News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Trump Nominates Warsh and Sets 15% Growth Target; Alphabet Issues $20 Billion Bonds; US Tech Stocks Rebound (February 10, 2026)2Bitmine buys $84 million in ETH as Tom Lee calls market pullback 'attractive' entry point: onchain data3As Palantir Projects a 61% Increase in Revenue for 2026, Is Now the Time to Invest in Palantir Shares?

Cathie Wood’s Strategic Leap: Joins LayerZero Advisory Board to Revolutionize Cross-Chain Connectivity

Bitcoinworld·2026/02/11 00:51

Is GoPro Stock Worth Buying, Selling, or Holding in February 2026?

101 finance·2026/02/11 00:48

US Q4 Employment Cost Index Indicates Labor Market Remains Unsettled

101 finance·2026/02/11 00:36

Toymaker Mattel's Holiday Sales Slump, Stock Plunges 28% After Hours

新浪财经·2026/02/11 00:25

What you can look forward to at CoinDesk's Consensus Hong Kong 2026

101 finance·2026/02/11 00:18

FDA refuses to review Moderna's influenza vaccine application

101 finance·2026/02/11 00:15

Crypto Tycoon Novogratz: The "Speculative Era" of Cryptocurrency May Be Over

新浪财经·2026/02/11 00:08

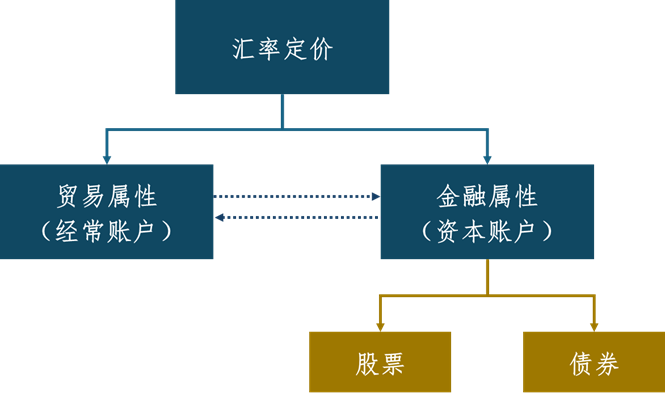

CNY: Clock Reversal

BFC汇谈·2026/02/11 00:02

Gilead's 2026 Outlook Falls Short of Wall Street Expectations, Stock Price Drops

新浪财经·2026/02/10 23:29

First Impression: GXO Logistics Inc.

101 finance·2026/02/10 23:24

Flash

00:49

Bitmine stakes another 140,400 ETH, worth 282 millionsChainCatcher reported that Bitmine continued to stake 140,400 ETH (worth 282 millions) today. Their total ETH holdings now amount to 4,325,738, with 3,037,859 ETH already staked, and the staking rate has exceeded 70%.

00:48

Analysis: Ethereum On-Chain Token Transfers Spike During Price Drop, Extreme Activity Could Signal Seller ExhaustionBlockBeats News, February 11th, CryptoOnchain posted on social media that when the Ethereum price dropped to the $2000 range, Token Transfers (14-day moving average) sharply surged to 2.75 million, the highest level since August 2025.

This spike indicates panic selling and a "washout" of weak hands. Historical data shows that such extreme activity often signals a depletion of selling pressure and may indicate a local bottom forming.

Reportedly, Token Transfers (14-day moving average) is an on-chain data metric used to observe the trend and intensity of token transfer activity on the Ethereum (or relevant blockchain) network. It typically refers to the simple moving average of the total number of ERC-20 or similar standard token transfer transactions on the network over the past 14 days.

00:44

Ahead of the employment report release later today, Asian currencies entered a consolidation phase during early trading. Carol Kong from CBA stated in a research report: "We expect the trend of lower-than-expected employment figures to continue, putting further pressure on the currency." The economist and strategist pointed out that further weakening of the labor market, combined with easing inflationary pressures, could "encourage" two more rate cuts this year.Ahead of the employment report to be released later today, Asian currencies entered a consolidation phase during early trading. Carol Kong from CBA stated in a research report: "We expect the trend of employment numbers coming in below expectations to continue, putting further pressure on the currency." The economist and strategist pointed out that further softening in the labor market, coupled with easing inflationary pressures, could "encourage" two more rate cuts this year.

News