Enthusiasm rises on stablecoin bill passage, but regulatory uncertainty remains

Quick Take Reps. Patrick McHenry and Maxine Waters have been working on a stablecoin bill that was advanced out of the Republican-led House Financial Services Committee over the summer last year. Rep. Maxine Waters told Bloomberg News this week that they were on their way “to getting a stablecoin bill in the short run.” Others say a sticking point on who should be the primary regulator of stablecoin issuers would have to be resolved first.

Optimism that a stablecoin bill's passage is near is being met with a dash of skepticism.

Over the past two weeks, new legislation was introduced in the Senate that would rein in stablecoins, and on Wednesday, Ranking Democrat of the House Financial Services Committee Maxine Waters said she and Chair Patrick McHenry were on their way "to getting a stablecoin bill in the short run."

"I want you to know that Patrick McHenry and I have been working very well together. We've been working on this for 22 months," Waters told Bloomberg . "We have put together a legislation with a few more tweaks that we may have to put to it that I think is going to bring everybody together."

McHenry and Waters have been working on a stablecoin bill that was advanced out of the Republican-led House Financial Services Committee over the summer last year. At the time, Waters called the bill "deeply problematic" due to a provision that allows state regulators to approve stablecoin issuances without Federal Reserve input.

Though it's hard to ignore the optimism, said Cody Carbone, vice president of policy for the Chamber of Digital Commerce, there is still the unresolved sticking point on who should be the primary regulator for stablecoin issuers, he said in an interview with The Block.

"This has been the hang-up all along and I haven't seen anything to show me that they have solved this," Carbone said.

Offices for McHenry and Waters did not respond to a request for comment about whether they had resolved the issue of state versus federal regulation and supervision.

"Long story short, until I can see that being resolved, I don't know how there is a pathway. They could tell me, 'Hey, we're 95% there,' but if that 5% is still this state versus federal issue, I'm still pessimistic that this is going to move forward," Carbone added.

The Senate bill, introduced by Sens. Kirsten Gillibrand, D-N.Y., and Sen. Cynthia Lummis, R-Wyo., has a provision to create "federal and state regulatory regimes for stablecoin issuers that preserves the dual banking system." Specifically, the bill creates a cap, allowing "state trust companies to create and issue payment stablecoins up to $10 billion."

"Maybe they're viewing that as the solution and the compromise, but I haven't heard anything from McHenry to say that's what he would like to do," Carbone said.

Attached to other bills to get passage

A stablecoin bill does have a shot at being included in the upcoming Federal Aviation Administration reauthorization. FAA reauthorization is through May 10, but political urgency to respond to Iran's attack on Israel could mean lawmakers have more time, TD Cowen said in a note on April 15.

Carbone put it at a 35% chance of a stablecoin bill being included in the FAA reauthorization.

"I don't know if I'm saying this with like my heart or my head," Carbone said. "I want it to pass, and I want them to move forward and I want to have a regulatory framework here because it seems like such low-hanging fruit."

Otherwise, post-election season, a stablecoin bill could be attached to end-of-year bills such as the National Defense Authorization Act or part of a legislative package that includes a bill that would allow financial institutions to provide services to the marijuana industry.

"It gets really, really tough," Carbone said. "I would love nothing more for a stablecoin bill to pass, but I have a hard time figuring out what the pathway is."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

鲍威尔凌晨又将登场!这次他会让市场高兴吗?

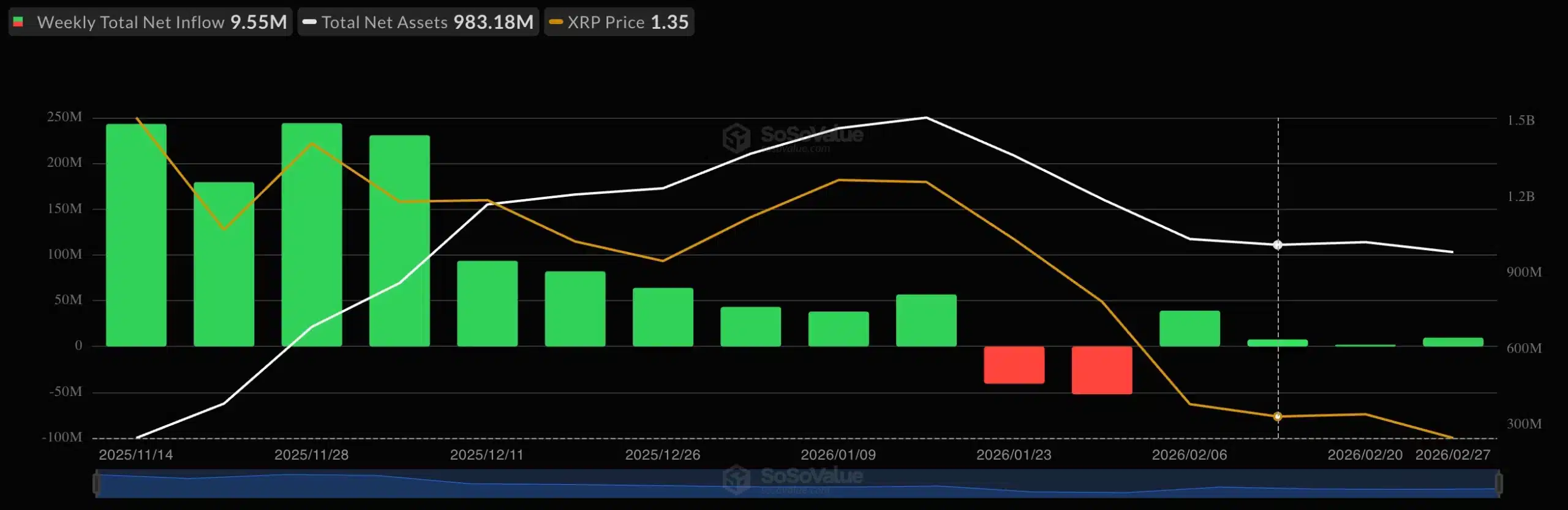

While Bitcoin ETFs bled, Solana and XRP won the week – Here’s the data!

美股收盘 | 三大指数集体收跌;新能源车股重挫,Rivian大跌超14%,特斯拉跌近6%;热门中概股普跌,极氪跌超23%