Pro-Crypto CFTC Chair Nominee Won’t Commit to More Agency Resources or Dem Commissioners

During a generally friendly Senate confirmation hearing Wednesday, CFTC Chair nominee Mike Selig refused to say the agency needs more resources, even as the CFTC is poised to take on new duties in regulating the crypto market. And while not directly pushing back on the idea of non-Republican commissioners at the CFTC, as required by law, Selig would not commit to advocating for their inclusion.

Selig, who currently serves as chief counsel for the SEC’s crypto task force, received a warm reception from both sides of the aisle during his confirmation hearing before the Senate Agriculture Committee on Wednesday afternoon. His nomination to lead the CFTC has been supported by the crypto industry, which could soon see much of its market activity fall under the regulator’s jurisdiction.

But when pressed repeatedly about whether the CFTC—which has historically regulated sleepier agriculture futures—would need more resources to regulate the sprawling crypto spot market (and the exploding prediction market sector), Selig declined to commit to expanding the agency’s staff or budget.

“Whether we need more resources or not, once confirmed I will make that assessment,” Selig said in response to a line of questioning by Sen. Ben Ray Lujan (D-NM). “But I really think it would be irresponsible of me to pre-judge that issue.”

Selig’s refusal to commit on the issue was notable, given both the top ranking Democrat and Republican on the Senate Ag Committee—Amy Klobuchar (D-MN) and John Boozman (R-AR)—voiced support for a larger CFTC budget in light of the agency’s impending crypto-related responsibilities.

“I don’t know why it’s hard to say we need more staff,” Sen. Lujan said at one point during the hearing.

The senator then added, in an apparent sarcastic reference to the president’s massive crypto portfolio: “I’m guessing President Trump wants to see a robust CFTC in this space?”

Earlier this year, the White House withdrew its first nominee to run the agency, Andreessen Horowitz Global Head of Crypto Policy Brian Quintenz. Quintenz’s nomination faced fierce backlash from Trump-cozy crypto executives Tyler and Cameron Winklevoss—who faulted Quintenz for wanting to grow the CFTC to deal with the task of regulating crypto.

During Wednesday’s hearing, Selig also declined to say outright whether the CFTC should feature minority Democrat commissioners.

By law, the regulator is supposed to be led by five commissioners, two of which must belong to an out-of-power party. But it currently features just one Republican acting chair, and—in a departure from longstanding precedent—President Donald Trump has given no indication that he intends to nominate Democrats to fill its current vacancies.

The Trump administration has moved in recent months to purge Democrat commissioners from ostensibly independent federal agencies, in a series of controversial actions that will soon be reviewed by the Supreme Court.

Though Selig said he generally enjoys hearing opposing viewpoints on policy issues, he maintained that the president has the final say on appointments to the CFTC and emphasized he would honor such decisions, whatever they were.

“The CFTC is able to function with a single chairman,” he said.

The question of whether the CFTC will remain without Democrat commissioners has become central to negotiations over the Senate’s crypto market structure bill, which would establish a federal framework for regulating most crypto activity.

Senate Democrats have become concerned about handing the CFTC far-reaching authority to craft rules for the crypto industry, should the agency feature only Republican leadership in years to come.

“For those of us who want to get to ‘yes’ on a market structure bill…having some sense that there’s some oversight—that it isn’t just going to be you, vulnerable to the pressure of the president, as the only one there—is something I think many of us are going to be watching,” Sen. Elissa Slotkin (D-MI) told Selig during Wednesday’s hearing. “Certainly me.”

A vote on Selig’s confirmation has been fast-tracked to take place on Thursday.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

GLXY.O Moves Up, Yet Technical Indicators Suggest a Potential Decline

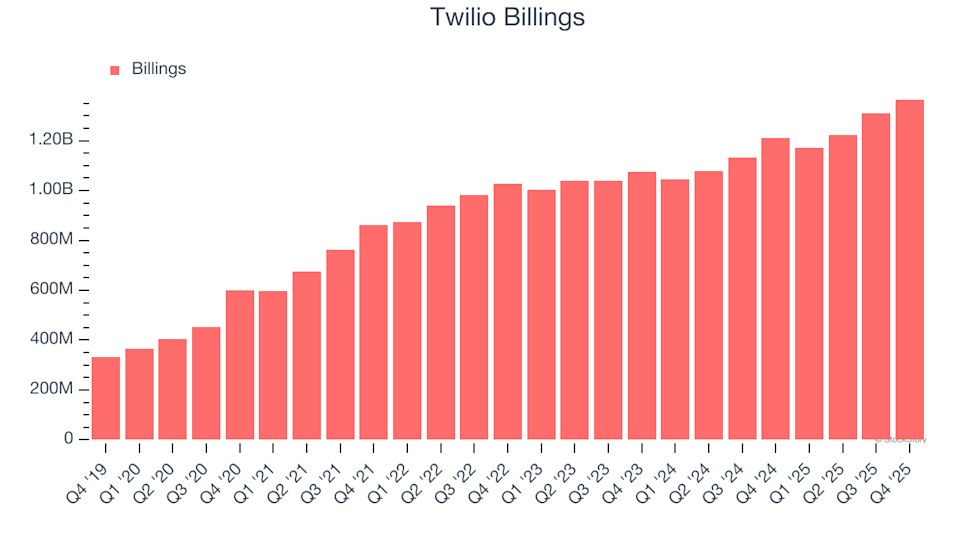

3 Reasons to Avoid TWLO and One Alternative Stock Worth Buying

Venezuela to ensure security of mining companies, US Interior Secretary says

Low Likelihood, Significant Expense: The Macroeconomic Impact of Withdrawing from CUSMA