Bitcoin ready to revert a two-week downtrend: but there's a catch

Bitcoin (BTC) spiked past $70,000 today and broke its two-week downtrend. Trader Rekt Capital highlights, however, that this already happened recently, and a daily close above the resistance must occur to confirm this breakout.

The trader shared on X that this downtrend started near the $71,500 price level, and it’s not something out of the ordinary in Bitcoin’s post-halving periods. It consists of rejections at gradually lower prices, forming lower highs. The daily close above $68,000 is then imperative so that BTC can start picking momentum back again.

Moreover, Rekt Capital frequently emphasizes that Bitcoin has two phases left in the current bull cycle: the re-accumulation phase and the parabolic upward movement phase. In a video published on June 2nd, the trader compares the current cycle with the 2016 halving, as both cycles registered multiple accumulation periods.

Notably, the current re-accumulation period might take 150 to 160 days to end, starting on April 15th. “We do see lots of cross-similarities between 2016 and 2024: the re-accumulation ranges here [2016] are very similar to what was seen in 2024, and the post-halving danger zone is very similar to what we saw,” added Rekt Capital.

2016 accumulation periods. Image: Rekt Capital/

TradingView

2016 accumulation periods. Image: Rekt Capital/

TradingView

Consequently, if history repeats itself, Bitcoin might consolidate between $68,000 and $71,500 up until September before the upward parabolic movement phase starts. This means that even with a daily close today above resistance, history says BTC won’t start a strong bullish movement in the short term.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

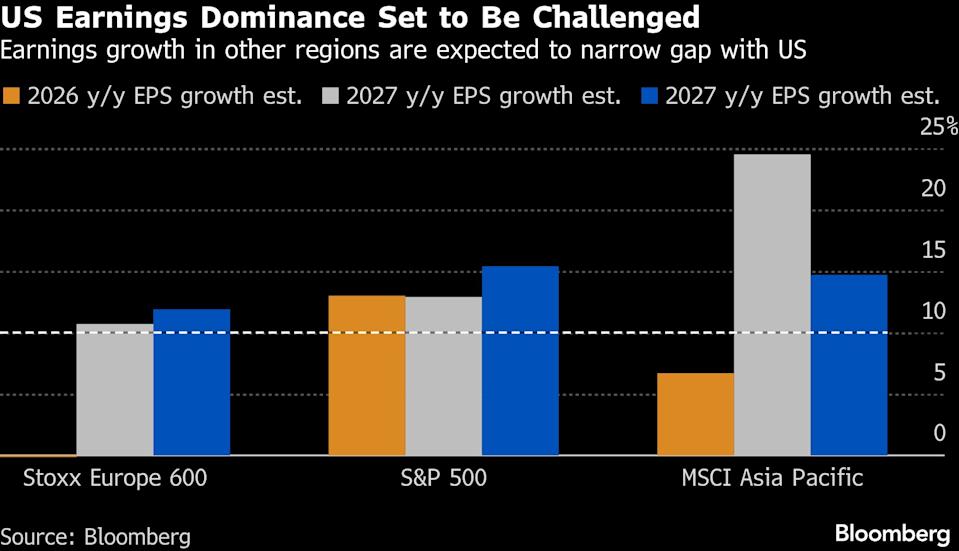

Global profits indicate a move away from the US as the S&P 500 declined

礼来惊吓,诺和诺德救场!减肥药市场前景依旧令众玩家垂涎

SaaS enters, SaaS exits: Discover the forces behind the SaaSpocalypse

The discussion within the Fed regarding how AI is affecting things