News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Why ZEC Coin and Bitcoin Prices Are Facing Volatility

Cointurk·2026/01/27 16:51

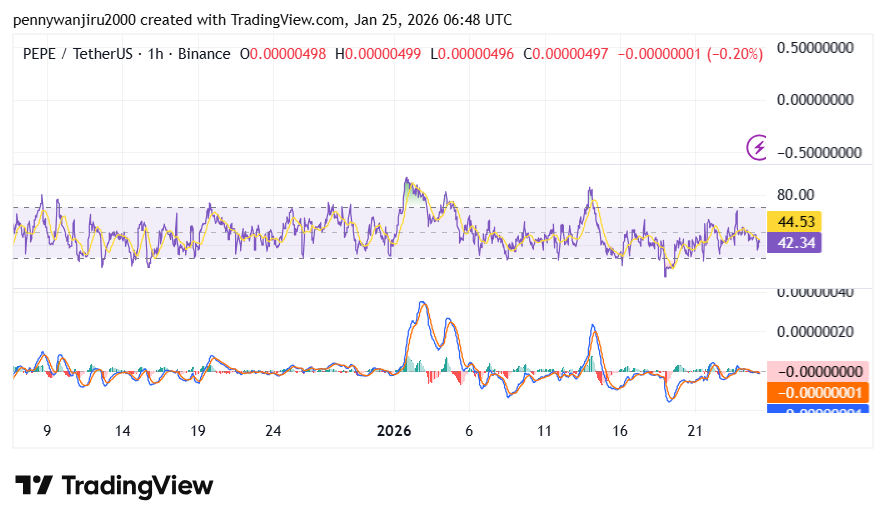

PEPE Trades at $0.05497 as Tight Range and Flat MACD Limit Breakout Momentum

Cryptonewsland·2026/01/27 16:33

Bitcoin Hyper Price Prediction: DeepSnitch AI Surges 150% as Investors Rotate from HYPER and BFX to DeepSnitch AI

BlockchainReporter·2026/01/27 16:21

Tether Taps Oobit to Make the USA₮ Stablecoin Spendable Anywhere Visa is Accepted

Nftgators·2026/01/27 16:18

Empty threats: Trump acts on only 1 in 4 tariff warnings, study shows

Cointelegraph·2026/01/27 16:15

Standard Chartered Predicts $500 Billion Shift to Stablecoin | US Crypto News

BeInCrypto·2026/01/27 16:15

4 Forces Driving On-Chain Transparency In Crypto Casinos

BlockchainReporter·2026/01/27 16:12

5 crypto to sell before Federal Reserve meeting tomorrow

Crypto.News·2026/01/27 16:12

Trump family-backed American Bitcoin achieves 116% BTC yield

Coinjournal·2026/01/27 16:12

Flash

06:54

BitMine has staked 53.4% of its Ethereum holdingsBlockBeats News, January 28th: Ethereum treasury company BitMine currently holds 4,243,338 ETH, accounting for 3.52% of the total supply (120.7 million). On-chain data shows that BitMine has currently staked 2,265,984 ETH, representing 53.4% of its Ethereum holdings.

Tom Lee previously stated that if all the held ETH is staked, based on a 2.81% CESR, the annual staking yield could reach $374 million, averaging over $1 million per day.

As a result, the amount of ETH queued to join the Ethereum PoS network remains high, currently standing at 3,458,771 ETH, worth approximately $10.4 billion, with an expected activation delay of around 60 days and 1 hour.

06:45

Bloomberg analyst: Since 2022, bitcoin has still outperformed silver and gold; the institutional narrative has been priced in early, leading bitcoin into a consolidation phase.BlockBeats News, January 28, Bloomberg ETF analyst Eric Balchunas posted on social media, saying, "I see some panic among bitcoin holders (and some schadenfreude among bears), but in my view, this is quite short-sighted. Since 2022 (before BlackRock filed for a bitcoin ETF), bitcoin has risen 429%, gold is up 177%, silver is up 350%, and QQQ is up 140%." In other words, bitcoin's performance in 2023 and 2024 has left other assets far behind (though many seem to have forgotten this). Even if other assets later had 'the best year ever' while bitcoin was in a slump, they still have not caught up to bitcoin's performance to this day. In my view, what really happened is that the 'institutionalization' narrative was priced in by the market too early and too quickly, and even before it actually materialized. Therefore, bitcoin needs a period of consolidation to allow real-world developments to catch up with the previous price surge."

06:39

The CEO stated that the Senate stablecoin bill gives banks an advantage but restricts the development of decentralized finance (DeFi): The DeFi bill gives banks an advantage but limits the growth of DeFi.According to a report by Bijie Network: Eco CEO Ryne Saxe has warned that a proposed bill in the US Senate, which would prohibit stablecoin issuers from paying passive yields, could prompt US users to turn to offshore platforms and on-chain DeFi, while shifting regulatory pressure to the crypto front-end, such as applications and wallets. He believes that this regulation, under the guise of consumer protection, may actually create structural advantages for banks and can be easily circumvented by "activity-based" reward mechanisms, ultimately failing to curb the formation of a global, borderless liquidity market.