News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

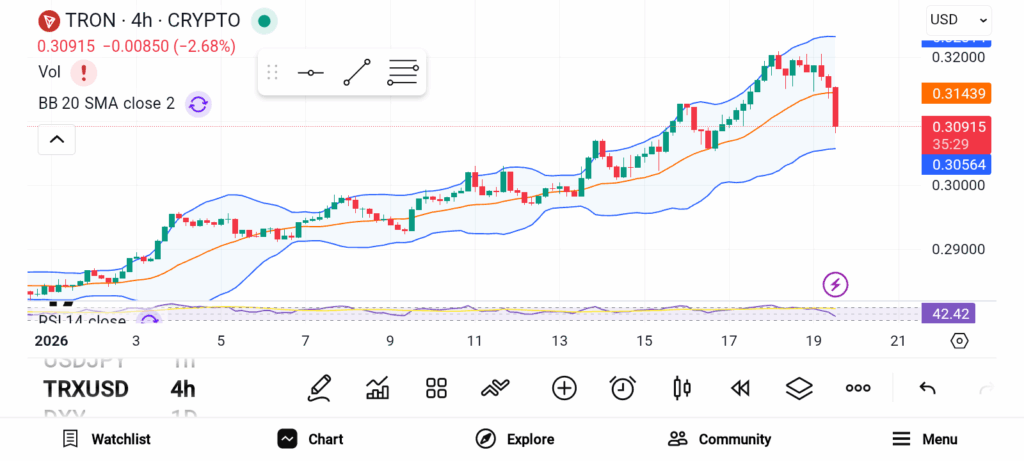

3 Altcoins to Invest in February 2026 — ADA, TRX, and HYPE

Cryptonewsland·2026/01/28 09:30

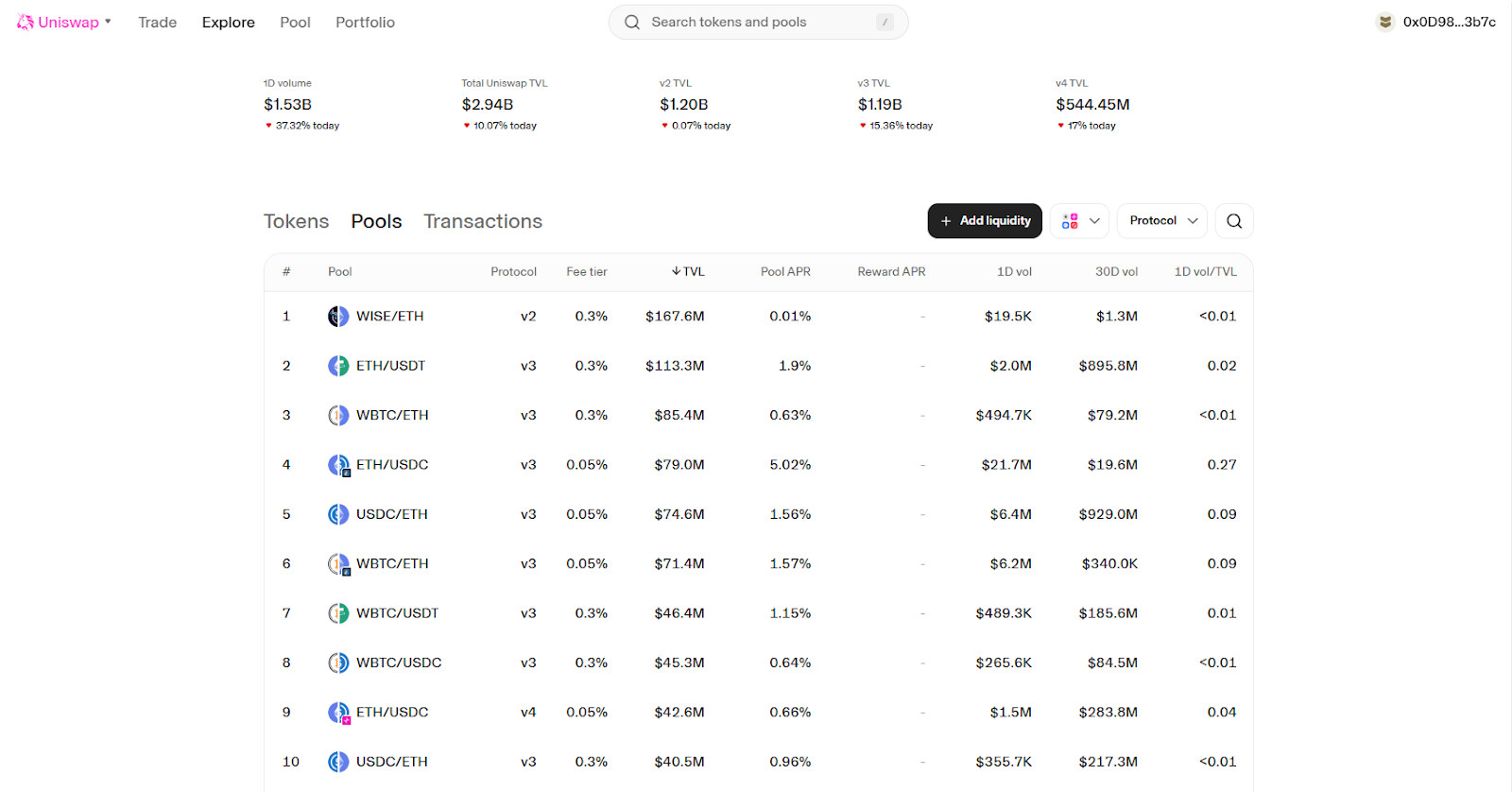

How Crypto Market Liquidity Actually Works

CryptoNewsNet·2026/01/28 09:12

Ethereum Makes Progress Toward Quantum Resilience

Coinomedia·2026/01/28 09:12

Morgan Stanley Goes From Crypto Curious to Crypto Committed as Wall Street ‘Opens the Pipes’

BeInCrypto·2026/01/28 09:06

Tether Is Disrupting the Gold Industry With Its Enormous Metal Reserves

101 finance·2026/01/28 09:00

ZEC Faces Downside Risk – Key Levels to Watch for Zcash

Cryptonewsland·2026/01/28 08:48

The Top 5 Analyst Questions That Stood Out During Old Second Bancorp’s Q4 Earnings Call

101 finance·2026/01/28 08:45

UNP Q4 In-Depth Analysis: Margin Challenges and Merger Ambiguity Shape This Quarter

101 finance·2026/01/28 08:45

Hyperliquid HIP-3 reaches $793 million open interest driven by commodities boom

CryptoValleyJournal·2026/01/28 08:42

Jerome Powell speech tonight: What to expect and where to watch

Crypto.News·2026/01/28 08:39

Flash

15:13

Five Major Institutions Outlook on the Fed's 2026 Rate Cut PathBlockBeats News, January 28th, five major institutions including JPMorgan Chase and Citigroup look ahead to the Fed's 2026 rate cuts and tonight's rate decision focus as follows:

Barclays Bank

Rate Cut Prediction: Total rate cut of 50 basis points (June and December).

Viewpoint: It is expected that the FOMC will signal that it is not in a hurry to further cut rates. The committee may point out that the current downside risks to employment are balanced with upside risks to inflation.

Powell's Statement: It is expected that he will reinforce the FOMC's stance of not rushing to cut rates.

Bank of America

Rate Cut Prediction: Total rate cut of 50 basis points (June and July).

Viewpoint: Political factors may become a focus in the January meeting. The Fed is expected to firmly maintain the status quo, with no change in the assessment of balanced risks.

Powell's Statement: The press conference may revolve around political rather than policy issues. However, in terms of policy, the current market pricing may bring unexpected dovish risks.

Citigroup Group

Rate Cut Prediction: Total rate cut of 50 basis points (June and September).

Viewpoint: If the next rate cut is aimed at policy normalization rather than addressing immediate risks, decision-makers may seek a broader consensus than in December last year, contingent on clearer inflation progress.

Powell's Statement: He is likely to emphasize that the just-completed three rate cuts have helped stabilize the job market, and the current policy stance is appropriate to assess its impact.

JPMorgan Chase

Rate Cut Prediction: No rate cuts in 2026.

Main Points: After completing three risk management rate cuts earlier, many FOMC members have indicated that the current pause is an appropriate time for action.

Powell's Statement: It is expected that he will indicate that current policy is sufficient to address the risks facing the dual mandate, and will avoid discussions involving various political issues related to the Fed.

Wells Fargo Bank

Rate Cut Prediction: Total rate cut of 50 basis points (March and June).

Viewpoint: A strong argument is that the longer the FOMC waits to cut rates, the higher the economic threshold needed to further ease policy.

Powell's Statement: It is expected that he will not imply further policy easing at the next meeting in March. He is likely to be asked about the Department of Justice's investigation, but responses are expected to be consistent with earlier statements. (FXStreet)

15:12

US winter storm causes hashrate drop, Bitcoin (BTC) mining stocks surgeAccording to Bijie Network: Bijie Network reports that the winter storm in the United States has caused bitcoin mining companies to halt production. The resulting decrease in hash rate has reduced mining competition and improved profitability, leading to double-digit gains in the stock prices of major mining companies on Wednesday.

15:11

Besant: We have introduced favorable policies for growthChainCatcher News, according to Golden Ten Data, U.S. Treasury Secretary Bessent stated that the S&P 500 index surpassed 7,000 points for the first time, reflecting that we have implemented sound policies conducive to growth.