News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Fed Hawkish Stance; Google Bond Oversubscribed; Robinhood Profit Decline (February 11, 2026)2'If individuals around the globe understood what I do': MicroStrategy's Michael Saylor shares a viral statement regarding MSTR shares and Bitcoin potentially reaching $10 million3Robinhood launches public testnet for blockchain built on Arbitrum

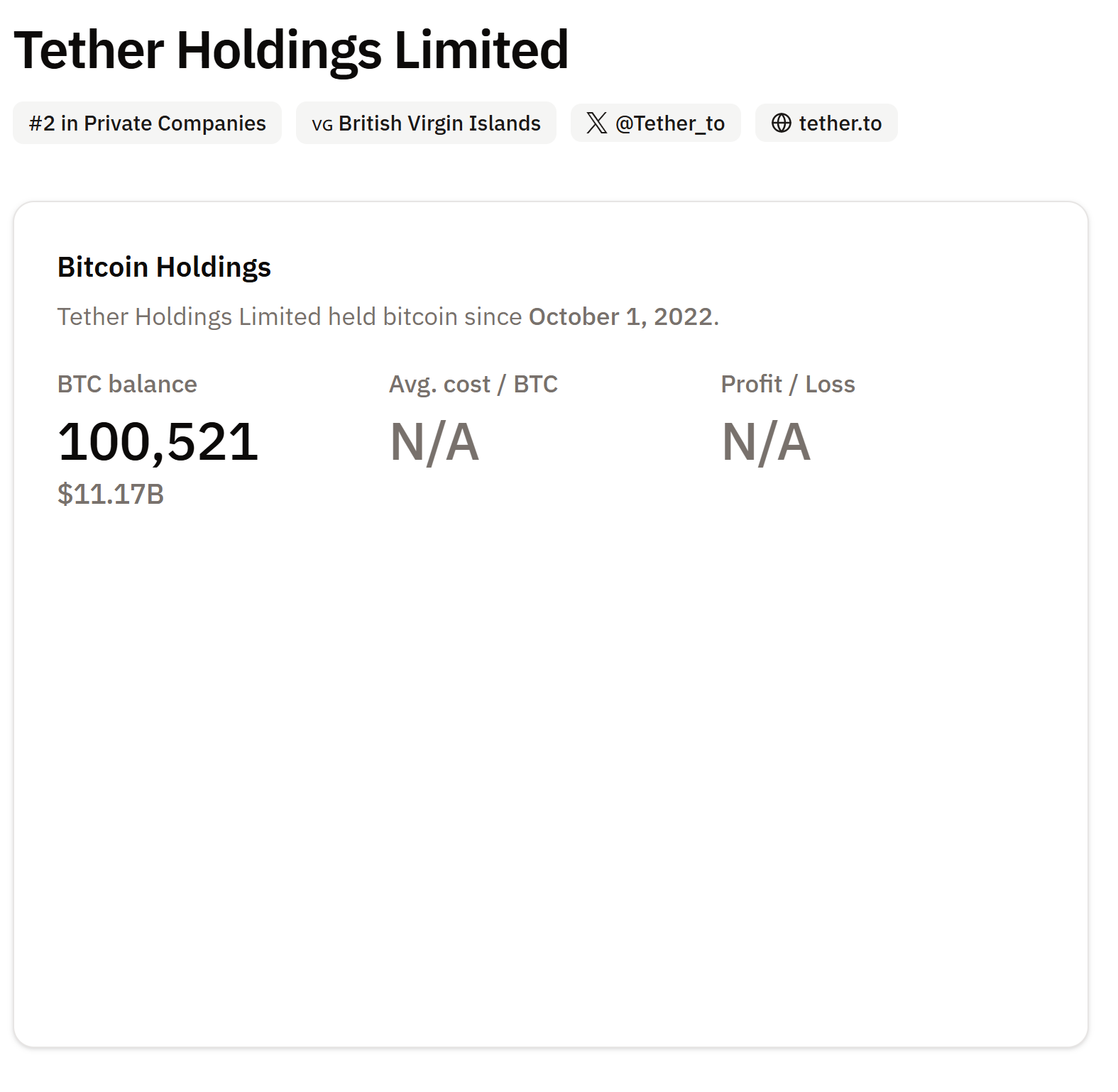

Tether denies Bitcoin sell-off rumors, confirms buying BTC, gold, land

CryptoNewsNet·2025/09/07 16:30

Solana (SOL) Founder Makes Statement About Ethereum: “What They’ve Been Able to Do Since 2015, We…”

CryptoNewsNet·2025/09/07 16:30

Stripe unveils Tempo, a blockchain dedicated to payments in stablecoins

Cointribune·2025/09/07 16:15

India Reconfigures Energy Imports Amid BRICS Push

Cointribune·2025/09/07 16:15

Bitcoin Mining Difficulty Hits Record High Amid Volatility and Centralization Concerns

Cointribune·2025/09/07 16:15

Crypto: A Historic Signal on Ethereum Opens the Way to $7,000

Cointribune·2025/09/07 16:15

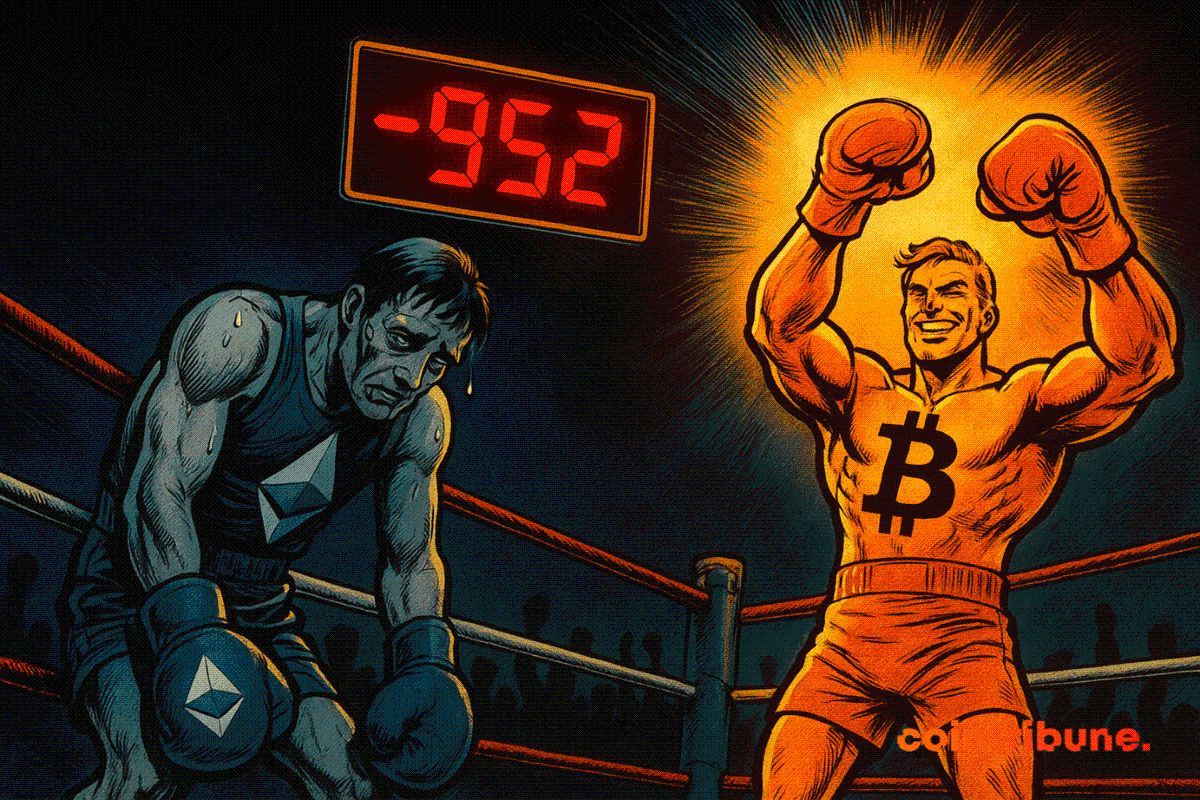

Ether ETFs Face $952M Outflows as Bitcoin Funds Gain Flows

Cointribune·2025/09/07 16:15

Bittensor (TAO) To Dip Further Before Bounce Back? Key Emerging Harmonic Pattern Saying Yes!

CoinsProbe·2025/09/07 16:15

Is Artificial Superintelligence Alliance (FET) Poised for a Breakout? Key Pattern Formation Suggests So!

CoinsProbe·2025/09/07 16:15

Tether Clarifies Bitcoin Holdings Strategy Following Speculation About Asset Sales

BTCPEERS·2025/09/07 16:10

Flash

11:33

Odaily Evening News1. A certain exchange has partnered with Franklin Templeton to launch an institutional OTC collateral program; 2. Non-farm payrolls are expected to see the largest annual downward revision in history, and the US Dollar Index is expected to remain volatile before the data is released; 3. Matrixport: Retail buying demand remains insignificant, extending the current consolidation phase; 4. Strategist: The Federal Reserve's anti-inflation battle is nearing its end, and the inflationary impact of tariffs is expected to gradually fade in the second half of the year; 5. Hyperliquid's largest ETH long position increased by 5,000 ETH, with a current total unrealized loss of $10.43 million; 6. Trend Research's ETH long position ultimately lost $869 million; 7. The "ETH long address with $204 million" increased its ETH long position by 5,000 in the past 50 minutes, with a total unrealized loss exceeding $10.03 million; 8. A major trader who previously profited $673,000 has built a position of 3,700 ETH; 9. Machi Big Brother's 25x leveraged ETH long position was partially liquidated again, with cumulative losses exceeding $27.52 million; 10. A whale suspected to be related to Matrixport went long 105,000 ETH on Hyperliquid, with a current unrealized loss exceeding $10 million.

11:30

Consensys founder predicts a breakthrough in the DeFi sector by 2026Consensys founder and CEO Joe Lubin stated in an interview at Consensus Hong Kong 2026 that the security of "blue-chip" decentralized finance (DeFi) protocols is now on par with traditional finance. He believes that global banks are being "devalued" and becoming less secure, predicting that the DeFi sector will experience a true breakthrough in 2026. Regarding bitcoin, Lubin mentioned that "Q Day" (the moment when quantum computers may break current cryptographic technology) poses an "existential issue" for bitcoin, but he believes this moment is still far off, while artificial intelligence will accelerate technological development. He stated that Ethereum will soon be in a good state, while other blockchains may face technical challenges and systemic risks in the future.

11:27

Analyst: The weakening trend in the job market is clear, and non-farm payroll data may gradually reflect this reality.Glonghui, February 11|According to Investinglive analyst Justin Low, US private data provider Revelio Labs estimates that non-farm employment in January at the start of the new year decreased by 13,300, and has significantly revised December's data down to an increase of 34,400 (previously an increase of 71,100). This is not the official "estimate" for non-farm employment, but rather an indicative metric reflecting the overall trend. Revelio Labs' measurement standard is "a set of employment statistics derived from over 100 millions professional profiles obtained from professional social networking sites" (such as LinkedIn, etc.). Although its methodology appears unconventional, it does provide a good indication of the overall trend in the labor market. Therefore, even if today's non-farm data is unlikely to show negative growth, the trend is already clear: the labor market is weakening. In the current economic situation, non-farm employment data will continue to reflect this reality over time. When assessing any market reaction to tonight's report, this serves as a reminder: a single data point does not constitute a trend.

News