News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Fed rate decision: What to expect in crypto market tomorrow?

Crypto.News·2026/01/27 16:06

Hyperliquid becomes ‘most liquid venue for crypto price discovery’- What does it mean?

AMBCrypto·2026/01/27 16:03

Bitcoin Confirms Bearish Structure After $98,000 Rejection — Here's The Next Potential Target

Newsbtc·2026/01/27 16:03

Importaciones de soja de la UE en 2025/26 bajan un 13% al 23 de enero

101 finance·2026/01/27 16:03

Consumer confidence drops to its lowest point since 2014

101 finance·2026/01/27 16:00

Canada Seeks to Increase Energy Shipments to India Amid Strategic Shift

101 finance·2026/01/27 16:00

Electric vehicles surpass petrol cars in European sales for the first time

101 finance·2026/01/27 15:57

Roper forecasts 2026 revenue, profit below estimates on soft government contract demand

101 finance·2026/01/27 15:57

UPS plans to reduce its workforce by as many as 30,000 positions this year

101 finance·2026/01/27 15:57

How the SEC Has Approached Cryptocurrency Cases One Year After Trump Took Office

101 finance·2026/01/27 15:48

Flash

09:46

IOTA Brings Seafood Supply Chains On-Chain With Kalalohko PartnershipIOTA adds Kalalohko to its Business Innovation Program to trace seafood from hook to plate and improve transparency for supply chains.

Kalalohko plans to use IOTA Identity, Notarization, and Gas Station to verify provenance and sponsor fees for a smoother user flow.

IOTA has added seafood traceability to its enterprise product suite as Kalalohko joined the IOTA Business Innovation Program. The initiative aims at bringing transparency and accountability to global seafood supply chains, supporting local fishermen and reducing reliance on opaque intermediaries. IOTA said the work will use public digital infrastructure to record provenance data and enable verification from “hook to plate.”

Kalalohko is an EU-funded project focused on rebuilding the seafood supply chain with clearer records and fairer participation for stakeholders. The project is targeting long-standing issues in the sector, including limited visibility into sourcing, pricing pressure on small operators, and complex distribution chains that can reduce local economic benefits.

IOTA described the partnership as a real-world adoption case that links physical trade activity to onchain records.

IOTA’s public digital infrastructure connects economies on-chain. Kalalohko is joining our Business Innovation Program to bring transparency and accountability to seafood supply chains – cutting out the middlemen, not the fishermen. ⛴️ pic.twitter.com/Po7tKQVAjL

— IOTA (@iota) January 27, 2026

The program follows IOTA’s recent focus on trade and logistics. As CNF reported, the network has increased real-world integration with live trade systems in Kenya and the UK, and it has also held active talks in ASEAN countries. It has also outlined a broader plan to connect trade flows to public blockchains with regulated, technology-neutral infrastructure designed for production use.

Kalalohko to Use IOTA Identity and Notarization

Kalalohko will use IOTA Identity to create digital identities for participants across the logistics chain. These identities will target actors in fishing companies, transport providers, and final buyers, attaching relevant data to certified entities. This is aimed at minimizing information disparities, which usually prevail between catch, processing, shipping, and final sale.

The project is also to be equipped with IOTA Notarization to document the major supply chain events in an unalterable manner. This would enable customers and partners to trace the progress of a product and ensure that the records are what was reported at previous stages in the chain. The network described notarization as a single record of a fish’s path from capture to delivery, supporting provenance checks for restaurants, municipalities, and other buyers.

To simplify user experience, Kalalohko will rely on the IOTA Gas Station model, which can sponsor transaction fees so participants do not need to hold tokens to write supply chain updates. This setup is designed for operational settings where fishermen and logistics actors may want simple tools that work without added crypto steps.

IOTA also linked the partnership to rising demand for verifiable sourcing. It cited upcoming EU regulations and noted recent sustainability-related reclassification actions in the seafood sector that increase interest in traceable data. The two partners aim to extend the same model to other industries with similar supply chain dynamics, including artisanal goods and other protein categories.

IOTA’s broader strategy continues to center on real-world assets, data, and identity. As CNF reported, IOTA unveiled a “Blue Ocean” strategy, positioning its network as a venue for tokenizing and transacting real-world information on-chain.

IOTA trades at

$0.08633

at press time, a

1.41%

rise in the past 24 hours.

09:45

South Korea's ruling party finalizes the "Basic Law on Digital Assets," requiring stablecoin issuers to have a minimum capital of approximately $3.5 millionPANews, January 28 — According to Korean media reports, South Korea's ruling Democratic Party has finalized the name of its bill aimed at regulating the virtual asset market as the "Basic Digital Asset Act" and plans to submit it before the Lunar New Year holiday. They have also agreed to set the minimum statutory capital requirement for stablecoin issuers at 5 billion KRW (approximately $3.5 million). However, sensitive issues such as the scope of authority for the Bank of Korea and restrictions on major shareholders' holdings will be finalized after further coordination with the policy committee.

09:45

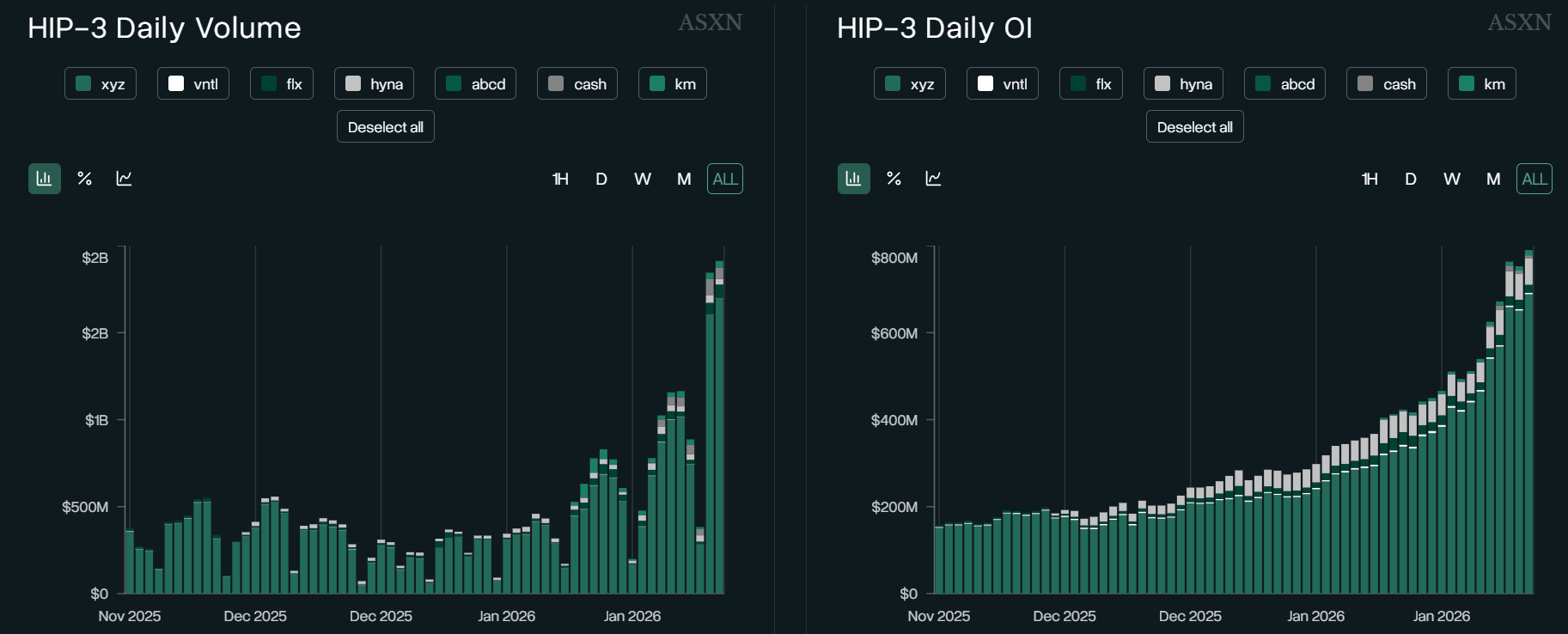

Monthly Max Liquidation Whales Check: The "Short Army Commander" has been liquidated with a $400 million scale this week, and multiple high-leverage whales have been liquidatedBlockBeats News, January 28th, according to HyperInsight and CoinGlass monitoring, this month's market volatility has intensified, with multiple high-leverage whales experiencing forced liquidation due to extreme market conditions, and the single largest liquidation size setting new 24-hour records across the network. Below are some of the whales with the largest single liquidation transactions recorded on the Hyperliquid platform this month:

“Air Force Commander”: Once the largest short seller of BTC, ETH, and other currencies, with a total position of nearly $500 million. Recently, suffered continuous liquidations, including around $199 million on January 22nd and around $120 million on January 26th. Today, after being liquidated for about $83 million, their position has shifted to long, currently holding only about $49 million in BTC long positions.

“Heavy Long 33 Million USD BTC”: This address sold ETH spot on January 16th and opened a BTC short position, only to be liquidated on January 19th, with a single liquidation of about $25.83 million and a total liquidation size of $33 million.

“Liquidated 26 Million HYPE Long”: On January 21st, affected by HYPE falling to $20, their HYPE and ETH long positions were liquidated by about $14.77 million. Previously, this address was liquidated for $26.3 million on December 18th, with the largest single liquidation of about $11.08 million.

“PUMP and FARTCOIN Largest Longs”: On January 15th, their PUMP long was liquidated for about $14.32 million, and the FARTCOIN long was liquidated for about $11.16 million, both setting the largest single liquidation records for that day. Subsequently, between January 16th and 19th, this address's positions continued to be liquidated, eventually bringing the account to zero.