C3.ai Faces Major Challenges: Legal Battles and Falling Shares Put AI Industry to the Test

- C3.ai faces stock collapse and lawsuits alleging CEO health and growth misrepresentation, triggering a 25.58% single-day plunge to $16.47. - Class-action suits from Glancy Prongay & Murray et al. accuse leadership of downplaying CEO health impacts on deal-making and overstating growth prospects. - New CEO Stephen Ehikian inherits a bleak outlook: projected 2026 losses of $1.33/share and 224.39% EPS decline, amid sector volatility and regulatory scrutiny. - AIaaS market growth (37.21% CAGR to $209B by 203

C3.ai, Inc. (NYSE: AI) is currently grappling with both disappointing financial results and mounting legal challenges, as its share price continues to slide and several class-action lawsuits accuse the company of securities violations. On October 21, 2025, the AI software provider’s stock ended the day at $18.23, down 1.03% for the session and 0.49% over the previous month—underperforming its industry peers and the S&P 500, according to

The complaints claim that C3.ai’s management exaggerated its growth prospects and minimized the effects of the CEO’s health concerns, which allegedly hindered the company’s ability to close deals. On August 8, 2025, C3.ai issued updated financial forecasts and reported weak first-quarter results, attributing the setbacks to “reorganization under new leadership” and the CEO’s health. This disclosure led to a sharp 25.58% drop in the stock price in a single day, falling from $22.13 to $16.47 per share, as detailed by

The lawsuits underscore broader issues facing the AI industry, where high expectations often collide with operational challenges. The global AI-as-a-Service (AIaaS) market is forecasted to expand at a 37.21% compound annual growth rate, reaching $209.49 billion by 2033, fueled by increased cloud usage and advances in healthcare, according to a

C3.ai’s prospects remain uncertain, with consensus forecasts predicting a 224.39% drop in earnings per share and a 23.13% decrease in revenue compared to 2024. The Zacks Rank system currently rates C3.ai as a 3 (Hold), reflecting ongoing doubts about its recovery, as previously mentioned by Yahoo Finance. Meanwhile, the pending lawsuits—with an October 21, 2025, lead plaintiff deadline—highlight investor dissatisfaction with the company’s management. Law firms like Levi & Korsinsky, known for recovering significant sums for shareholders in prior cases, are preparing to advocate for those affected.

The future of the AI sector will depend on how well companies balance innovation with responsibility. Although the AIaaS market’s projected expansion points to long-term opportunity, firms such as C3.ai must contend with immediate challenges, including leadership changes and increased regulatory attention. For now, investors are wary, and the next few quarters will be critical in determining whether C3.ai can recover or continue to lose credibility and value.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

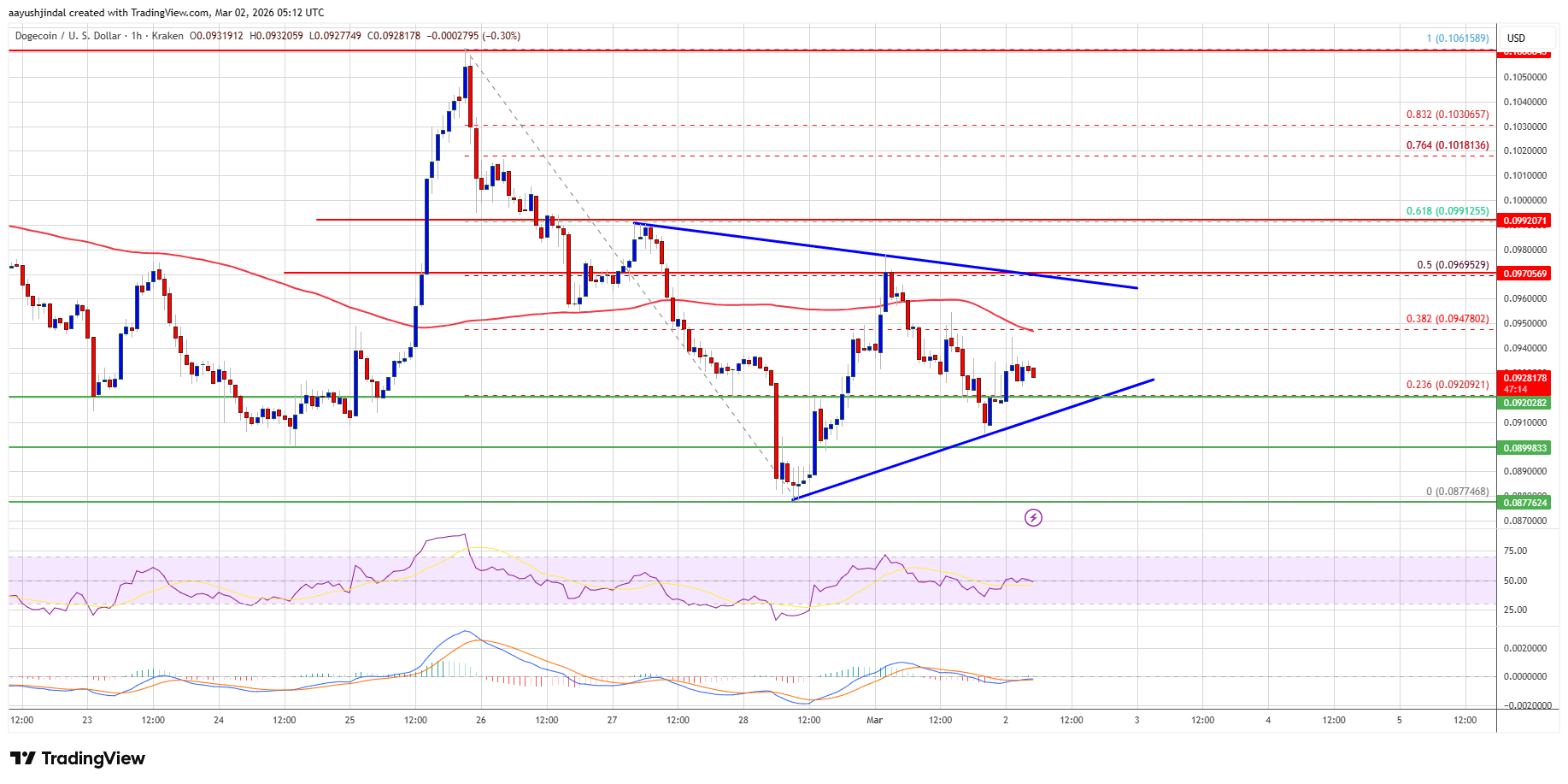

Dogecoin (DOGE) Slips Toward Critical Support, Breakdown Threat Emerges

GBP/JPY rebounds by almost 150 pips during the day, targets the mid-210.00s as JPY softens

Sluggish Fourth Quarter Expansion and Prospects for Inflation in Switzerland

XRP Price if 30% of XRP Is Staked from Current Circulating Supply