News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

First Bancorp: Fourth Quarter Earnings Overview

101 finance·2026/01/27 12:24

5 Best Crypto Presales to Watch Before the 2026 Bull Run Hits Full Speed

BlockchainReporter·2026/01/27 12:21

Arizona Legislators Move Forward With Proposal to Exclude Cryptocurrency From Property Taxation

101 finance·2026/01/27 12:21

Dogecoin Founder Addresses Crypto Crash Amid Gold and Silver Price Boom

CryptoNewsNet·2026/01/27 12:18

2,807% Shiba Inu (SHIB) Burn Surge: Does It Even Matter?

CryptoNewsNet·2026/01/27 12:18

ADA Levels To Watch as Cardano Preparing for a Directional Move Amid Volatility Squeeze

CryptoNewsNet·2026/01/27 12:18

Axie Infinity Price Prediction: bAXS Token Announcement Sparks Trendline Breakout

CryptoNewsNet·2026/01/27 12:18

Cardano Prediction for Jan 27: ADA Breaks Below Key Level But Analyst Says Support Confirmed

CryptoNewsNet·2026/01/27 12:18

Hyperliquid Price Prediction: Silver Volume Surge Drives HYPE To Test Four-Month Trendline

CryptoNewsNet·2026/01/27 12:18

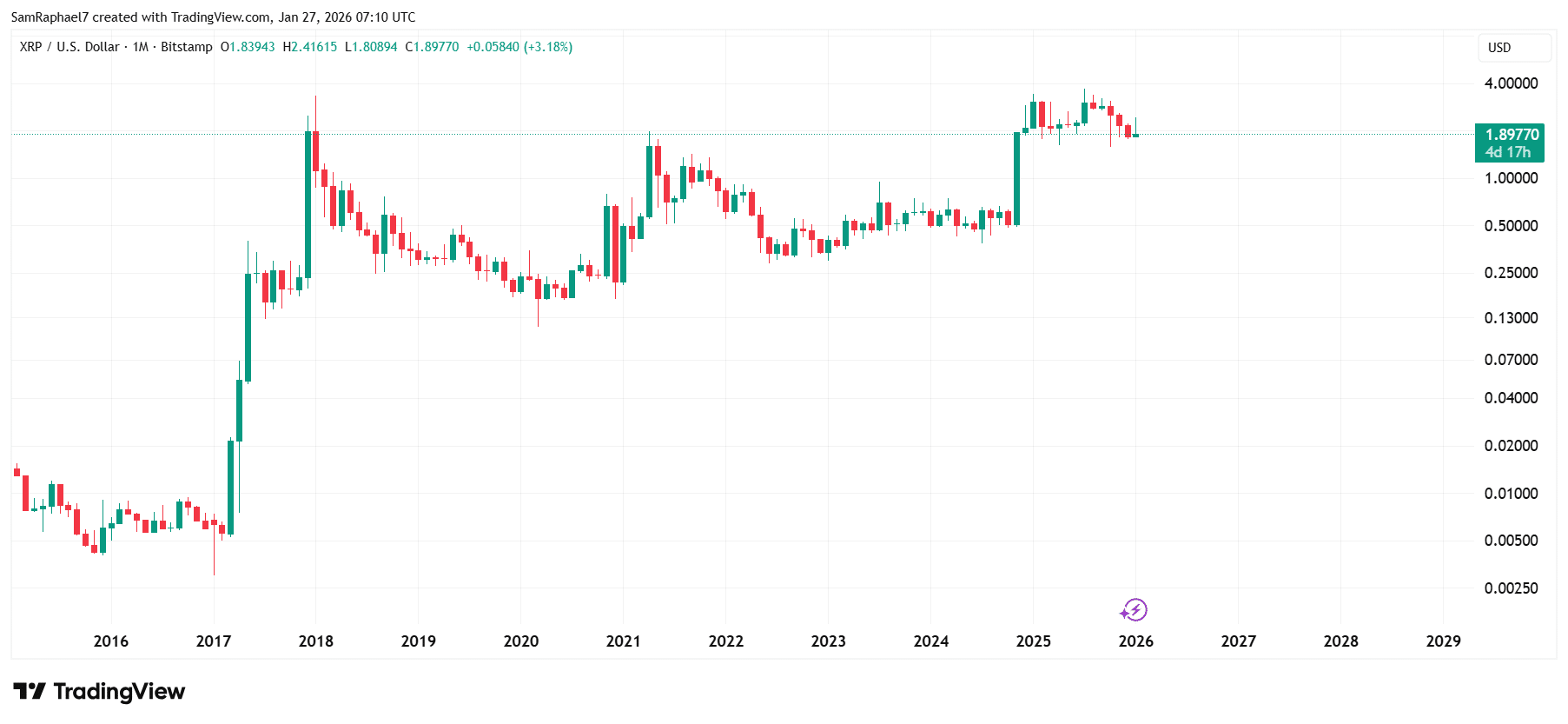

XRP Has Replicated Silver’s Price Action Since 1980: What Next?

CryptoNewsNet·2026/01/27 12:18

Flash

19:51

Powell: If tariff-driven inflation this year eases, it would show we can ease policyBlockBeats News, January 29, Federal Reserve Chairman Powell: Has no intention to lay out specific criteria for when to cut interest rates again. Risks on both sides of the dual mandate have somewhat diminished, and there are differing views within the Committee on how to balance these risks.

It is expected that the impact of tariffs on goods will peak this year and then decline. If we see this (tariff-driven inflation peak and fall back), it would suggest that we can ease policy.

Short-term inflation expectations have fully receded, which is very reassuring. Longer-term inflation expectations reflect confidence in inflation returning to 2% (FX678).

19:49

Three Strikes of Evasive Silence: Powell Tight-Lipped on Sensitive IssueBlockBeats News, January 29, Currently, reporters have three questions and three non-answers: The Fed did not provide more information on political pressure. No comment on whether he will leave the Fed in May. Similarly, no comment on the US dollar exchange rate. (FX168)

19:46

21Shares reveals the bullish case for XRPAccording to a report by Bijie Network, cryptocurrency asset management firm 21Shares predicts that by 2026, the fundamental target price for XRP will be $2.45, citing regulatory clarity and the widespread adoption of US spot ETFs as potential drivers of a “supply shock.” The company’s report outlines multiple scenarios: from a bull case of $2.69 driven by institutional RWA expansion and supply depletion, to a bear case dropping to $1.6 if adoption stalls. Meanwhile, XRP reserves on exchanges have fallen to a seven-year low of 1.7 billion, and with new spot ETFs having raised over $1.3 billion in assets, XRP’s scarcity is further intensified.