Bitcoin Predicted to Reach $250,000 by Peter Brandt, with an Unexpected Twist

Macroeconomic Conditions Could Propel Bitcoin's Value, Yet Volatility Remains a Concern

Key Points

- Top trader Peter Brandt predicts Bitcoin could potentially reach $250,000.

- However, he also acknowledges the possibility of Bitcoin’s price decreasing to $60,000.

Despite the current challenges faced by Bitcoin , renowned trader Peter Brandt has suggested the cryptocurrency could potentially reach a value of $250,000.

Brandt clarified that his prediction is based on potential outcomes, not probabilities, and also mentioned the possibility of Bitcoin’s value decreasing.

Brandt’s Bitcoin Price Prediction

On October 22, Brandt, a self-proclaimed Bayesian trader, shared his views on Bitcoin’s future price.

He stated that he considers all possibilities and looks for asymmetrical bets in either direction, which could lead to a Bitcoin price of $250,000 or $60,000.

As per CoinMarketCap data , Bitcoin is currently valued at $108,301.34, which is still a significant distance from the $250,000 target suggested by Brandt.

Brandt’s prediction aligns with a forecast made by Charles Hoskinson, founder of Cardano, who cited growing interest from tech giants like Apple Inc. and Microsoft Corp as potential catalysts for Bitcoin’s surge.

Potential Downside for Bitcoin

Alongside his optimistic outlook, Brandt also acknowledged the potential for Bitcoin’s price to decrease.

He suggested the price could drop to as low as $60,000, based on various possibilities and asymmetrical bets.

Brandt has previously shown support for Bitcoin and stated that he is prepared to take a long position if the price increases, and a short position if it decreases.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

AECOM Secures Key Role in Seattle's $1B Transit Modernization

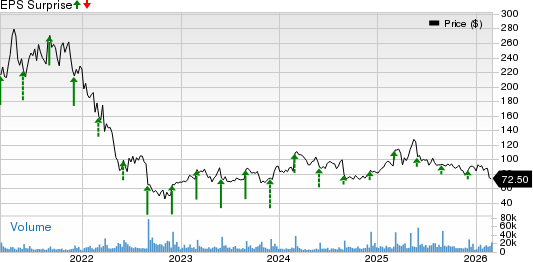

Okta Set to Report Q4 Earnings: What's in Store for the Stock?

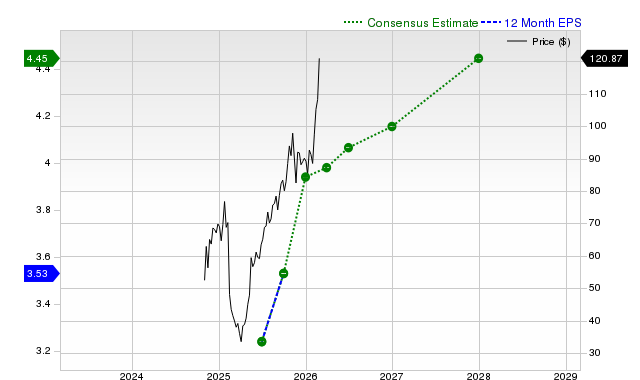

Earnings Estimates Rising for Everus Construction Group, Inc. (ECG): Will It Gain?