News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Fed Hawkish Stance; Google Bond Oversubscribed; Robinhood Profit Decline (February 11, 2026)2'If individuals around the globe understood what I do': MicroStrategy's Michael Saylor shares a viral statement regarding MSTR shares and Bitcoin potentially reaching $10 million3Robinhood launches public testnet for blockchain built on Arbitrum

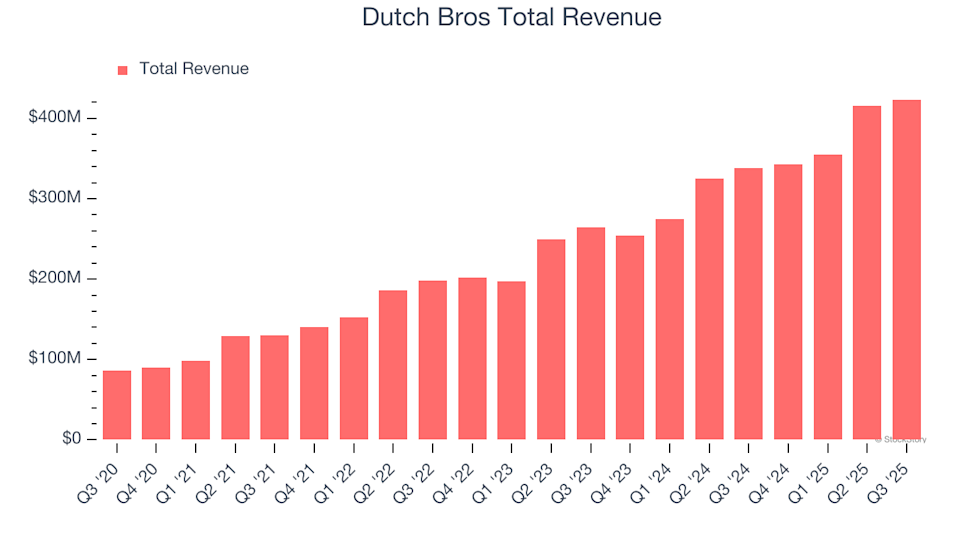

Dutch Bros (BROS) Set to Announce Earnings Tomorrow: Here’s What You Should Know

101 finance·2026/02/11 03:18

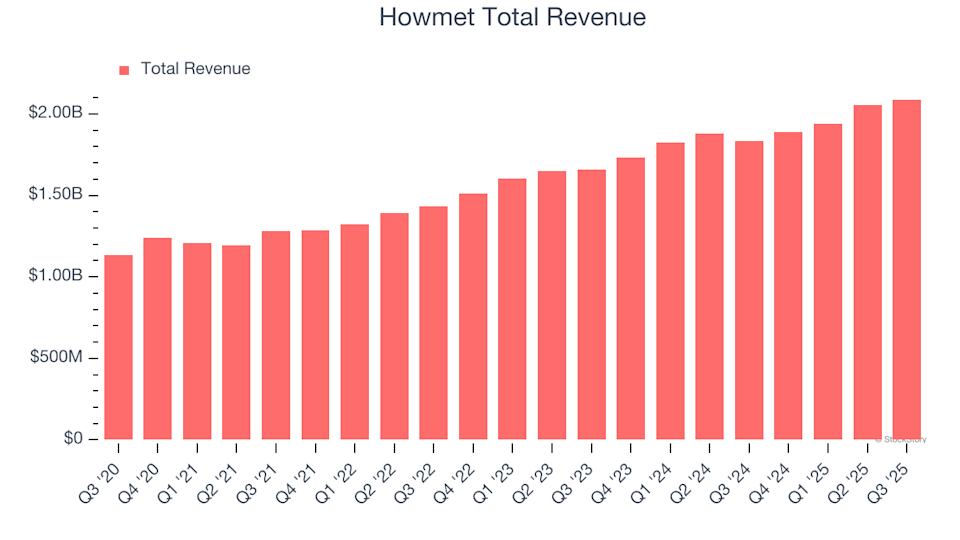

Howmet (HWM) Q4 Earnings Preview: Key Points to Watch

101 finance·2026/02/11 03:18

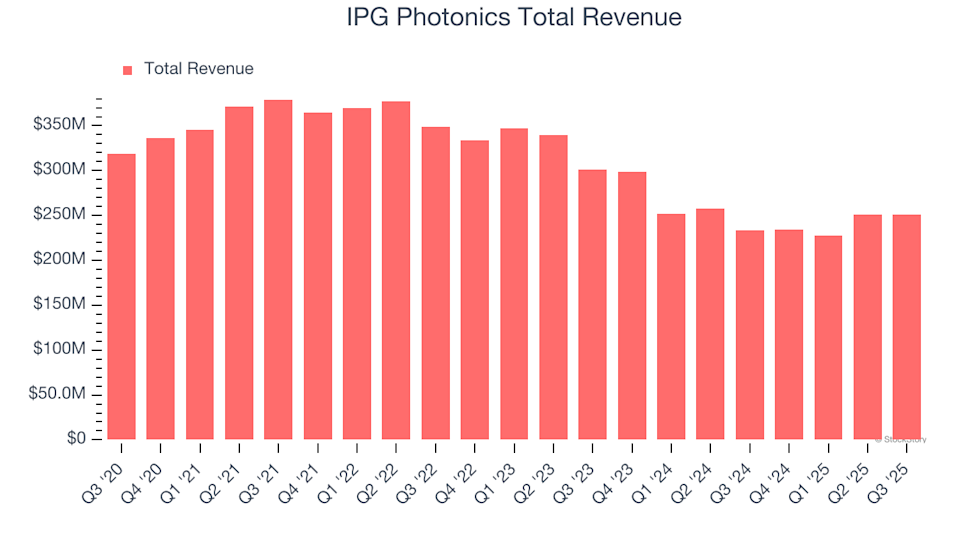

IPG Photonics (IPGP) Q4 Preview: Key Information Before Earnings Release

101 finance·2026/02/11 03:18

Twilio Earnings: Key Points to Watch for TWLO

101 finance·2026/02/11 03:18

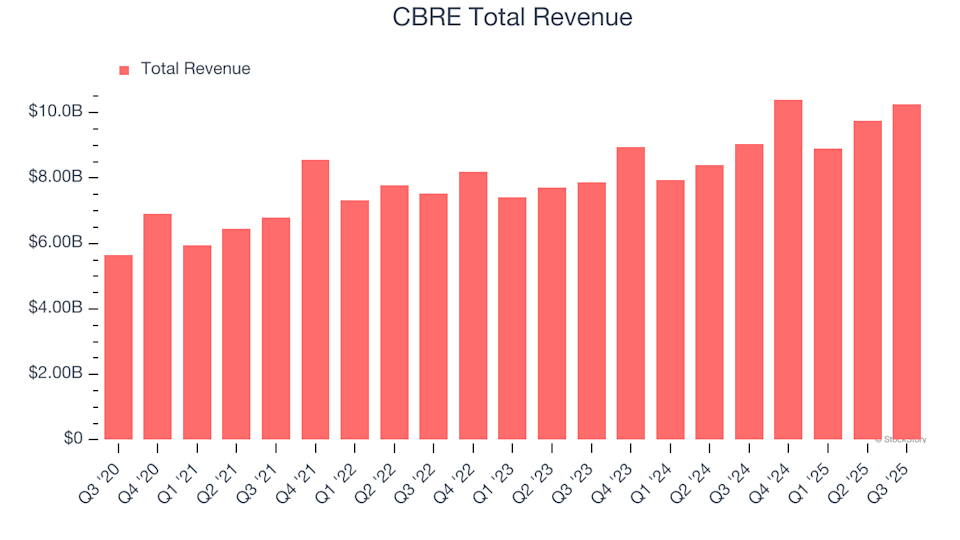

CBRE Earnings: Key Points to Watch in CBRE’s Report

101 finance·2026/02/11 03:18

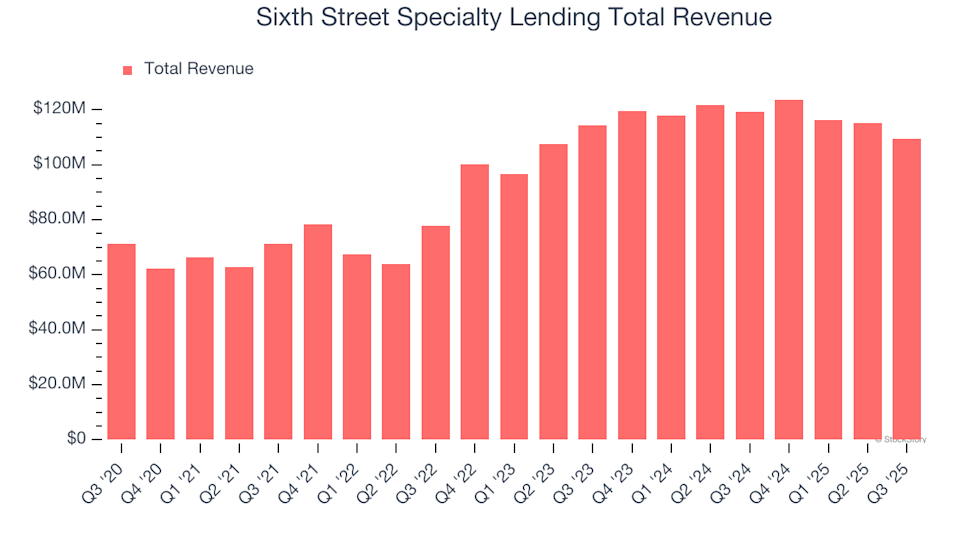

Sixth Street Specialty Lending Results: Key Points to Watch for TSLX

101 finance·2026/02/11 03:15

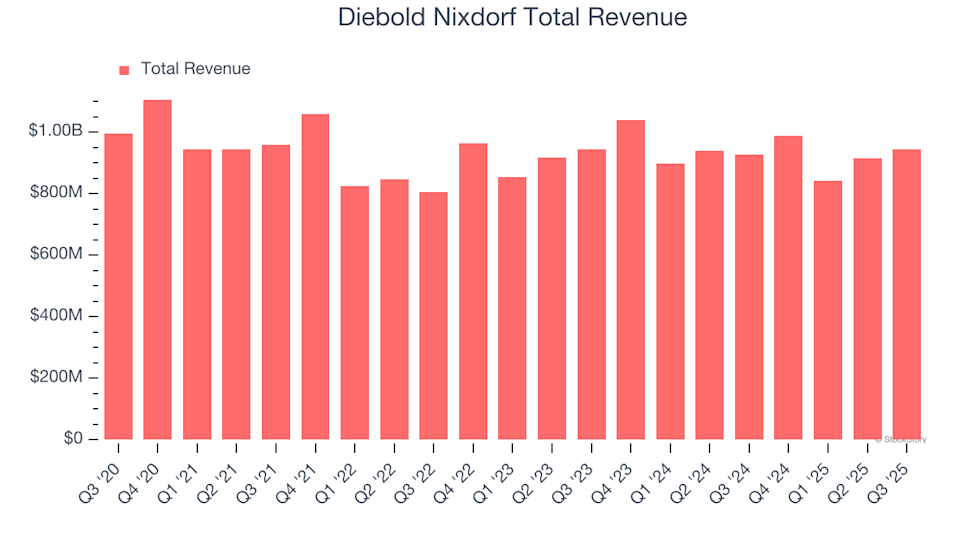

Diebold Nixdorf (DBD) Q4 Results: Anticipated Outcomes

101 finance·2026/02/11 03:15

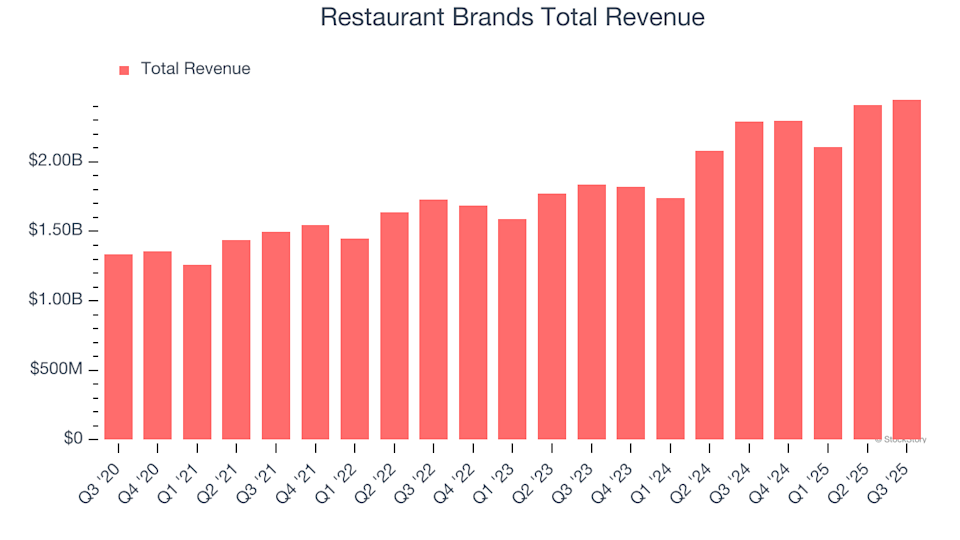

Earnings To Watch: Restaurant Brands (QSR) Will Announce Q4 Results Tomorrow

101 finance·2026/02/11 03:15

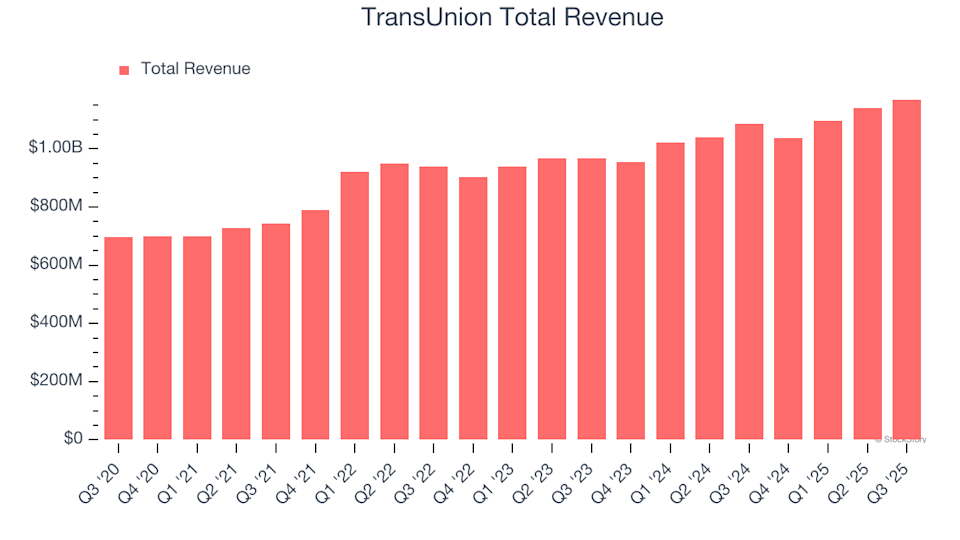

Earnings To Watch: TransUnion (TRU) Will Announce Q4 Results Tomorrow

101 finance·2026/02/11 03:09

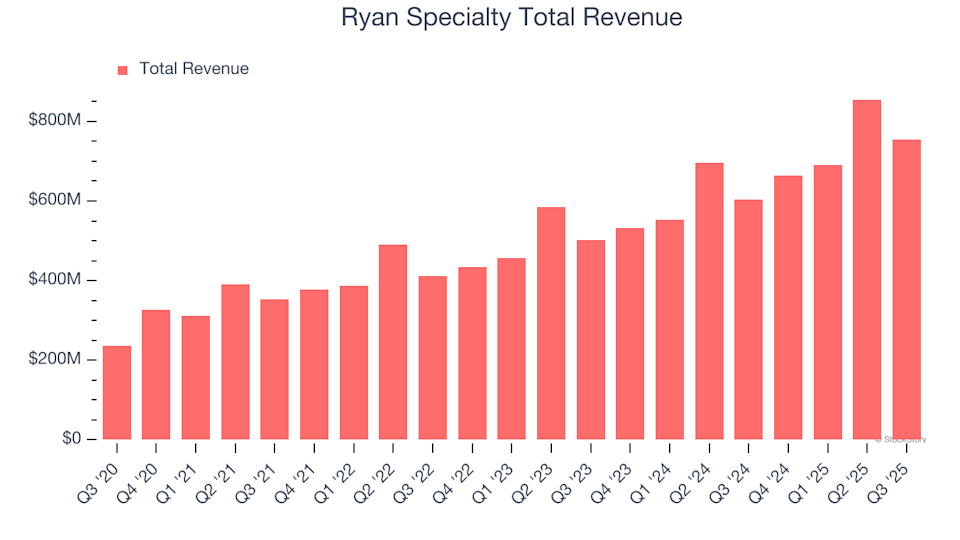

Earnings To Watch: Ryan Specialty (RYAN) Will Announce Q4 Results Tomorrow

101 finance·2026/02/11 03:09

Flash

03:44

GTE partners with LayerZero to build the Turbo financial layer on ZeroForesight News reported that GTE has announced a partnership with LayerZero to build the Turbo Treasury Layer on Zero. GTE is powered by Turbo, a high-throughput, low-latency decentralized system designed specifically for trading. Turbo features three dedicated layers: a Treasury Layer built on Zero, a decentralized margin engine, and a custom Rust-based matching engine. GTE is a decentralized trading platform that previously completed a $15 million financing round led by Paradigm in June 2025.

03:37

「Suspected Listing Hype Insider Trading」 Whale HYPE Long Positions' Unrealized Loss Expanded to $13.7 Million, Liquidation Price $26.15BlockBeats News, February 11th, according to Coinbob Popular Address Monitor, as the HYPE price continues to fall, one of the largest on-chain bulls "suspected of HYPE listing insider trading" has seen its unrealized losses expand to $13.7 million. The address currently holds a 5x leveraged HYPE long position with a position size of approximately $39.7 million, at an average entry price of $38.67, with the current loss at around 171%.

Recently, the address has been continuously withdrawing collateral from Hyperliquid, causing its liquidation price to be raised from $20 to $26.15. Currently, the margin call is only about 9.1% away. Despite a previous significant surge in HYPE where its position was close to breaking even, the whale has never closed the position.

This address went long on HYPE before its listing on an exchange on October 23 last year, entered at a price that immediately went below the entry point, and has been in an unrealized loss state for a long time. There has been no adjustment or reduction of the position throughout, continuing to "hodl" to this day. Previously, its peak unrealized loss was close to $26 million, with a liquidation price of around $20.1, and in mid to late January, it was as close as 0.37% away from liquidation.

03:35

Investors Optimistically Bet on AI Prospects, Emerging Market Stocks Climb to Record HighsGlonghui, February 11|Driven by Asian technology stocks, emerging market equities have climbed to record highs. Investors remain optimistic about the prospects of artificial intelligence and continue to pour funds into developing markets. The MSCI Emerging Markets Index rose as much as 0.8% on Wednesday, reaching 1,561.71 points, surpassing the previous intraday record set on January 29. Major stock indices from South Korea to Mexico and Brazil are also hovering near historic highs. This rally extends last year’s strong gains of over 30% in emerging market equities, with Asian markets such as Taiwan and South Korea standing out due to high demand for AI-related hardware, including semiconductors. Strategists at BlackRock Investment Institute believe there are investment opportunities in AI-related stocks within this asset class and expect that the global supply chain restructuring will benefit countries such as Mexico, Brazil, and Vietnam.

News