Litecoin Is Being Ignored by Retail — While Institutions Quietly Accumulate 3.7 Million LTC

Litecoin (LTC) has not escaped the shadow of its long downtrend since 2021. Its weak price performance has caused many retail investors to overlook this “legacy” altcoin. However, new reports reveal quietly growing positive signals. These signals form the basis for analysts to predict that the price may soon break above $100. Institutions Accumulate 3.7

Litecoin (LTC) has not escaped the shadow of its long downtrend since 2021. Its weak price performance has caused many retail investors to overlook this “legacy” altcoin.

However, new reports reveal quietly growing positive signals. These signals form the basis for analysts to predict that the price may soon break above $100.

Institutions Accumulate 3.7 Million LTC Despite Falling Prices

This year, as companies and institutions expand their digital-asset reserves and launch crypto ETFs, Litecoin has also joined this trend.

According to data from Litecoin Register, by the end of 2025, Treasuries and ETFs held nearly 3.7 million LTC. The total value exceeded $296 million.

Total Treasury & ETF Holdings (LTC). Source:

Litecoin Register

Total Treasury & ETF Holdings (LTC). Source:

Litecoin Register

“There are now over 3.7 million Litecoin being held in 10 public companies and investment funds. An increase of one million LTC since August 2025,” the Litecoin Foundation commented.

The chart illustrates a persistent accumulation over the past year. This trend continued even though LTC has not set a new high in 2025.

Notable holders include Grayscale, Lite Strategy, and Luxxfolio Holdings. Luxxfolio Holdings aims to accumulate 1 million LTC by 2026.

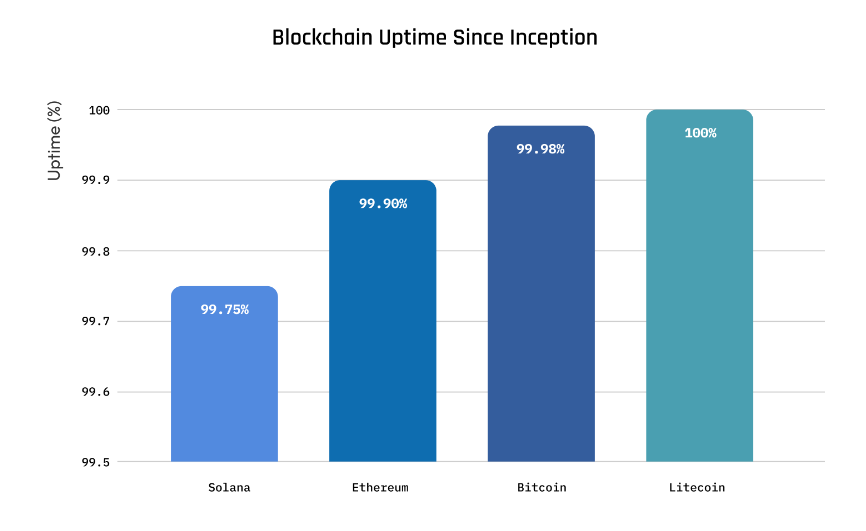

In addition, the “Silver Standard” report from LitVM highlights Litecoin as the blockchain with the highest uptime among legacy networks. It has maintained 100% uptime for the past 12 years.

Blockchain Uptime Since Inception. Source:

LitVM

Blockchain Uptime Since Inception. Source:

LitVM

Uptime measures the duration of a network’s continuous operation without interruption. A blockchain with high uptime demonstrates system stability, security, and reliability in processing transactions without technical failures.

“Institutions want sound money. They want LTC’s 12-year reliability,” investor Creed stated.

Fundamental data does not always create an immediate short-term impact. However, the short-term outlook from derivatives markets appears highly positive.

Binance top traders are rapidly increasing their $LTC long positions.

— CW (@CW8900) December 12, 2025

Top traders on Binance rapidly increased long LTC positions in the second week of December. Their behavior signals strong bullish expectations.

These factors may explain why several long-time investors continue to trust LTC. A crypto investor active since 2015, Lucky, believes that LTC will recover soon.

“I don’t see $LTC staying below $100 for much longer,” Lucky predicted.

Litecoin price recovery scenario. Source:

Lucky

Litecoin price recovery scenario. Source:

Lucky

LTC’s situation resembles that of several altcoins with strong fundamentals but slow price action, such as XRP, XLM, LINK, and INJ.

Experts also argue that only altcoins supported by liquidity from DATs and ETFs can survive and grow sustainably in the new phase of the market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Is a Year-End Rally Coming? Camel Finance Flags Fed-Fueled Dip & Rip

Renewable Energy Learning: An Unseen Driver of Expansion in 2025

- 2025 wind energy education programs are critical for addressing a 100,000-technician labor gap and advancing green infrastructure. - Institutions like STL USA and NREL integrate AI analytics, blade recycling, and hands-on turbine training to meet industry demands. - Industry partnerships with OEMs and $36M+ in federal funding accelerate workforce development but face policy risks from DOI land-use restrictions. - Global clean energy investment reached $2.1T in 2024, with U.S. renewables accounting for 93

Investing in EdTech and Skills Training to Empower Tomorrow's Workforce

- Global high-growth sectors like AI, renewables, and biotech are reshaping workforce demands, driving rapid STEM education evolution through edtech and vocational training. - AI-powered adaptive learning and immersive VR/AR tools now personalize education, with 36% of 2024 edtech funding directed toward workforce-specific skill development. - Vocational programs and industry partnerships (e.g., U.S. EC4A, EU Green Deal) are closing STEM skills gaps, creating direct pipelines to 16.2M+ clean energy jobs by

The Rising Influence of EdTech on Career-Focused Investment Prospects

- Global EdTech market grows at 20.5% CAGR to $790B by 2034, driven by STEM/digital skills demand. - STEM workers earn 45% higher wages; 10.4% occupation growth vs 4.0% non-STEM, reshaping labor markets. - 2025 EdTech VC investments show 35% YoY decline, concentrating on AI tools and scalable upskilling platforms. - MENA/South Asia EdTech sees 169% funding growth, addressing equity gaps through global platforms. - AI-driven EdTech and M&A activity (e.g., ETS-Ribbon) highlight sector's shift toward outcome-