobs data awaited