3 Altcoins To Watch In the First Week Of November 2025

As November 2025 begins, Sonic, THORChain, and Sky stand out with major upgrades and protocol improvements that could reshape price action and attract renewed investor attention.

The crypto market has had a rough end to the month of October, with most of the altcoins noting losses. However, as a new week and month begin, many crypto tokens are preparing for important network developments.

These developments could shape the price action going forward, and BeInCrypto has analysed three such altcoins for the investors to watch.

Sonic (S)

The upcoming Sonic mainnet and testnet upgrade to version 2.1.2 this week could act as a bullish catalyst for the S price. The update introduces native fee subsidies and crucial security enhancements, which may improve network efficiency and user confidence.

These technical upgrades may attract renewed investor interest and strengthen market sentiment.

Currently, S price is down 25%, trading at $0.1299, just above the critical $0.128 support level. The Relative Strength Index (RSI) has slipped into the oversold zone, a condition that has historically preceded short-term recoveries. This setup could trigger a rebound toward $0.159 or potentially extend to $0.176.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

S Price Analysis. Source:

S Price Analysis. Source:

S Price Analysis. Source:

S Price Analysis. Source:

However, if investor response to the upgrade remains muted, S’s price could fail to hold above $0.128. A breakdown below this level might accelerate losses, driving the token toward $0.112 or even $0.100. Such a move would negate bullish expectations and signal continued bearish control in the market.

THORchain (RUNE)

THORChain is set for a key network upgrade this week, with developers keeping details tightly under wraps. The anticipated V3.12 upgrade has sparked curiosity among investors, potentially drawing attention back to RUNE.

If the update delivers performance or liquidity improvements, it could serve as a short-term bullish catalyst.

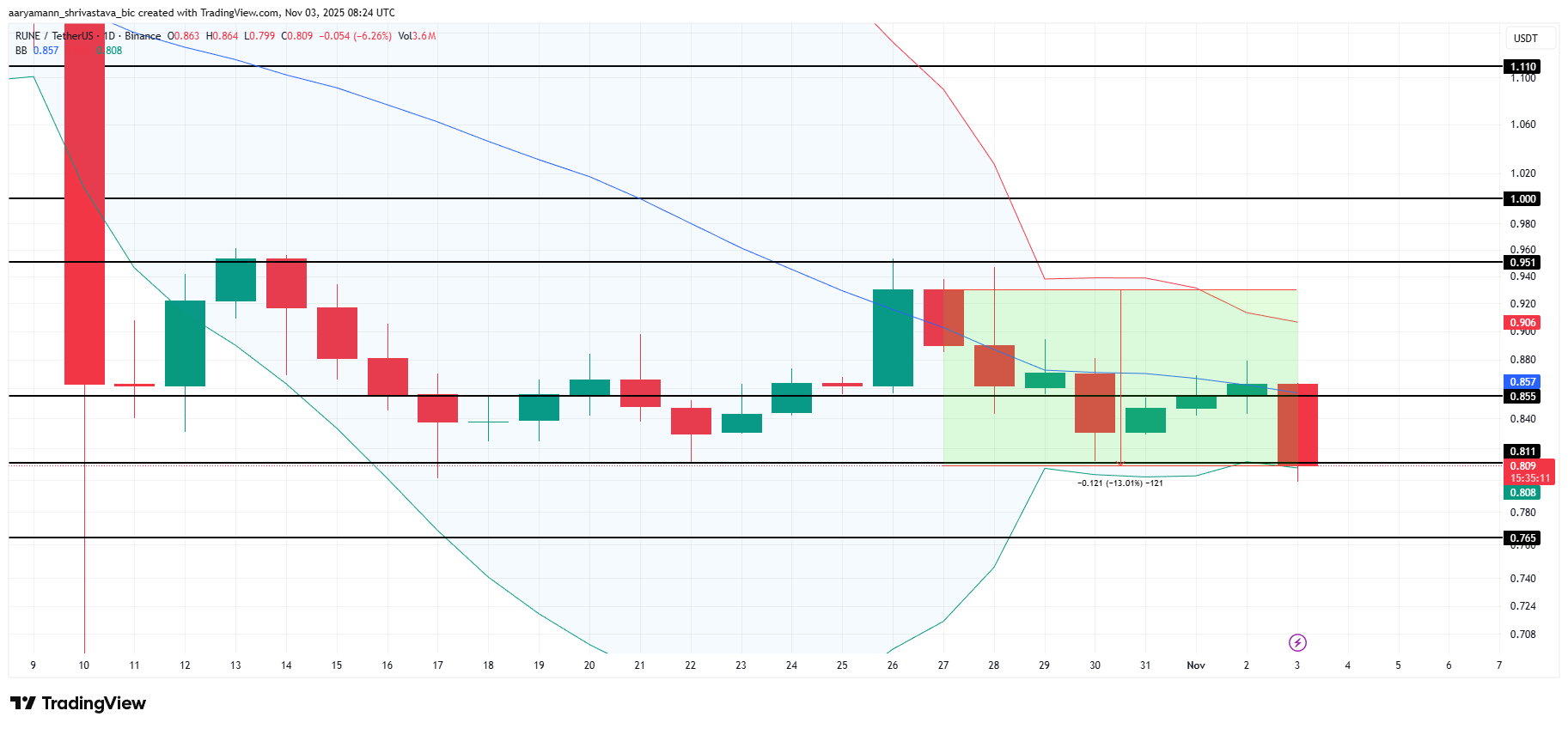

RUNE price has fallen 13% over the past week, now trading at $0.809. Technical indicators suggest a possible shift ahead. The Bollinger Bands are converging, signaling an incoming volatility spike.

If momentum turns positive, RUNE could break past the $0.855 resistance and target the $0.951 barrier in the near term, placing it among the top altcoins.

RUNE Price Analysis. Source:

RUNE Price Analysis. Source:

RUNE Price Analysis. Source:

RUNE Price Analysis. Source:

However, if bearish sentiment persists, RUNE may continue its descent. A drop below $0.765 could confirm further weakness, erasing recent gains and invalidating bullish projections.

Sky (SKY)

Sky Network’s latest Executive Vote has been approved, marking a key governance milestone. The proposal increases daily SKY buybacks to 300,000 USDS and transfers 500 million SKY to the protocol treasury for staking rewards.

These changes aim to enhance token demand and strengthen long-term sustainability across the Sky Network ecosystem.

Following this development, the SKY price could see renewed upward momentum. A rebound from the $0.0545 support level may push the token past $0.0559 and toward $0.0575. Such movement would help recover the 7.8% weekly losses and signal growing investor confidence in the network’s economic reforms.

SKY Price Analysis. Source:

SKY Price Analysis. Source:

SKY Price Analysis. Source:

SKY Price Analysis. Source:

However, if market response remains muted, the positive impact of the governance upgrade could fade. A breakdown below $0.0545 may send SKY toward $0.0536, reinforcing short-term bearish sentiment.

Sustained weakness at these levels could delay recovery efforts and extend the current downtrend across the asset’s price trajectory.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Accelerates Its Transition to Quantum Resistance

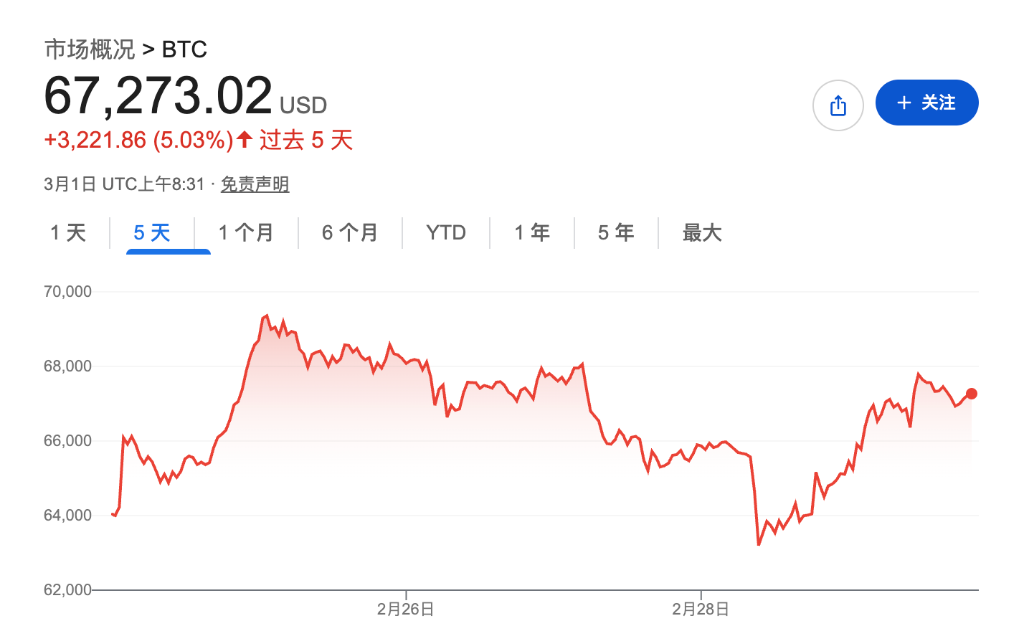

鲍威尔凌晨又将登场!这次他会让市场高兴吗?

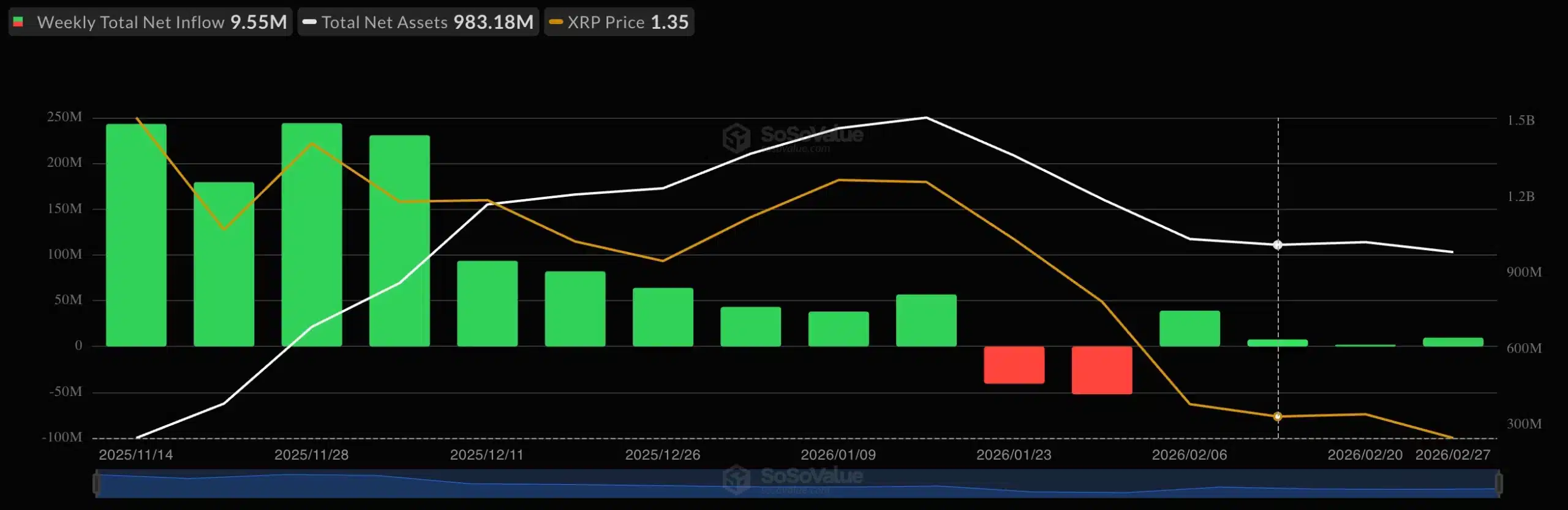

While Bitcoin ETFs bled, Solana and XRP won the week – Here’s the data!