The price of Bitcoin ( BTC ) fell to a weekly low ahead of U.S. inflation data and a Fed meeting set for Tuesday, while United States spot Bitcoin exchange-traded funds ( ETFs ) recorded their first net outflow in over 19 trading days.

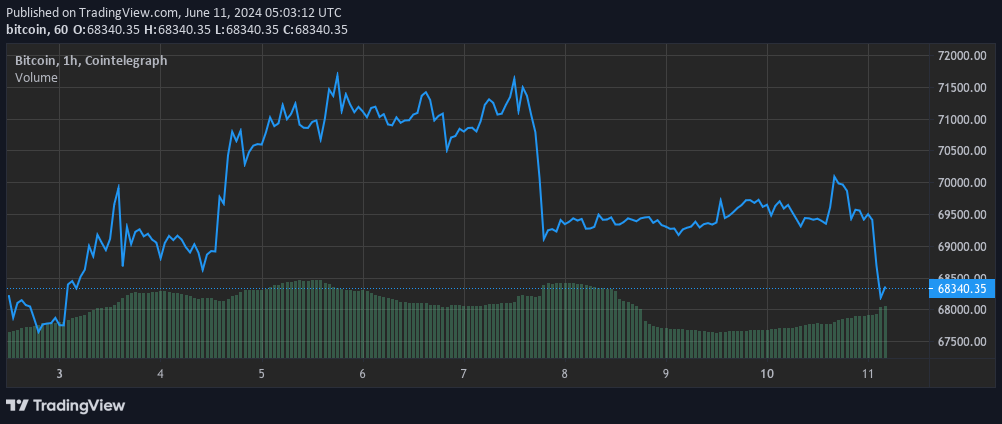

Bitcoin dropped 2.3% over the last 24 hours and hit $68,186 at around 3:00 am UTC on June 11, its lowest point since June 3, according to Cointelegraph Markets Pro .

Other cryptocurrencies followed, with Ether ( ETH ), Solana ( SOL ) and Dogecoin ( DOGE ) also fell in the last 24 hours.

Bitcoin’s price over the last week with a drop in early-morning Asia trading hours. Source: Cointelegraph Markets Pro

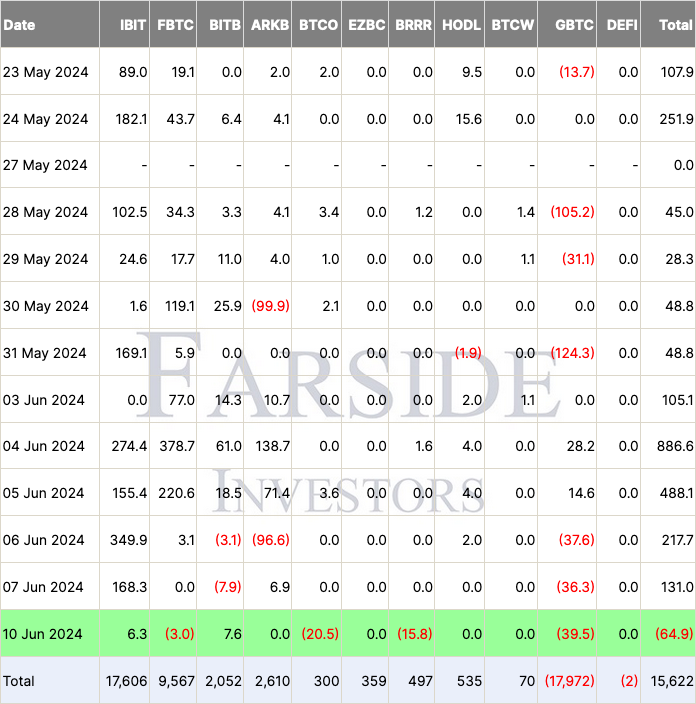

Bitcoin tumble comes after the 11 U.S. spot Bitcoin ETFs recorded a joint net outflow of $64.9 million on June 10 — their first net outflow in a month, according to Farside Investors.

The Grayscale Bitcoin Trust (GBTC) led with $39.5 million net outflows, followed by $20.5 million from the Invesco Galaxy Bitcoin ETF (BTCO) and a minor $3 million outflow from the Fidelity Wise Origin Bitcoin Fund (FBTC).

That came alongside tepid respective inflows of $7.6 million and $6.3 million from Bitwise and BlackRock’s ETFs .

U.S. Bitcoin ETFs June 10 inflow data noted in green. Source: Farside Investors

The U.S. Bureau of Labor Statistics is set to release May figures for its inflation-measuring Consumer Price Index (CPI) on June 11.

Analysts have forecast inflation to rise 0.1% after a 0.5% bump in April, bringing the year-on-year figure to 3.4% with core inflation forecast to rise 0.3% in May, the same as April, Morningstar reported .

The Fed’s monetary policy is also to be decided at a two-day Federal Open Market Committee (FOMC) meeting starting the same day.

Investment research firm Zacks predicted there is no chance the Fed moves on an interest rate cut — with the central bank expected to keep its 23-year high 5.25% to 5.5% target rate.