Goldman Sachs doubles down on Bitcoin ETFs, boosting holdings to $1.5 billion in Q4 2024

As of Dec. 31, 2024, Goldman Sachs owns $1.27 billion (or 24.07 million shares) of BlackRock’s iShares Bitcoin Trust.

Goldman Sachs loaded up on the two largest spot Bitcoin exchange-traded funds in the final quarter of 2024, according to the investment banking giant’s latest 13F filed Tuesday. 13f filings are a way to get a glimpse into how the largest portfolios and some of the most influential money managers play the market.

As of Dec. 31, Goldman Sachs owns $1.27 billion (or 24.07 million shares) of BlackRock’s iShares Bitcoin Trust ETF (IBIT), the largest spot Bitcoin ETF by assets under management. This represents an 88% increase in the amount of shares Goldman owned in the prior quarter.

Goldman Sachs also upped its holdings of the Fidelity Wise Origin Bitcoin Fund, owning $288 million in FBTC (3.5 million shares). This is a 105% increase in shares from the previous period. Goldman also reported smaller Bitcoin ETF positions that either decreased or were closed.

Each quarter, institutional investment managers with at least $100 million in equity assets under management file 13F reports with the U.S. Securities and Exchange Commission. The filings, which are required within 45 days of the end of each quarter, provide a view of the manager's stock holdings.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Insurance gaps leave airlines exposed as Iran conflict widens

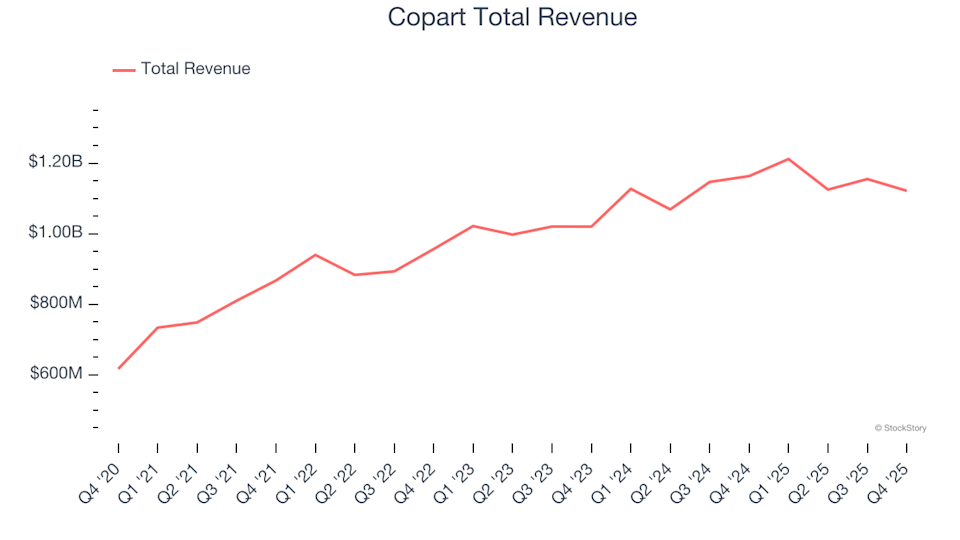

Business Services & Supplies Stocks Fourth Quarter Overview: Comparing Copart (NASDAQ:CPRT)

Berkshire Hathaway's Most Recent Purchases During Warren Buffett's Tenure as CEO

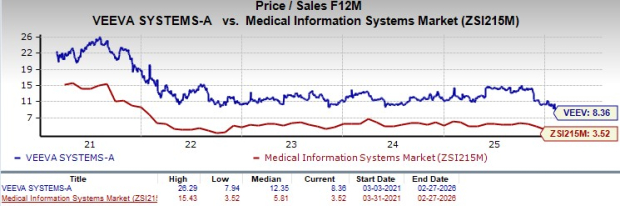

Can Advancements in AI and Robust R&D Propel VEEV Forward Before Q4 Results?