The number of weekly transactions under the x402 agreement increased by 492.63% month-on-month.

according to Dune data, the number of transactions in the x402 protocol increased by 492.63% compared to last week, reaching 156,492 transactions, setting a new historical high.

x402 is an open-source payment protocol launched by Coinbase in early 2025, implementing a blockchain-independent micro-payment system based on the HTTP 402 status code. The protocol is specifically designed for AI agents and autonomous payments, supporting instant settlement using stablecoins such as USDC, without the need for account registration, subscription, or complex signature processes.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Florida’s Fields Are Hurting – What That Means for Reefer Freight Right Now

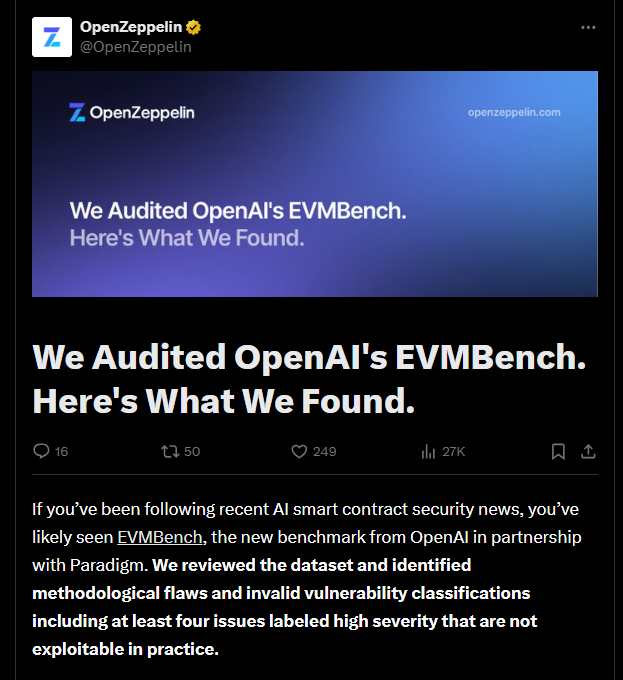

OpenZeppelin finds data contamination in OpenAI’s EVMbench

Seer Narrows Losses but Revenue Falls, Shares Plunge 16%